How to Create Invoice in Excel? Guide, Examples and Templates

In this article we’ll go through how to create invoice in Excel. You’ll find both step-by-step guidance and examples as well as free templates.

Table Of Content

1. How to create invoice in Excel?

2. What should be included in an invoice?

3. What are the critical functions of an invoice?

4. Invoice Examples

5. How do I make my own invoice?

6. How do I automatically create an invoice number in Excel?

7. Conclusion

Creating invoices is a fundamental task for businesses and freelancers alike, serving as a formal request for payment for goods or services provided. Despite the abundance of alternatives, many people still choose Microsoft Excel because of its powerful features, ease of use, and adaptability.

So, as an important element of bookkeeping, we will summarize the main steps to make professional invoices.

1. How to create invoice in Excel?

Creating an invoice in Excel can be simplified into several key steps. So, this guide will help you to complete your invoices.

But before we start, we have to understand clearly what’s an invoice.

Now, let’s discover how to create an invoice in Excel with simple steps.

Step 1: Download an invoice template in Excel

Firstly, we will start with downloading an invoice template.

Microsoft Excel provides you with different invoice designs in its invoice gallery, which you can download easily. Also, there are third-party providers for Excel invoice templates.

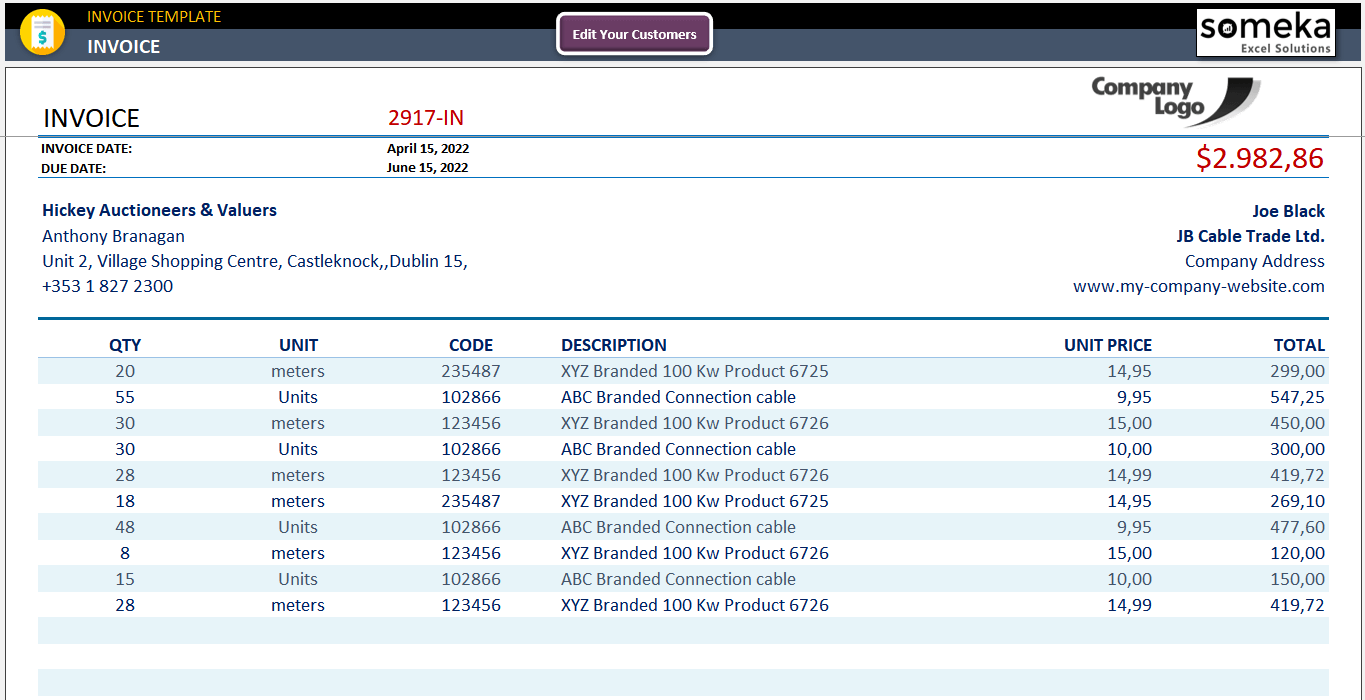

Today we’ll use Someka’s Invoice Generator, as this tool is a all-in-one solution for creating invoices:

- Professional design

- Editable

- Printable

- Instant Download

- Compatible with Windows and Mac

>> Download Invoice Template in Excel

Now, if you have downloaded your template, we can start to create our invoices.

