How To Create a Cash Flow Statement in Excel?

We will explain how to create a cash flow statement in Excel with explanationary images and examples. You’ll find some basic information about cash flow calculation and a step-by-step guide in addition to a free template.

Table Of Content

1. What is a statement of cash flows?

2. Free Cash Flow Statement Template

3. Key Concepts for Cash Flow Statements

4. What is the formula for cash flow?

5. Direct vs. Indirect Cash Flow Methods

6. How to Create a Cash Flow Statement in Excel?

7. How to Read a Cash Flow Statement?

8. Why is the Statement of Cash Flows Important?

9. Conclusion

1. What is a statement of cash flow?

An essential financial document that offers a thorough assessment of a company’s financial situation is the cash flow statement. This statement, which is essential to financial analysis, follows the flow of money within an organization.

It aids stakeholders in comprehending a company’s cash management effectiveness, a crucial indicator of its financial stability.

Cash flow is a concrete representation of a company’s liquidity and capacity to finance operations and expansion, in contrast to profit or revenue, which are open to interpretation by the accounting community.

2. Free Cash Flow Statement Template

If you do not want to spend time preparing a cash flow statement from scratch, we have a ready-to-use Cash Flow Statement Template in our portfolio. It is:

- Instant download

- Provided in Excel and Google Sheets

- No installation needed

- Printable and Editable

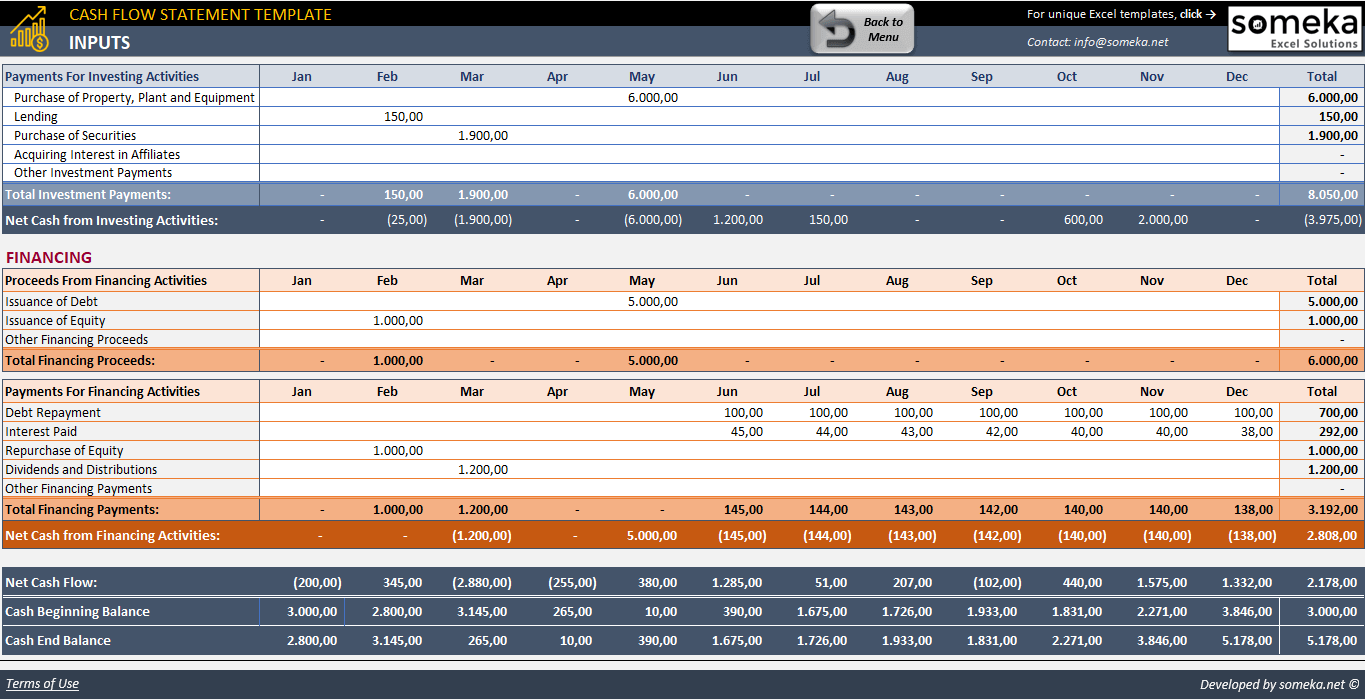

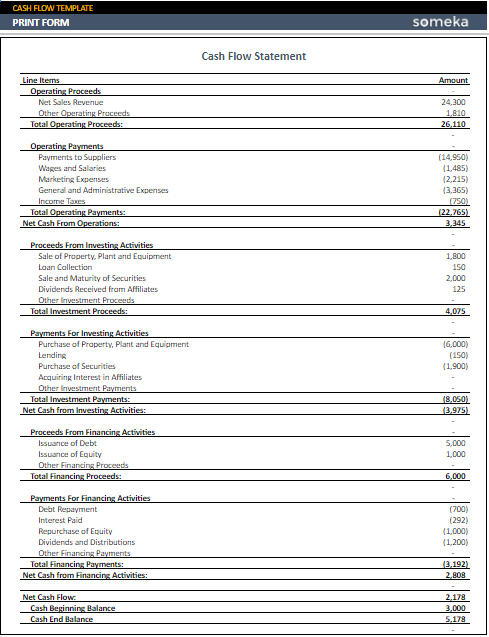

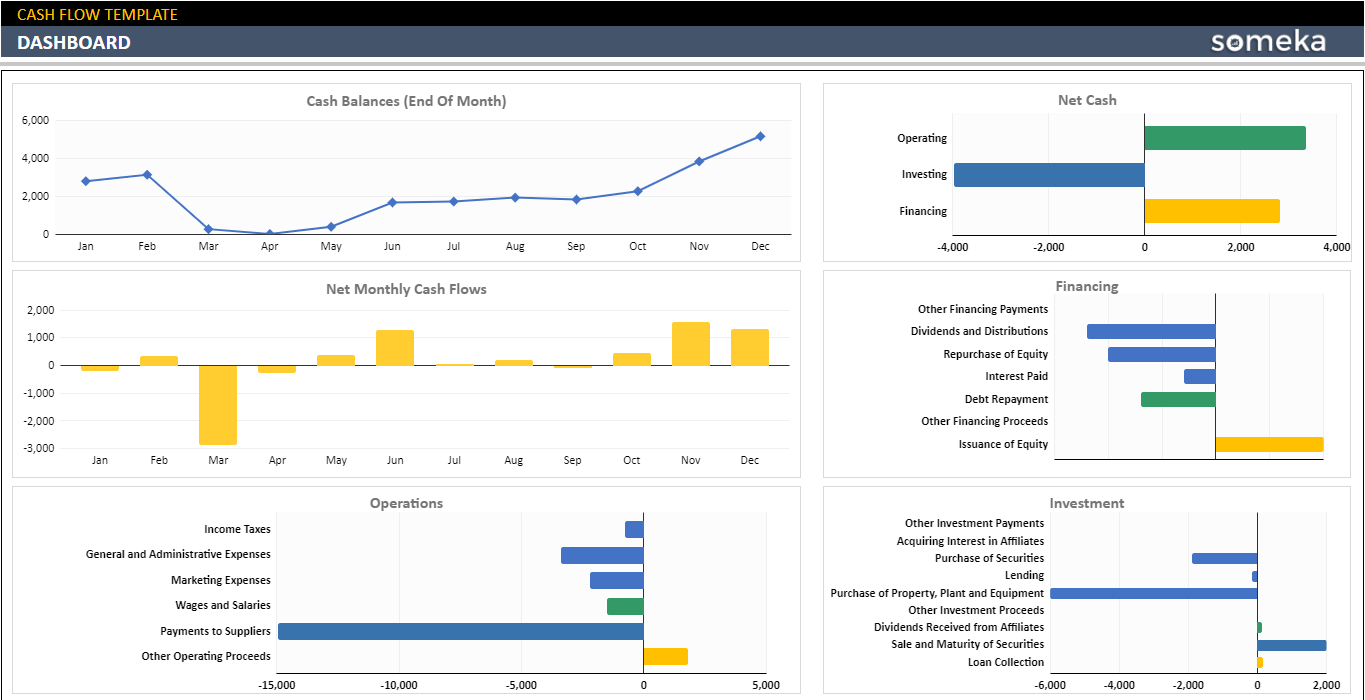

– This image is from Cash Flow Statement Template in Excel –

These templates offer a structured format that makes the process of creating a cash flow statement easier.

3. Key Concepts for Cash Flow Statements

Accurately interpreting cash flow statements requires a solid understanding of fundamental concepts. What are key concepts of cash flow statement?

Cash Flow: The net amount of money coming into and going out of a business.

Cash Balance: This is the total amount of cash that a business has available at any one time. This represents a moment in time of the company’s financial status.

Cash Equivalents: Investments that are extremely liquid and can be swiftly changed into a predetermined amount of cash. Treasury bills and money market assets are two examples.

