NPV Excel Formula: How to calculate Net Present Value in Excel?

Making well-informed decisions is crucial when it comes to investing and finance, and the Net Present Value (NPV) calculation is a crucial tool to determine the real value of money. And in this post, we’ll explore the Net Present Value concept and explain NPV Excel function in easy steps with examples.

Table Of Content

1. What is NPV?

2. Someka Excel NPV Calculator

3. What is NPV Formula?

4. Excel NPV Function

5. Example for NPV calculation in Excel

6. How to calculate PV in Excel?

7. How to calculate XNPV in Excel?

8. What is the difference between NPV and IRR?

9. What is the difference between NPV and DCF?

10. Conclusion

Knowing NPV gives you a clear picture of the potential of an investment. So, we will examine many facets of net present value (NPV), from fundamental definitions to sophisticated applications. Our goal is to provide you with the necessary knowledge to use this essential financial metric.

Regardless of your level of experience with investing analysis, this tutorial provides insightful information on using net present value (NPV) in Excel.

1. What is NPV?

Net Present Value (NPV) is a financial metric, measuring the profitability of an investment or project. NPV calculates the present value of cash flows, both incoming and outgoing.

This assessment is critical for financial decisions. It helps investors understand if a project is worth pursuing. NPV considers the time value of money, a key concept in finance.

Money today is worth more than the same amount in the future.

This is due to its potential earning capacity. NPV’s reliability makes it popular in financial analysis.