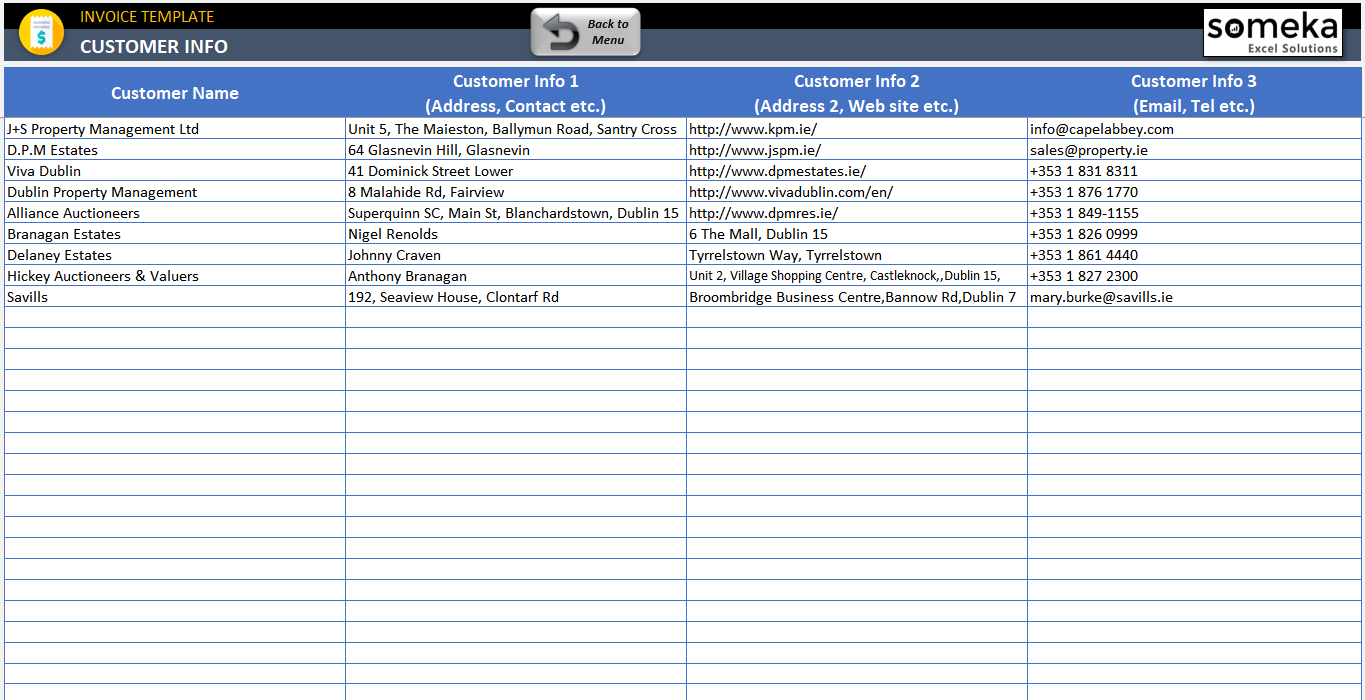

Step 2: Add your customer data

Firstly, we will create a customer database in order to automatize our invoice process. This is a very simple table including:

- Customer name

- Customer address

- Customer website

- Customer email and/or phone number

You can use the fields provided to enter your customer’s details while creating Excel invoice:

Feel free to add or remove sections from the fields as needed to make them fit your specific requirements. A customer ID or particular payment conditions are two examples of what you might wish to include.

