How to Make a Personal Financial Statement? Easy steps, examples and template

Do you need a Personal Financial Statement to submit your finance situation? Here’s a quick guide on how to make a personal financial statement. Now, open you Excel file and follow the steps.

Table Of Content

1. What’s a Personal Financial Statement?

2. What to Include in a Personal Financial Statement?

3. How to Prepare a Personal Financial Statement?

4. Why to use Excel to create a PFS?

5. How to fill out a personal financial statement?

6. Who prepares a personal financial statement?

7. Quick Takeaways

1. What’s a Personal Financial Statement?

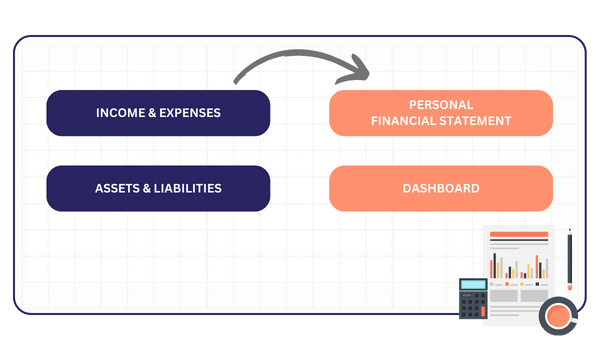

A personal financial statement (PFS) is a document that provides a snapshot of your financial health. Basically, it paints a detailed picture of your financial situation by itemizing your assets, liabilities, income, and expenses.

A personal financial statement (PFS) is a must-have when evaluating your financial condition for any purpose, including loan applications, budgeting, and long-term planning.

2. What to Include in a Personal Financial Statement?

A PFS document should include the following components:

- Assets: These are items of value that you own, such as cash, investments, real estate, and personal property.

- Liabilities: These are debts or obligations you owe, like mortgages, loans, and credit card balances.

- Income: This includes all sources of income, such as salaries, bonuses, interest, and dividends.

- Expenses: Also, these are your monthly or annual expenditures, including housing, utilities, groceries, and entertainment.

So, let’s see how to gather all these items together.

3. How to Prepare a Personal Financial Statement?

First of all, we’ll use Excel to create our personal financial statement. Because this will give us automatic calculations and editable layout.

Step 1: Gather your financial info

Firstly, gather all required financial documents. For example, financial records, investment accounts, loan paperwork, and large purchase receipts all fall into this category.

Step 2: Decide on you PFS term

Secondly, choose the time frame that your PFS will address.

Monthly, quarterly, or yearly terms are most often chosen. Also, the statement’s intended use and the frequency of updates should guide your choice of term.