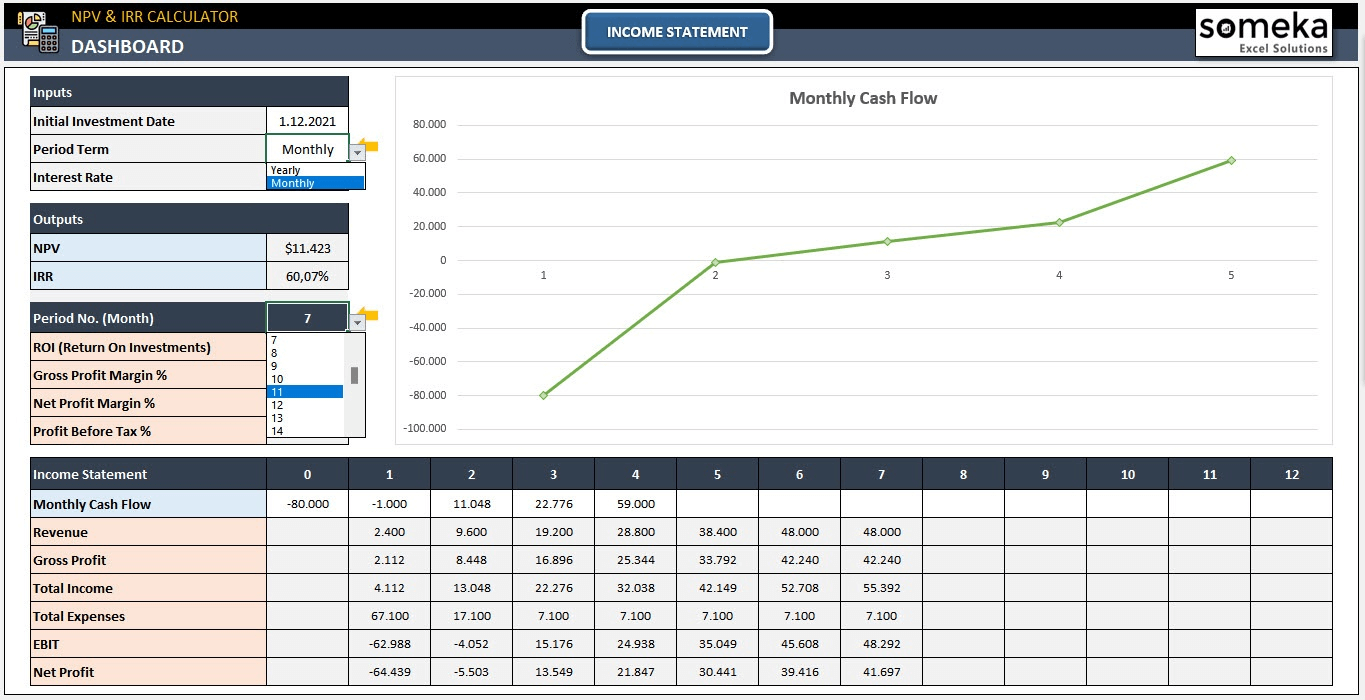

2. Someka Excel NPV Calculator: Dynamic Net Present Value Analysis

Someka offers a dynamic NPV calculator in Excel. Firstly, this tool simplifies complex financial calculations. Also, it provides you with financial analysis in addition to NPV and IRR calculations.

– A screenshot from Someka’s IRR and NPV Calculator Excel Template –

It’s designed for both professionals and beginners:

- Editable and printable worksheet

- Automated NVP and IRR calculation

- Ready-to-use

- Instant download

3. What is NPV Formula?

A fundamental component of financial analysis is the NPV formula. It’s employed to ascertain an investment’s worth over time. The formula takes money inflows and outflows into account.

- Rt: Net Cash Inflow

- i: Discount Rate

- t: Time period

- C: Initial Investment Cost

This formula calculates the present value of future cash flows. It compares them to the initial investment. Understanding this formula is vital for accurate financial forecasting.

4. Excel NPV Function

So, now we’ll make this calculation in Excel. Microsoft Excel provides us with a built-in function to easily calculate the NPV of our money, investment or project

How to calculate NPV in Excel?

This is a simple step-by-step guiding to calculate net present value in Excel.

-

Step 1: Prepare cash flow data:

We’ll list all expected cash flows in a column. Here we should include both inflows and outflows.

-

Step 2: Determine the discount rate:

This rate reflects the investment risk and time value of money. If your cashflows are yearly, then this rate will be an annual discount rate. If you have quarterly cash flows, and you should use a quarterly discount rate.

As a best practice, insert this rate in a separate cell.

-

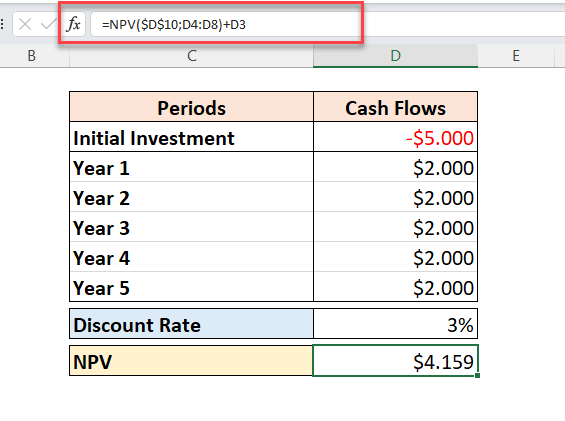

Step 3: Use Excel’s NPV function:

Now, we’ll use these input to calculate net present value with the Excel function:

-

Step 4: Subtract your initial investment:

You’ll now subtract your initial investment, if there is any.

This process yields the project’s Net Present Value.

Key Points About Excel NPV Function:

- We assume that values occur at the end of each period.

- The formula will process only the numbers, and will ignore texts or empty cells

- Values should be in chronological order and in regular time periods.

- You should use negative values for outflows and positive values for inflows .

Please note that if you use a negative value for initial investment, then you use sum formula for the NPV calculation. But if your value is positive, then you’ll use a minus sign. The main idea is subtracting the initial investment from the NPV formula calculation.

Commenting NPV Value:

In summary, an NPV of zero or higher forecasts profitability for a project or investment; projects with a negative NPV forecast loss.