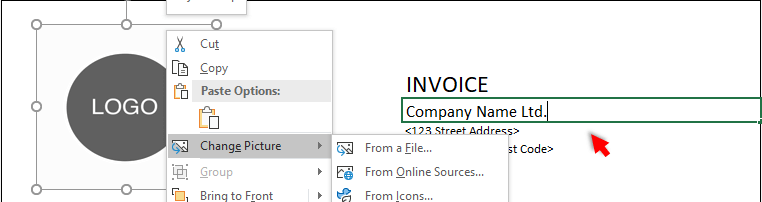

Step 3: Change your company logo

Similarly, you will find the logo placeholder in the template. So, you can easily replace it with your own by looking for it at the top of the invoice.

To change the company logo:

Right click on the logo and go to Change Picture and select your own logo from your device. If you still don’t have a logo yet, you can try AI logo generator to create your brand logo within seconds!

Step 4: Add your payment details for your Excel Invoice

The invoice’s bottom or a specific section can serve as a place for you to specify your payment terms. Everything from the due date to the accepted methods of payment to any penalties for late or early payments is detailed here.

To facilitate quick and easy payment, be sure to include your bank details or any other pertinent payment information.

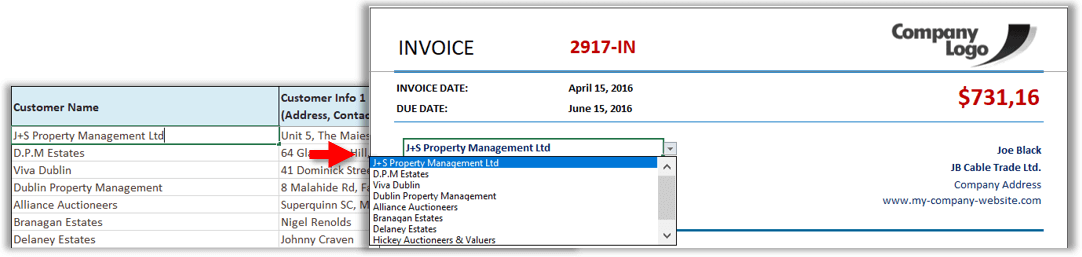

