Excel IRR Formula: How to calculate Internal Rate of Return in Excel?

In this article, we’ll get deeper into the IRR concept: What is IRR Excel function and how to use this formula in your financial analysis? So, this will be an important addition to your financial skills.

Table Of Content

1. What is IRR?

2. Someka Excel IRR Calculator

3. What is IRR Function?

4. How to Calculate IRR in Excel?

5. Example for IRR Calculation in Excel

6. How to Calculate MIRR in Excel?

7. How to calculate XIRR in Excel?

8. IRR vs NPV

9. Conclusion

Let’s start!

1. What is IRR?

Internal Rate of Return (IRR) is a financial metric to represent the percentage rate earned on each dollar invested. It is essential to the assessment of investment projects. Additionally, IRR is a widely used corporate finance tool.

This rate is usually used for investment budgeting and comparisons between two or more different investment alternatives.

NOTE: Although depending on the project and investment goals, a higher IRR rate is generally preferred.

2. Someka Excel IRR Calculator: Dynamic IRR Analysis

Someka offers an Excel-based IRR calculator. This tool simplifies dynamic IRR analysis.

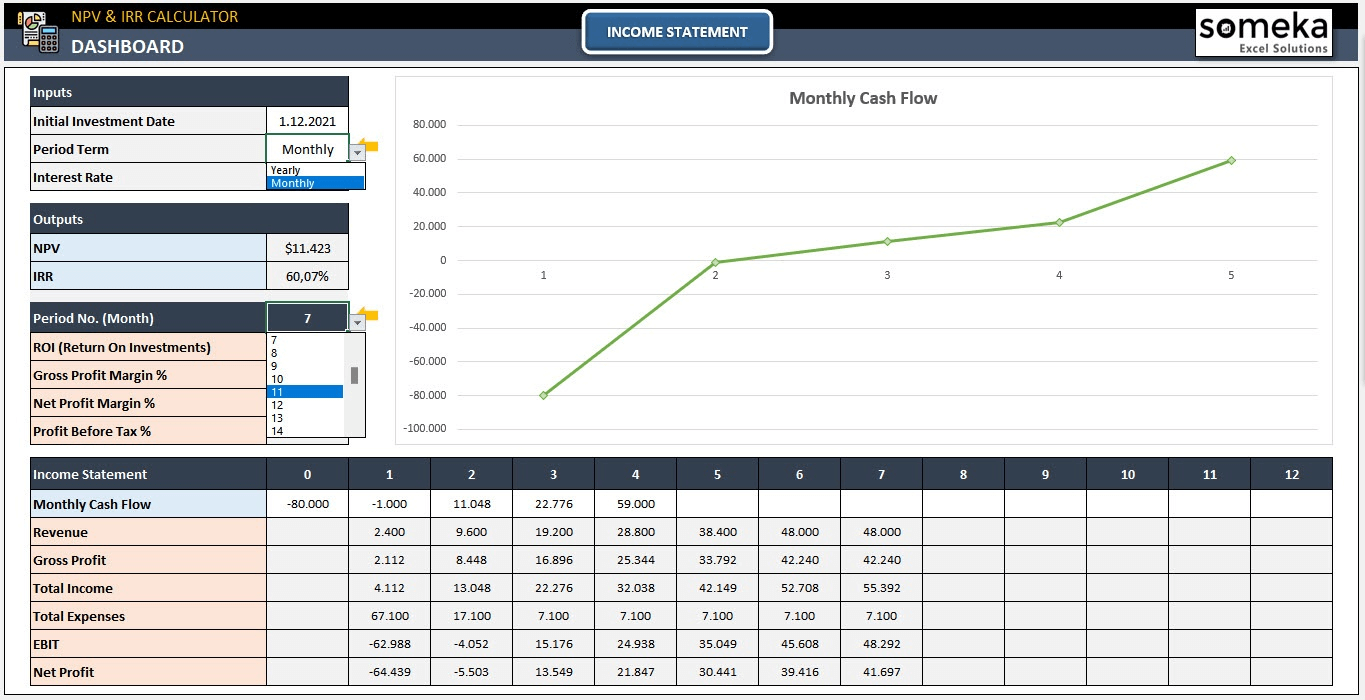

– A screenshot from Someka’s IRR and NPV Calculator Excel Template –

This template allows you quick and dynamic IRR calculation, in addition to NPV analysis. You only input your income statement data and cash flow and IRR/NPV analysis update automatically:

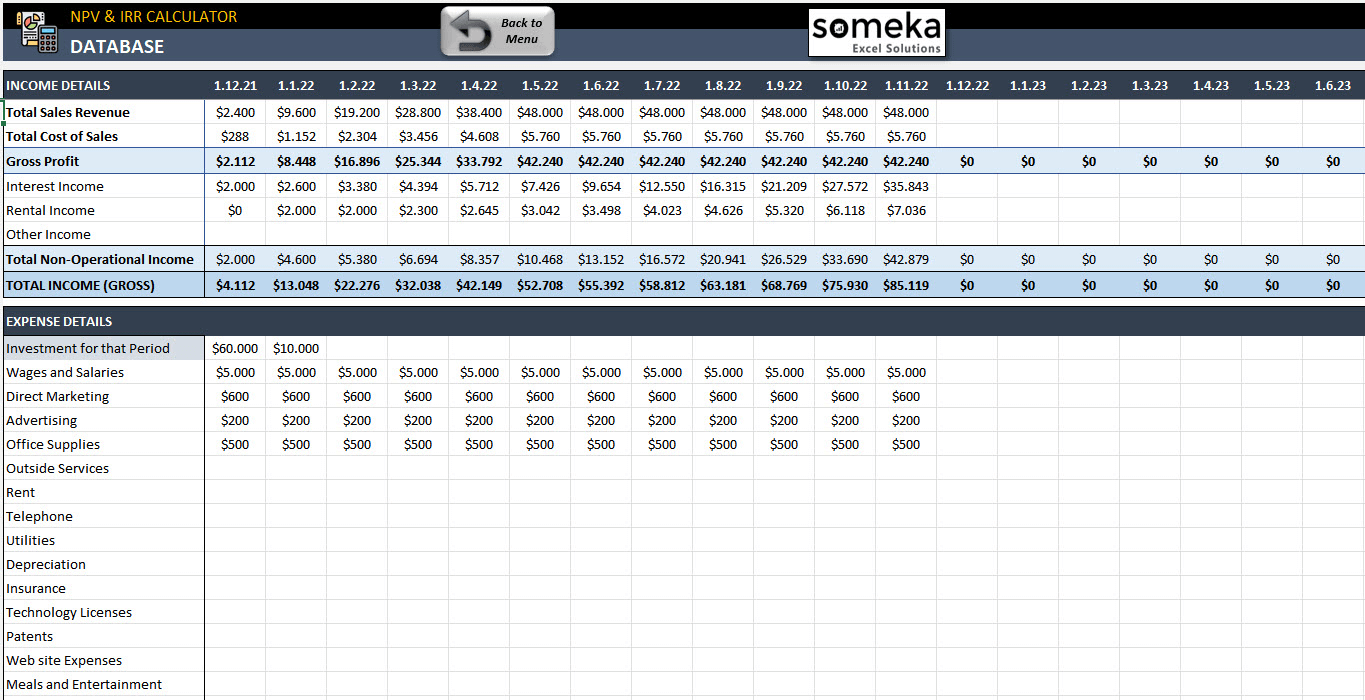

– Data Input area of IRR and NPV Excel Template by Someka –

Basically, this Excel spreadsheet gathers the data of the estimated cash flows in the future by dividing them into discount rates to find the Present Value of each cash flow.

Key features of Someka Excel IRR Calculator:

- User friendly

- Dynamic analysis

- Professional-design

- Editable

- Printable

3. What is IRR Function?

The IRR function is used to calculate an investment’s internal rate of return. This is based on a series of periodic cash flows.

The IRR function finds out the internal rate of return by calculating the rate at which the net present value (NPV) becomes zero.

The function considers both the initial investment and the incomes generated. It’s an essential tool for financial analysis. The IRR function helps in comparing the profitability of different investments. It’s a key component in the decision-making process for financial investments.

4. How to Calculate IRR in Excel?

Now, we’ll calculate IRR in Excel. As a very comprehensive spreadsheet program for financial analysis, Microsoft Excel provides a built-in formula to calculate Internal Rate of Return easily. So, we’ll first check the general IRR formula, and then see the syntax of IRR Function of Excel.

What’s IRR Formula?

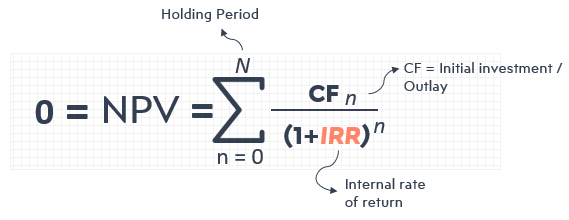

IRR is the return rate where NPV equals to zero.

How to Use IRR Function in Excel?

The IRR formula in Excel:

- Values: the series of cash flows, which include both initial investment and subsequent returns.

- Guess: Optional estimate for the expected IRR

So, Excel iteratively searches for the correct rate, and looks of the correct rate until the net present value of investments equals zero.

Using the IRR function in Excel is straightforward:

- First, enter all cash flows in a column. Include the initial investment as a negative value.

- Then, use the IRR function alongside these values.

So, Excel calculates the internal rate of return for these cash flows. Please remember, the accuracy of IRR depends on the detailed input of cash flow data.

Key Points for IRR Excel Function

Using Excel IRR function is very easy, but you should be careful about some key points:

- The values argument must include at least one positive value and one negative value.