In addition to these main concepts, it will be also useful to underline the three main sections of cash flow statements.

Basically, the cash flow statements consist of three main sections. And, the cash flows are calculated for each of these groups before getting consolidated.

- Operating Activities: The primary business activities, such as sales revenue and expenses, are covered in this section of the cash flow statement. It displays the amount of money made by the company’s main activities.

- Investing Activities: Transactions involving long-term assets are referred to as investing activities. It covers the buying and selling of real estate, equipment, and investments in other companies.

- Financing Activities: Any adjustments to debt, loans, or dividends are shown in this section. It displays the money movement within the business between its shareholders, creditors, and owners.

Every one of these ideas is essential to comprehending the financial dynamics of a business and offers a perception into its long-term sustainability and operational effectiveness.

4. What is the formula for cash flow?

In financial analysis, the cash flow formula is essential for determining a company’s net cash flow over a given time frame.

Cash flow is calculated as follows:

Stakeholders can evaluate a company’s financial health and make wise decisions by comprehending and utilizing this formula, which provides insights into how a business makes and spends its money.

5. Direct vs. Indirect Cash Flow Methods

The direct and indirect methods are the two main techniques used in financial reporting to compute cash flow from operating activities. It’s critical to comprehend how these two strategies differ from one another.

What is the difference between direct and indirect cash flow methods?

Direct Method:

The direct method lists all major operating cash receipts and payments. This includes cash received from customers, cash paid to suppliers, and cash paid for salaries. It provides a clear view of how and where cash is received and spent in the business’s core operations. Despite its detailed nature, this method is less commonly used because it requires a thorough tracking of all cash transactions.

Indirect Method:

The indirect method, more commonly used in practice, starts with net income and adjusts for non-cash transactions and changes in working capital. This method reconciles net income with cash flow from operations, reflecting adjustments for items like depreciation, changes in accounts receivable, and changes in inventory. It’s considered more practical for many businesses, as it builds on existing accounting records.

Although the total cash flow from operating activities is ultimately the same for both approaches, the ways in which that cash flow is generated are seen from different angles and with varying degrees of detail.

6. How to Create a Cash Flow Statement in Excel?

There are multiple steps involved in creating an accurate cash flow statement in Excel that shows a company’s inflows and outflows of cash. Here’s a detailed how-to:

Step 1: Prepare your cash flow worksheet

Open a blank Excel worksheet and add your main areas with months on the top header.

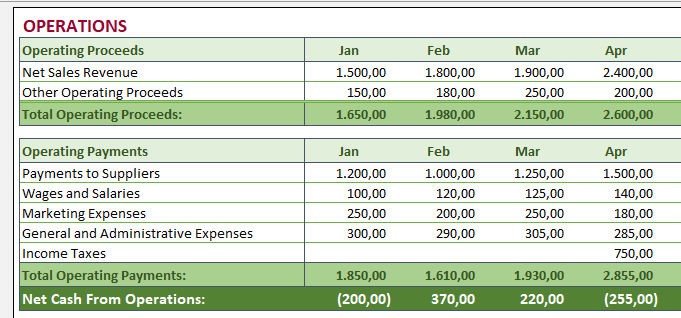

Step 2: Calculate Cash Flow from Operating Activities

Now we’ll start with calculating our cashflow from operating activities:

Here’s how to calculate net cash flow from operations:

- Write down your operating proceeds and sum all of them.

- List all payments related to your main operations, including the taxes, wages, supplier payments, and general administrative expenses and then sum all of them.

- Lastly, subtract total operating payments from your total operating proceeds.