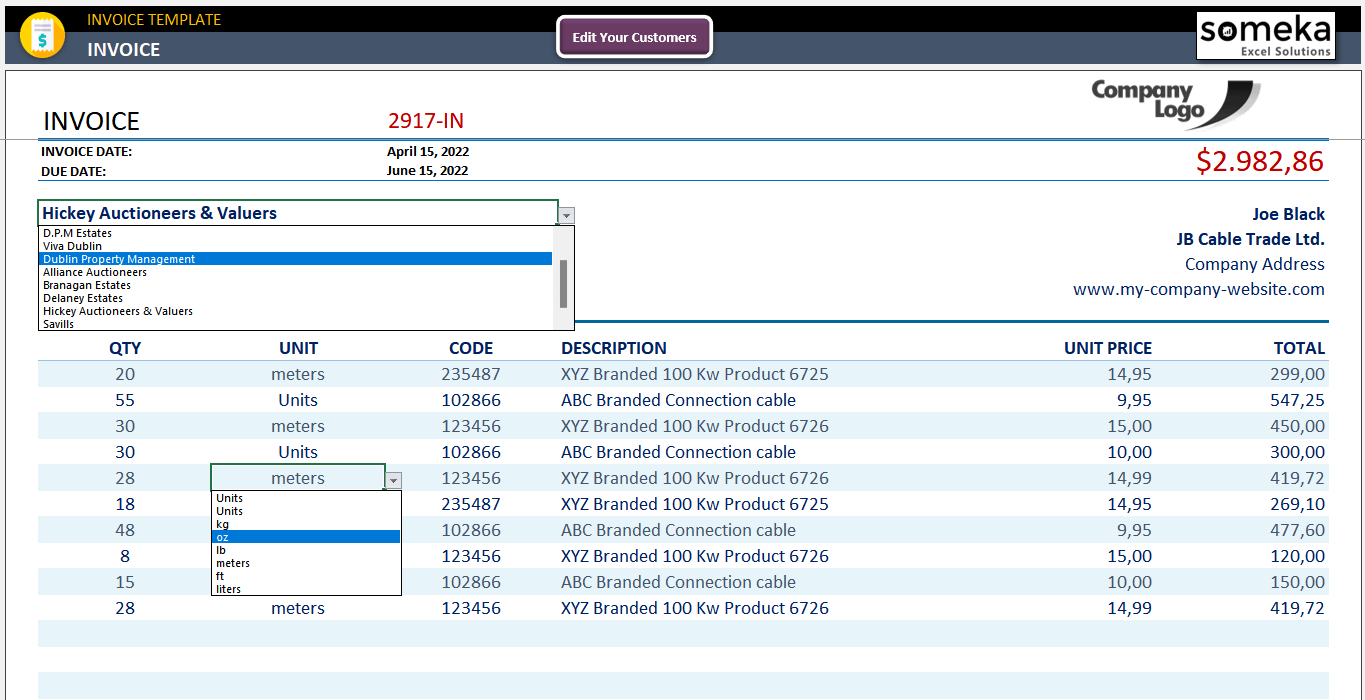

Step 5: Select your customer

As we have already prepared a customer database, all we have to do now is select the related customer from the drop-down menu.

Step 6: Add your products/services

Then, we should include detailed information about the goods and services we are billing for, such as the item’s description, quantity, unit price, and total to create an invoice in Excel:

In this template, you’ll again find drop-down menus to select your units. Here be sure the include the following information about the products/services related to the invoice:

- Quantity

- Unit

- Code/SKU

- Description

- Unit Price

- Total

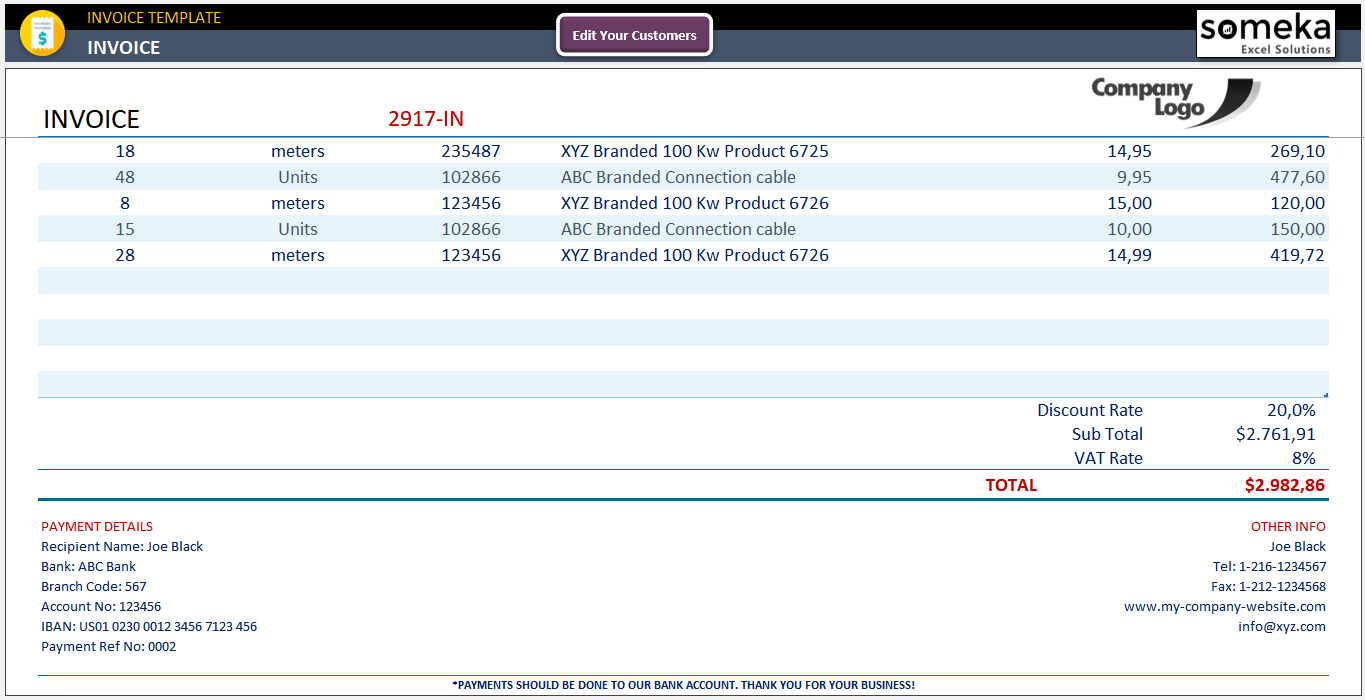

Step 7: Calculate Totals in your Excel Invoice

Now we’ll need to calculate total payable amounts. Here we’ll need to define:

- Discount Rate

- VAT Rate

Then the template will calculate Sub Total and Total amount automatically.