5. Example for NPV calculation in Excel

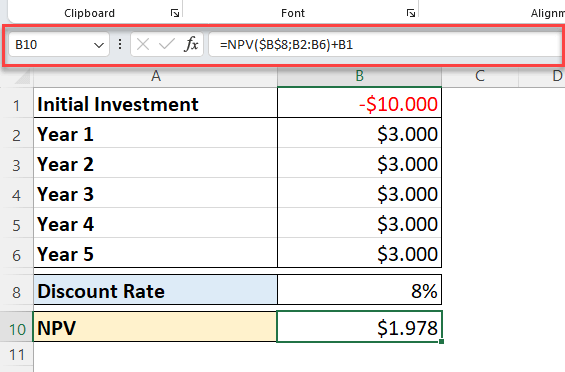

Let’s illustrate NPV calculation with an example.

Below are our assumptions:

- Assume an initial investment of $10,000.

- Projected cash inflows are $3,000 annually for 5 years.

- The discount rate is 8%.

Now here’s our steps:

- Firstly, input the cash flows in Excel, from year 1 to 5.

- Secondly, enter -10.000 in the first cell of B1 for the initial investment.

- Thirdly, in consecutive cells, enter 3.000 for each year from B2:B6

- Then, in a separate cell (B8) input the discount rate of 8% (0.08).

- Lastly, use the formula =NPV(B10, B2:B6)+B1

This calculation provides the NPV value.

6. How to calculate PV in Excel?

The terms Present Value (PV) and Net Present Value (NPV) are both central concepts in finance, but they refer to different calculations and are used in different contexts.

PV is the current worth of a future sum of money or stream of cash flows, given a specific rate of return. It’s used to determine the value of future cash flows in today’s terms.

Excel PV Formula:

In summary, while PV is a calculation for a single future cash flow, NPV involves summing the PVs of multiple cash flows related to an investment or project. PV is a component of the NPV formula, as NPV is essentially the net (total) of multiple PV calculations.

7. How to calculate XNPV in Excel?

XNPV is an advanced version of the Excel NPV formula. It considers specific dates for cash flows.

Note: XNPV is more accurate than NPV for irregular cash flow patterns.

To calculate XNPV in Excel, first input cash flows and their corresponding dates. Ensure the first cash flow is the initial investment. Then, specify the discount rate in another cell. Use Excel’s XNPV function:

This function calculates NPV with precise timing. It’s essential for detailed financial analysis.

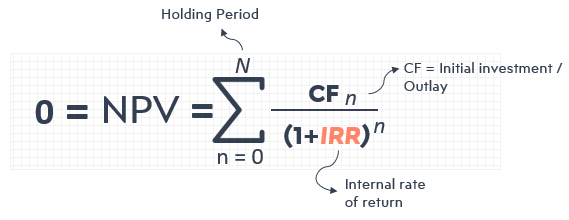

8. What is the difference between NPV and IRR?

NPV and IRR are both used in investment analysis, but they differ significantly.

NPV (Net Present Value) measures an investment’s value in today’s dollars, while IRR (Internal Rate of Return) is a percentage representing the return rate where NPV equals zero.

While they are interconnected, they are not equal. Each metric offers different insights into an investment’s value.

- NPV gives a clear insight about the absolute value of returns.

- IRR is useful for comparing the efficiency of different investments.