- If the given value array does not contain at least one negative and one positive value, then the formula will give you an error.

- The formula will process only the numbers, and will ignore texts or empty cells

- The values should be in chronological order, as the formula looks into the order of the cash flows. You should use regular periods like monthly, quarterly or even yearly.

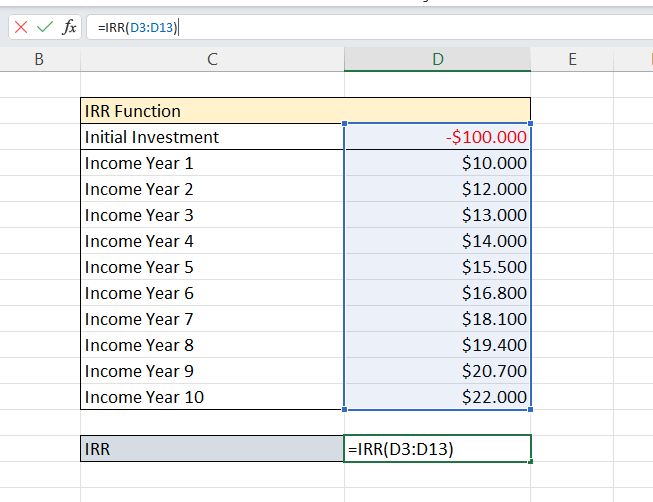

5. Example for IRR Calculation in Excel

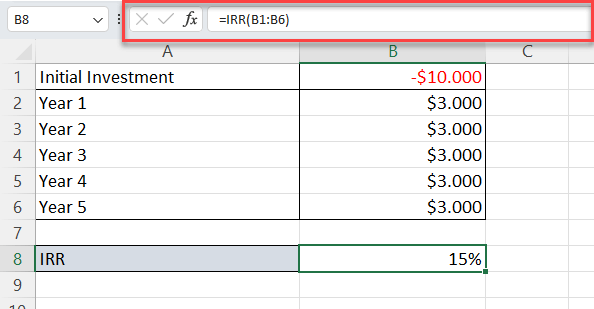

Let’s consider a simple example. Imagine an initial investment of $10,000. The expected yearly returns are $3,000 for the next five years. Here’s how to calculate the IRR:

- Enter the initial investment -$10,000 in cell B1.

- List the yearly returns of $3,000 each from B2 to B6.

- In a separate cell, use the formula =IRR(B1:B6).

Now let the Excel calculate the IRR for this investment scenario:

This example illustrates the ease of using Excel for IRR calculations. It shows how useful this function can be for financial decision-making.

6. How to Calculate MIRR in Excel?

First of all, Modified Internal Rate of Return (MIRR) considers both financing and reinvestment costs. So, it’s a refinement of the traditional IRR.

MIRR gives a more accurate reflection of an investment’s profitability.

MIRR Function in Excel:

- Values: Negative and positive cash flows

- Finance_rate: The interest rate paid for the money used

- Reinvest_rate: The interest rate received on the cash flows

MIRR is particularly useful for comparing projects with different cash flow patterns. It adjusts for varying costs and reinvestment rates, providing a comprehensive view of an investment’s potential.

7. How to calculate XIRR in Excel?

Additionally, XIRR stands for Extended Internal Rate of Return. Also, it’s used when cash flows are not periodic. So, XIRR provides a more accurate IRR calculation in such cases.

XIRR Function in Excel:

XIRR accounts for the exact dates of cash flows. This makes it ideal for irregular investment scenarios. It’s a powerful tool for a nuanced financial analysis.

8. IRR vs NPV

IRR and Net Present Value (NPV) are related but distinct concepts.

Is IRR equal to NPV?

No, it is not.

NPV calculates the total value of a series of cash flows in today’s terms. IRR, on the other hand, is the rate at which NPV equals zero. While they are interconnected, they are not equal. Each metric offers different insights into an investment’s value.

Is IRR better than NPV?

Whether IRR is better than NPV depends on the context:

- IRR is useful for comparing the efficiency of different investments. It’s a percentage, making it intuitive for comparisons.

- However, NPV provides a dollar value. This makes it better for understanding the absolute value of returns.

Both metrics are important for a comprehensive financial analysis.

9. Conclusion

So, it’s essential to know how to compute IRR in Excel when making financial decisions. And, in this article we try to show you the easy steps to calculate Internal Rate of Return in Excel.

Also, we have examined the nuances of IRR, MIRR, and XIRR; and explained which one is more suitable for which occasions. Lastly, we have compared NPV and IRR, two crucial concepts for assessing potential investments.

In summary, IRR calculation is very efficient and easily accessible thanks to Excel’s functions. Both individuals and companies can make wise financial decisions by learning these strategies.

Recommended Readings:

How to Create a Profit and Loss Statement in Excel? Step-by-Step Guide

How To Create a Cash Flow Statement in Excel?

20 Most Asked Excel Job Interview Questions for Financial Analysts