Now our invoice is pretty ready.

Step 8: Print and send your invoice

After making sure your invoice is accurate you can print or save your in PDF format. This template is provided as print-ready. So, just click CTRL+P to take a print our or Saves as PDF to download your pdf invoice.

By adhering to these guidelines, you will be able to make professional invoices in Excel that meet the specific requirements of your company, simplify the billing process, and project an air of professionalism.

2. What should be included in an invoice?

A comprehensive and detailed invoice not only facilitates timely payments but also serves as a record of the transaction between the seller and the buyer. To ensure clarity and professionalism, certain elements should always be included in an invoice:

Invoice Details:

- Header: The word “Invoice” should be prominently displayed at the top of the document to clearly identify its purpose.

- Invoice Number: Each invoice should have a unique invoice number.

- Date of Issue: The date when the invoice is issued should be clearly stated.

Seller Details:

- Seller’s Information: Include the name, address, phone number, email address, and, if applicable, the website of the seller.

- Payment Information: You should include your bank account number and other details.

- Payment Terms: Specify the payment terms agreed upon, including the due date for payment, accepted methods of payment (such as bank transfer, credit card, or online payment platforms), and any late payment penalties or interest.

Buyer Details:

- Buyer Information: Similar to the seller’s details, include the name, address, and contact information of the buyer.

Payment Amount Breakdown:

- Description of Goods or Services: To create an Excel invoice, provide a detailed list of the products or services provided, including quantities, unit prices, and the total price for each line item. This breakdown helps the buyer understand what they are being charged for.

- Subtotal: Before adding any taxes or discounts, list the subtotal amount. This is the total cost of all goods or services provided before any additional charges.

- Taxes and Discounts: Clearly state any taxes, discounts, or additional fees that apply to the transaction. This includes sales tax, VAT, or any discounts offered for early payment.

- Total Amount Due: This is the final amount the buyer owes the seller, after all, taxes, discounts, and fees have been applied.

Finally, you can also add Notes or Additional Information, and this section can be used to include any additional information relevant to the invoice or transaction, such as thank you notes, payment instructions, or warranty information.

3. What are the critical functions of an invoice?

So, it’s also important to understand what an invoice serve for. Here are the main functions of invoices:

- Request for Payment: At its core, an invoice is a formal request for payment, outlining the amount due from the purchaser to the seller for goods or services provided.

- Legal Document: An invoice also acts as a legal document that can be used as evidence in the event of a dispute, as it details the agreed-upon prices and terms of the sale.

- Record Keeping: Both parties use invoices for record-keeping purposes. For the seller, it helps track sales and inventory. For the buyer, it assists in managing purchases and expenses.

- Tax and Compliance: Invoices are crucial for tax purposes. They serve as proof of revenue for businesses and are necessary for both parties when filing taxes, claiming deductions, and ensuring compliance with regulations.

- Professionalism: Sending a well-organized and detailed invoice reflects professionalism and helps establish trust between the seller and the buyer. It indicates that the seller is serious about their business and maintains good business practices.

Having a good grasp of these responsibilities highlights the significance of making thorough and accurate invoices.

4. Invoice Examples

As we have discovered how to create invoice in Excel and what’s an invoice with critical functions and main elements, let’s see some examples of invoices:

Invoices are used by every single business type. So you can find any example for any profession or company.

Below is an example of an invoice for web development. Thus, you can clearly see the main elements as well as web-development related services invoiced in project or hourly-based.