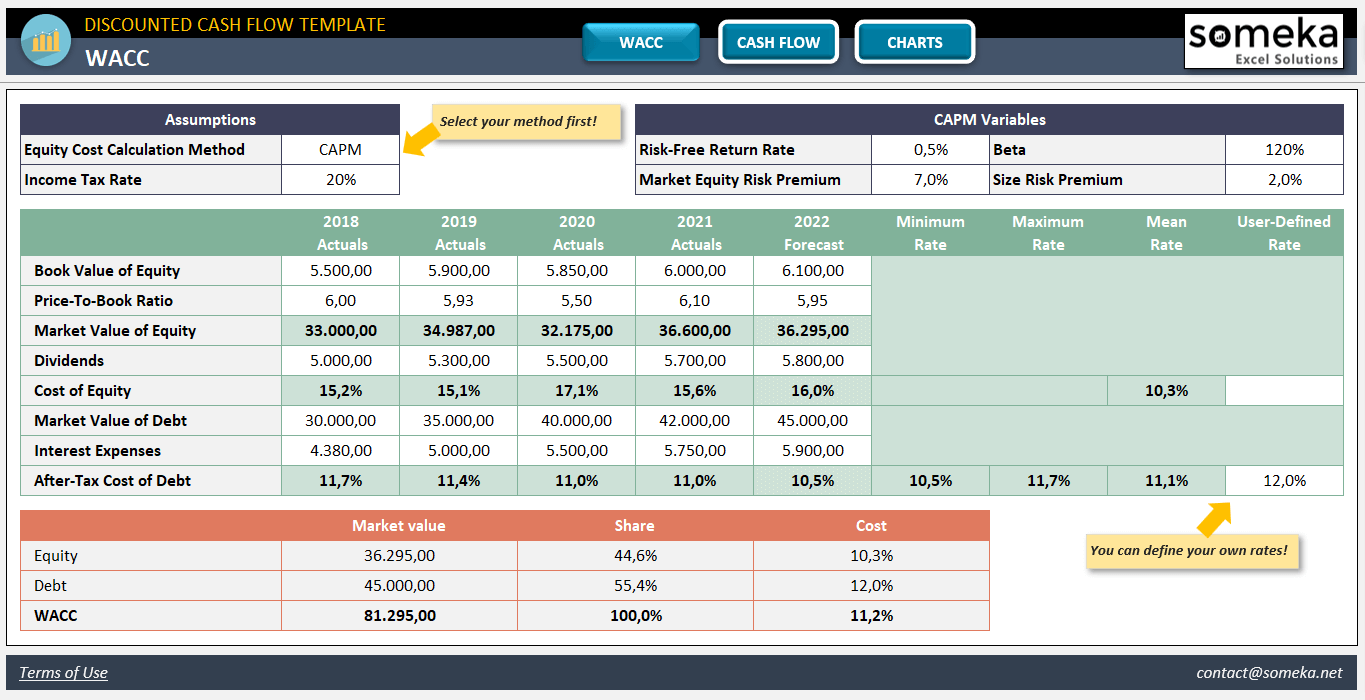

9. What is the difference between NPV and DCF?

NPV (Net Present Value) and DCF (Discounted Cash Flow) are related but distinct concepts in finance.

DCF is a broader method of analyzing investments. It involves estimating the total value of future cash flows, discounted back to the present value. However, NPV is a specific application of DCF. It calculates the value of these cash flows minus the initial investment.

– This is the main dashboard of Discounted Cash Flow Template by Someka –

NPV provides a direct measure of an investment’s profitability. DCF, on the other hand, offers a more comprehensive view of an investment’s value over time.

10. Conclusion

Definitely, finance requires the ability to calculate net present value (NPV) in Excel in addition to IRR, PV, DCF or LBO calculations. So, we have explained the significance and methodology of Net Present Value in this article.

Significantly, it’s always important to learn the main idea of the financial concepts. So, you should know what does it mean Net Present Value and how to comment it. But for the calculation part, you can handle this to Microsoft Excel.

Excel is a great software to make your financial calculations. And, if you also need a professional financial analysis, you can also download NPV and IRR Calculator Excel Template for a sleek-design dashboard for your presentations.

Recommended Readings:

How to Create a Profit and Loss Statement in Excel? Step-by-Step Guide

How To Create a Cash Flow Statement in Excel?

Excel IRR Formula: How to calculate Internal Rate of Return in Excel?