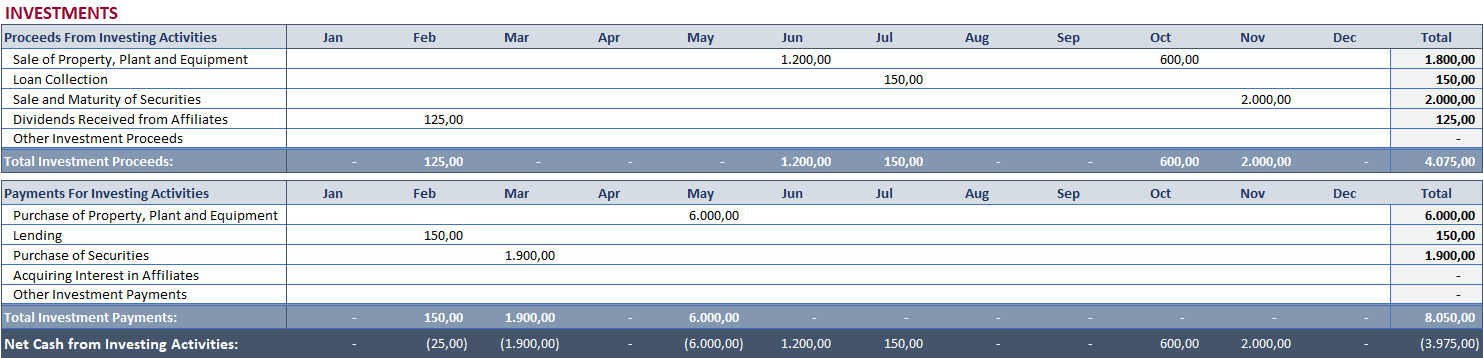

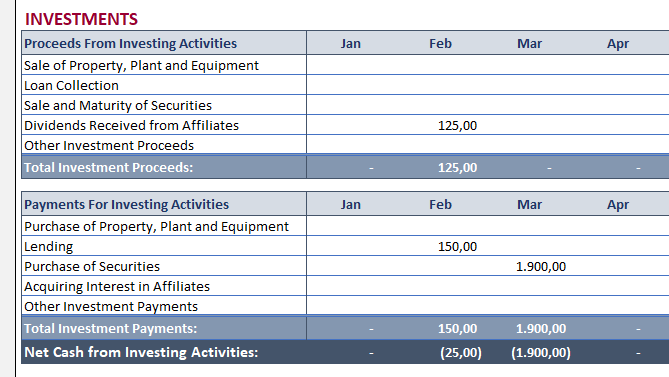

Step 3: Calculate Cash Flow from Investment Activities

This section will include proceeds from your investments (such as property sales, loan collection, sales of securities, dividends, etc.) and the payments for investing activities (such as lending, security purchase, etc).

Firstly, have a total of your proceeds and payments, and the bottom line calculate the difference.

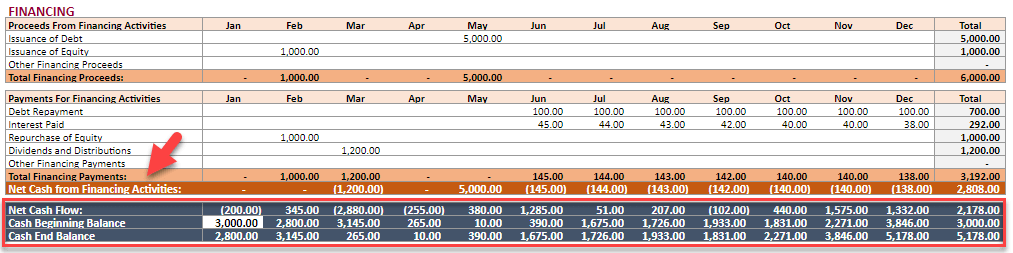

Step 4: Calculate Cash Flow from Financing Activities

This last group is for calculating your net cash flow from financing activities:

In this group, your main proceeds will include insurance debt, equity, and other financial proceeds, while the payments will have debt repayment, interests, dividends and distributions, etc.

Again, calculate the difference between your proceeds and payments at the bottom line.

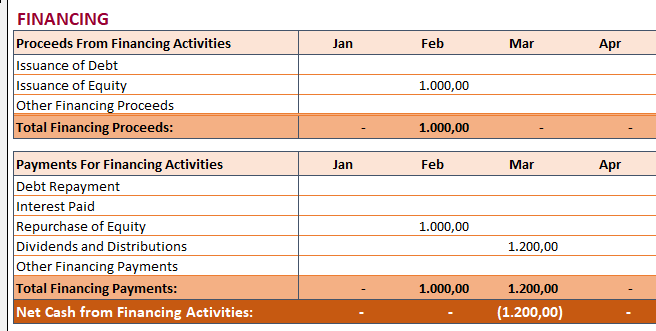

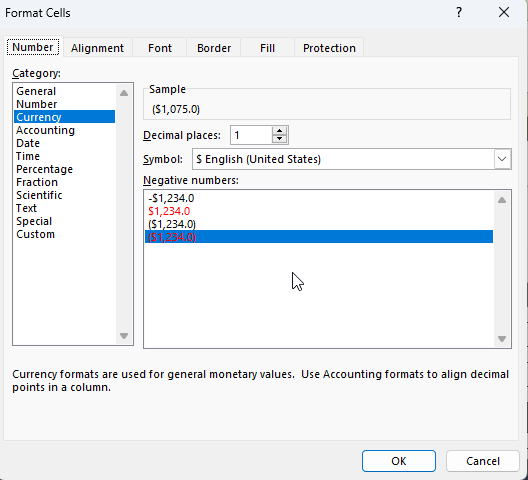

Step 5: Calculate Net Cash Flow

To calculate the Net Cash Flow for the period, add the totals for the three categories (Operating, Investing, and Financing).