>> Download Web Development Invoice Template

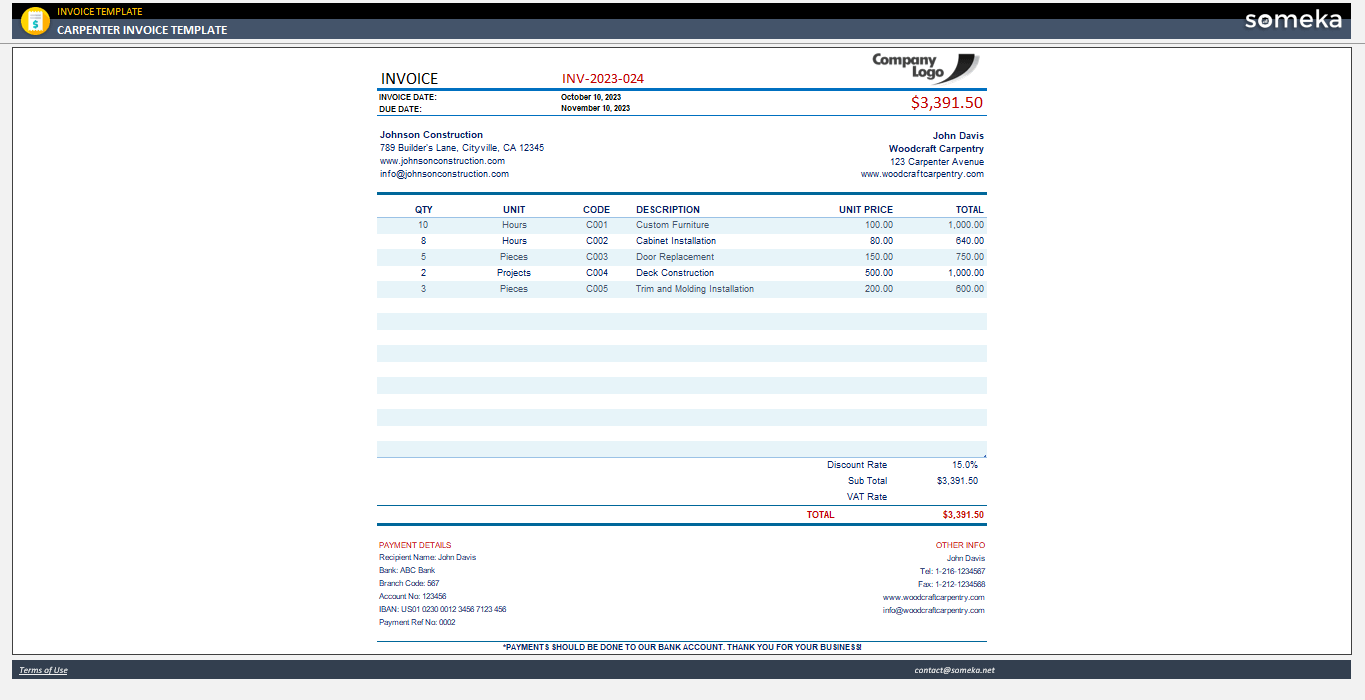

An orher example is from a carpenter invoice. Now you can see both service and goods in the description:

>> Download Carpenter Invoice Template

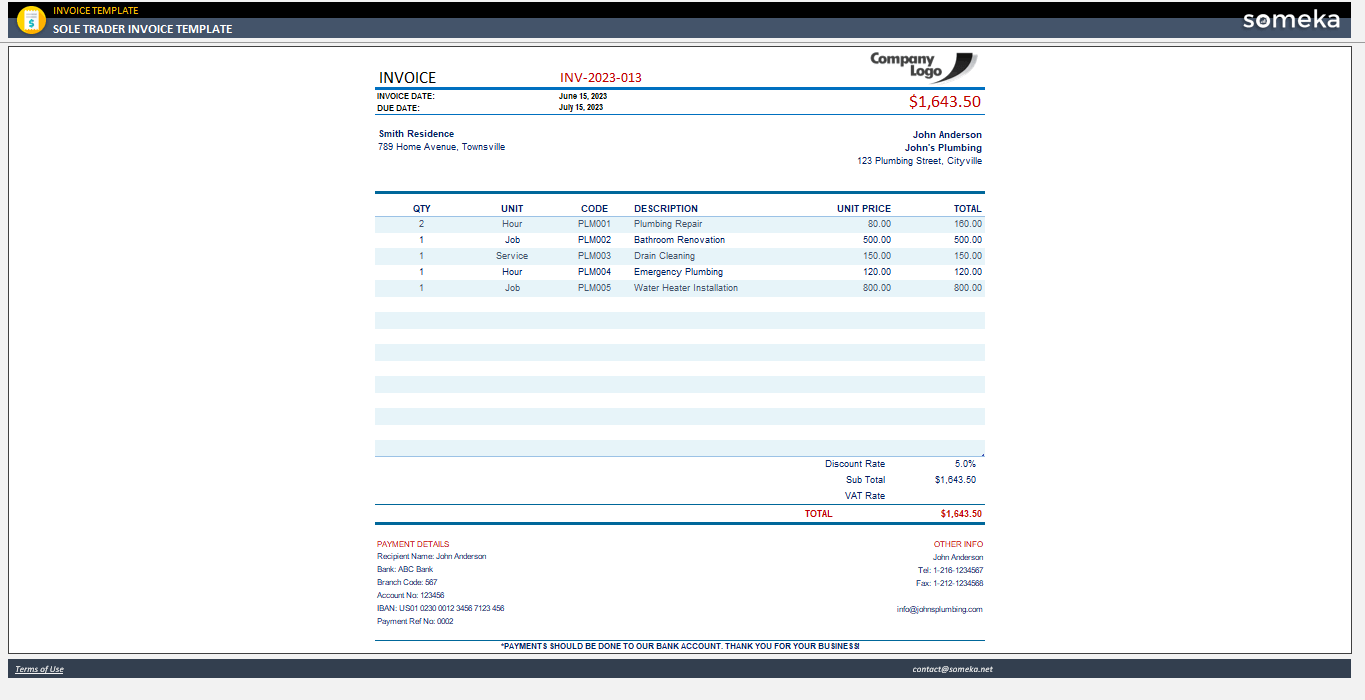

Our last example will be a trader invoice. As a trader, you can also add your hourly-based services or goods that you sell in your invoice:

>> Download Sole Trader Invoice Template

These are only a few examples for Excel Invoices.

5. How do I create my own invoice in Excel?

If you want to open a blank Excel sheet and create your own invoice format, you have to follow the below steps:

- Open Excel and Create a New Document

- Design Your Invoice Layout with your corporate colors and logo

- Add header

- Add invoice information with invoice number and date

- Prepare a customer information section for customer’s name, address, and other contact details

- Create a table for goods and/or services provided

- Add discount and tax rates

- Calculate Subtotals and Totals using Excel’s SUM Function and other formulas

- Add payment information, payment terms and additional information

- Save Your Invoice Template

This is the basic steps to make your own invoice. But, always remember that you can use a ready-made template and then customize it according to your needs. Because this will be a much more easy way to create invoice in Excel.

6. How do I automatically create an invoice number in Excel?

As one of the main functions of invoices is accurate recording, the invoice numbers are very crucial parts of invoices.

But, do you have to remember the invoice numbers each time? No, of course not.

You can create a dynamic formula or VBA coding to create automatic invoice numbers in Excel.

Option 1: Dynamic Formula to Create Invoice Numbers

You can use the ROW Function for sequential numbers. If you’re starting with a purely numerical sequence and plan to create a new invoice on each subsequent row, you can use the ROW() function to automatically increment your invoice number.

For instance, if your first invoice number is in A2 (starting with 1000), you can enter:

This formula adjusts the invoice number based on the row number, allowing for sequential incrementation.

Option 2: Excel Tables with Structured references

If you’re using an Excel table to manage your invoices, you can automate invoice numbering with structured references and the ROW function. Insert a Formula for Invoice Numbers: In the first row of the invoice number column within your table, enter a formula that references the row number.

For example, if you want to start with invoice number 1000, you might use:

This formula calculates the invoice number based on the row’s position within the table.

Option 3: Using macros to create invoice numbers

For more advanced needs, such as including the date or having a non-linear numbering system, you might consider using a VBA macro to generate invoice numbers automatically. This requires some familiarity with Excel’s VBA editor and programming concepts.