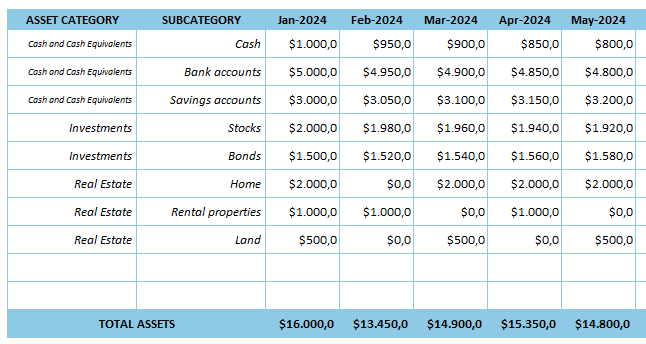

Step 3: List your assets

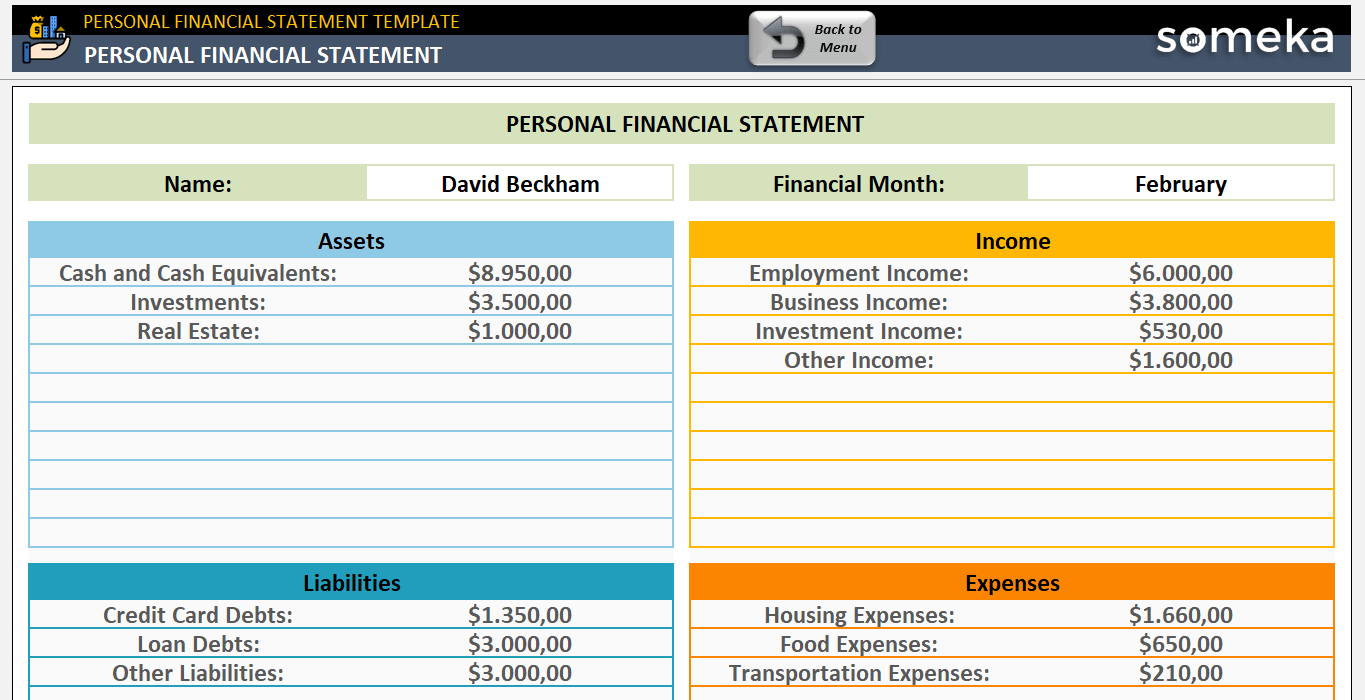

Now, we are going to input our financial data. Let’s start with our asset info:

So, you’ll make an exhaustive inventory of all your possessions.

For example, you should factor in liquid assets such as money in the bank or cash equivalents, retirement funds, stocks, bonds, property, cars, and valuable personal possessions. Make a note of how much each asset is worth right now.

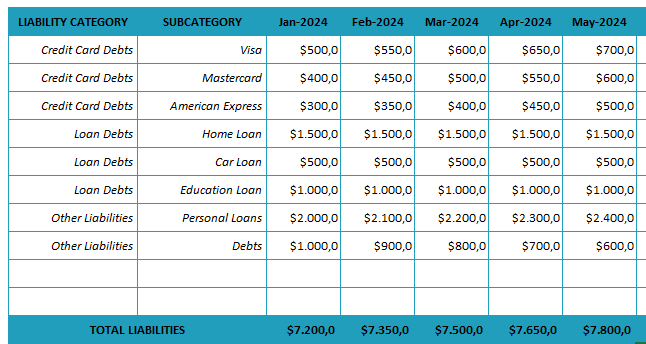

Step 4: List your Debts

Then, we’ll list all the debts so that we understand the balance of our financial situation.

So, please present a complete inventory of your debts. Also, everything you owe is considered a debt, including mortgages, auto loans, student loans, credit card balances, and more.

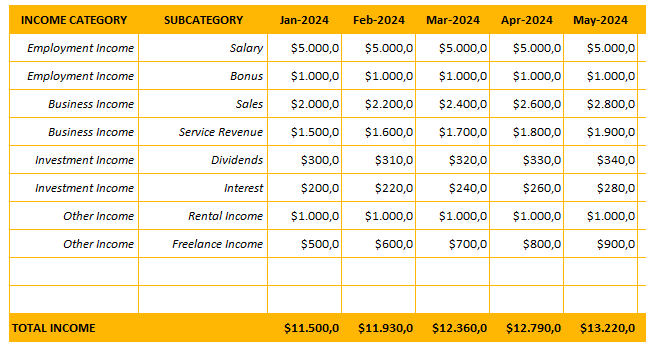

Step 5: List your income

Now, we’ll list our income items to understand our incoming cash flow.