Step 6: Calculate Cash End Balance

The ending cash balance is calculated by adding the Net Cash Flow to the beginning cash balance.

Firstly, add the starting cash balance manually for the first period. On the above image, the highlighted 3.000,00 value is a manual input.

Now we can calculate the cash end balance:

And now monthly cash beginning balance will be the previous month’s Cash End Balance.

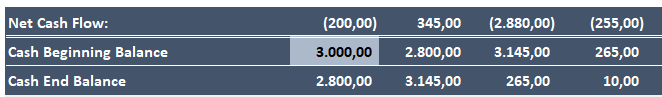

Step 7: Formatting Cash Flow Table

For formatting, make use of Excel’s features. Use background colors for clarity, format negative values, and make sure decimals are consistent.

Decimals:

You can configure your decimal settings on the Format Cell dialogue box.

Negative Value with Cell Formatting:

Again on the Format Cells window, you can format negative values, typically in red or parenthesis.

You can use premade formats on the Excel, or you can create a custom one.

Background Colors for Calculated Areas:

So, you can give different colors to the three main groups of your cash flow table.

Additionally, it’s always a good practice to give different colors for calculated areas and input data areas.

Step 8: Monthly Data Input

Now our table is ready to input data. So, you can easily input your monthly values to the related areas.

Also, to maintain the cash flow statement fresh, update the worksheet once a month with fresh transaction data.

Step 9: Print Form

Lastly, prepare the page for printing, making sure that all pertinent information is easily readable.

These steps will help you generate an extensive cash flow statement in Excel that will give you important information about the financial health of your business.

7. How to Read a Cash Flow Statement?

Understanding a cash flow statement’s components and what they reveal about a company’s financial situation is essential to reading one effectively.

– This is the Dashboard of Someka Cash Flow Template where you can find visual analysis on your cash flow –

Analyze Operating Activities:

The cash generated by the company’s primary business operations is shown in this section. Here, a steady, positive cash flow is indicative of a strong, sustainable company.

Negative figures could point to problems with efficiency or profitability.

Evaluate Investing Activities:

Negative cash flow in this area may be a sign of investments being made in the expansion of the business, such as buying new equipment. On the other hand, long-term sustainability should be assessed for regular large outflows.

Analyze Financing Activities:

This demonstrates how a business raises money for expansion and operations via dividends, equity, or debt. Observe patterns in the company’s capital raising and repayment practices.

Examine Net Cash Flow:

This is the total of the preceding three sections. A positive net cash flow indicates that the business is making more money than it is spending, which is encouraging. More research is necessary if there is a negative net cash flow.

Examine the Cash End Balance:

You’ll find out how much cash the business has left over at the end of the reporting period. It is essential to comprehend the liquidity and short-term financial stability of the company.

8. Why is the Statement of Cash Flows Important?

For a number of reasons, the cash flow statement is crucial to financial analysis and decision-making.

Liquidity insight gives a clear picture of a company’s liquidity and demonstrates how well it can finance its operations and meet short-term obligations. This is essential for determining the company’s short-term viability and growth.

Here are the key points:

- Operational Health

- Investment and Financing Decisions

- Complement to Other Financial Statements

- Risk assessment

In conclusion, the cash flow statement is an essential tool for anyone wishing to gain a thorough understanding of a business’s financial situation because it offers information not found in other financial documents.

9. Conclusion: How to create a Cash Flow Statement in Excel?

To sum up, the cash flow statement provides deep insights into a company’s financial health and is an essential tool in financial analysis. It presents a realistic picture of a company’s liquidity, operational effectiveness, and financial strategy in addition to disclosing how it handles its cash.

We have explained how to create a cash flow statement in excel with this step-by-step guide. If you want to use a ready-made template, then you can easily download our Cash Flow Statement Excel Template for free.

This tool includes: 1. Cash Flow Table, 2. Printable Cash Flow Statement, 3. Analysis Dashboard.

In order to keep your financials healthy, cash flow tracking will be one of your key actions.

Recommended Readings:

How to Create a Profit and Loss Statement in Excel? Step-by-Step Guide

Balance Sheet: Definition, Examples, Templates in Excel!

20 Most Asked Excel Job Interview Questions for Financial Analysts