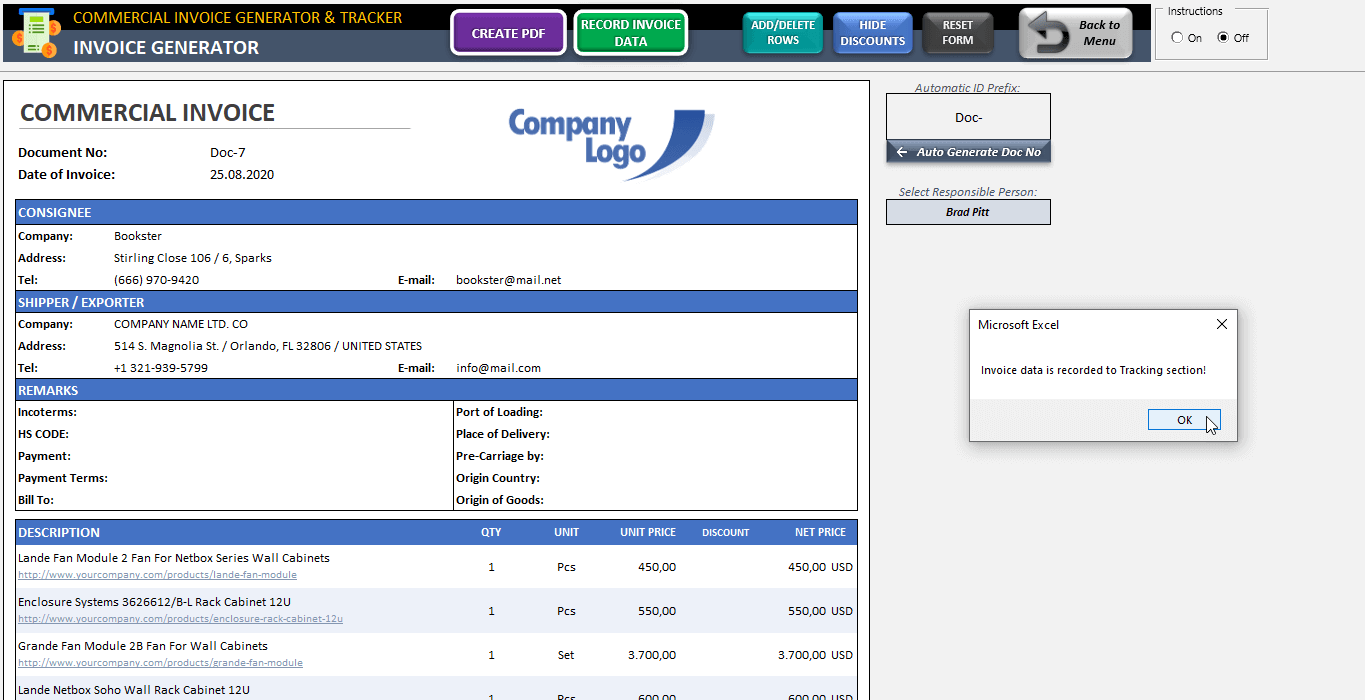

Option 4: Using a Auto-Invoice number generator

Here’s the easiest way to create invoice numbers. Someka’s Commercial Invoice Generator template let’s you create automatic invoice numbers as well as keep a log of your all previous invoices:

>> Download Commercial Invoice Generator

With this template, you’ll be able to define your Prefix, and then with a button click you’ll have your next invoice number. Also, you can record all invoice data, which let’s you to keep a log of your previous invoices to monitor payments, sales, and also customer interactions.

7. Conclusion: How to create invoice in Excel?

Anyone who owns a business, works as a freelancer, or is responsible for billing and financial transactions would benefit greatly from learning how to create invoices in Excel.

So, in this article we have tried to give a complete guidance about making invoices in Excel or in any other spreadsheet. The main issue here is to understand the functions of an invoice as well as the critical components that an invoice must have. Also, having a sleek-design format will be a proof of your professionalism across your customers.

That’s why we have also included some professional invoice formats. All these invoice templates are:

- Editable

- Printable

- Provided ready-to-use

- Available in Excel

- Professional design

This is the end of our invoice guide. For any of your billing needs, also don’t forget to check out our accounting templates. These are all designed to provide you a hassle-free bookkeeping and financial analysis process.

Recommended Readings:

What’s Price Quote and How to Write a Good One?

Can Excel be Used for Accounting?

Purchase Order vs Invoice: What’s the Difference Between PO and Invoice?