So, make sure to include all of your income sources, including salary, bonuses, rental income, and earnings from freelance work. Also, prior to deducting any amounts, be sure to record the gross income.

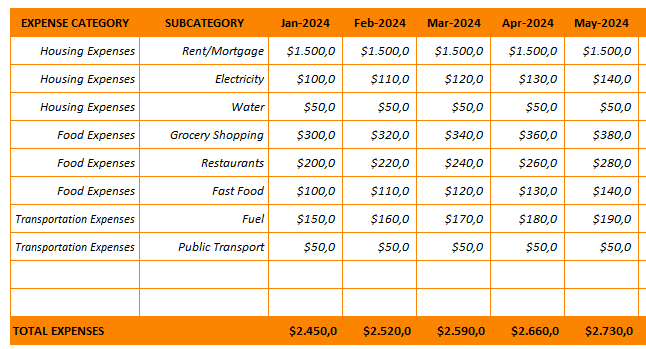

Step 6: List your expenses

Lastly, we’ll write down all of your regular outlays. This will extract our outgoing cash for the selected period.

In addition to covering fixed costs like rent or mortgage, utilities, and insurance premiums, this should also cover variable costs like groceries, eating out, and entertainment. Be sure to factor in one-time costs like vacations or major purchases.

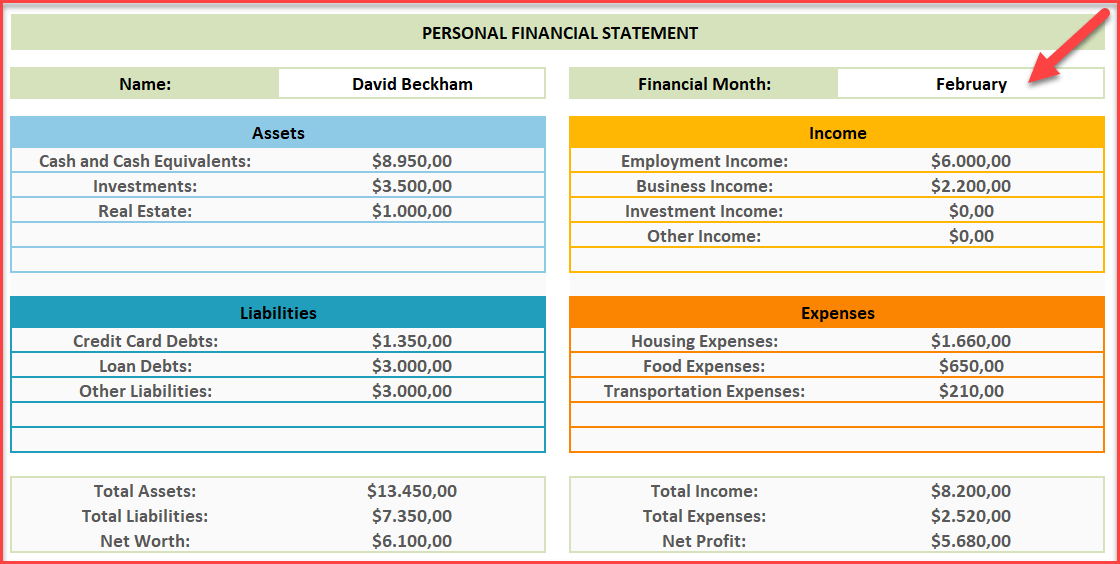

Step 7: Calculate sums for your balance sheet

Then, we’ll tally up all of your assets and liabilities.

>> Download Personal Financial Statement Excel Template

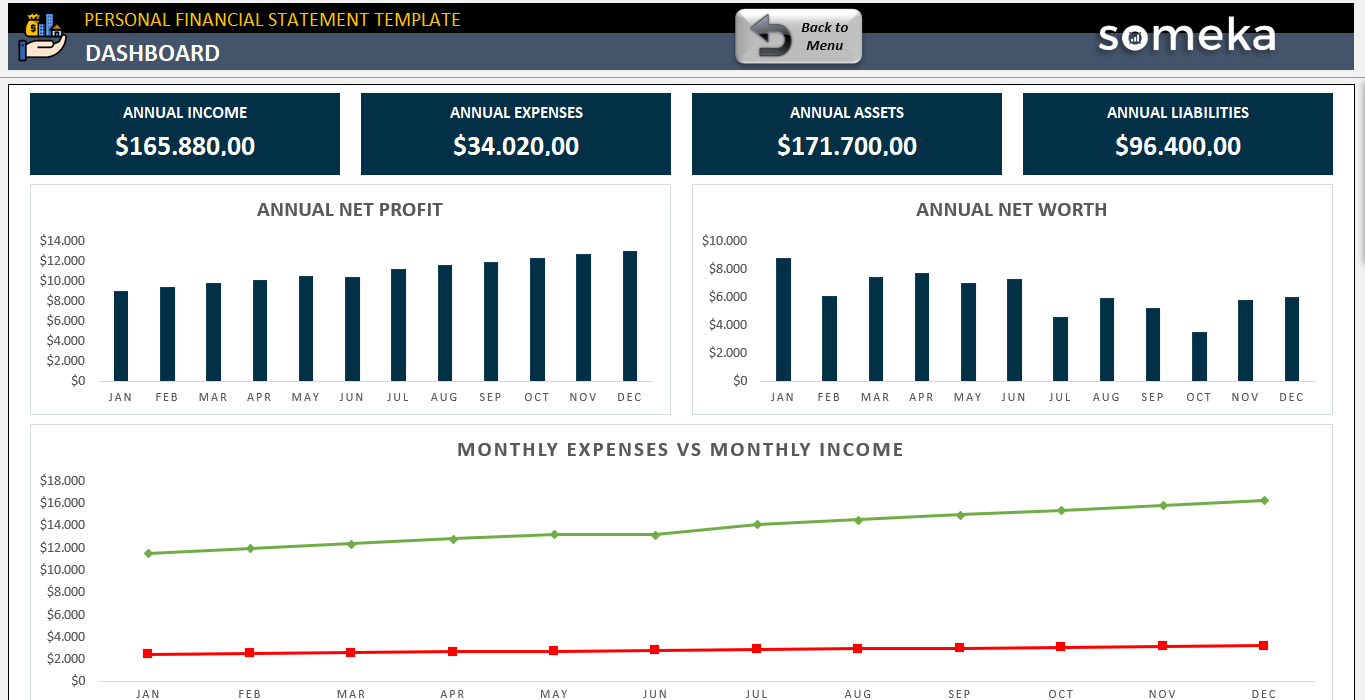

You can find your net worth by dividing your total assets by your total liabilities. So, you can see where you stand financially and where you can make improvements with this calculation.

Net Worth = Total Assets - Total Liabilities

Please remember that balance sheet info is a static data, so it will give you the period-end situation.

Step 8: Prepare your income statement

For a given time frame, an income statement will detail all of your earnings and expenditures.

So, to get your net income, add up all of your expenses and then subtract them from your total income.

Net Profit = Total Income - Total Expenses

With the information in this statement, you can better manage your money and keep track of your cash flow.

Step 9: Print out to submit to relevant authorities

Lastly, you should make sure your PFS is accurate after you’ve finished writing it.

After that, you can print it out and bring it to any bank, lender, or government agency that requests it. So, you can use CTRL+P shortcut key in Excel or Word to print your statement or export it to pdf.

Finally, you should update it frequently to reflect changes in your financial situation and keep a copy for your records.

4. Why to use Excel to create a PFS?

No doubt, Excel is one the best tools, or may be the best one, for creating a personal financial statement for several reasons:

- Editable: Excel allows you to customize your PFS to fit your specific needs.

- Formulas and Functions: Excel’s built-in formulas and functions make calculations easy and accurate. You can automate complex calculations, reducing the risk of errors.

- Visualization: Excel enables you to create charts and graphs to visualize your financial data.

- Ease of Updates: With Excel, you can easily update your PFS whenever your financial situation changes.

So, you can simply modify the relevant cells, and the rest of the document will update automatically.

>> Download Personal Financial Statement Excel Template

Lastly, with ready-made templates in Excel, you do not need to spend time on preparing your format.

5. How to fill out a personal financial statement?

To fill out a personal financial statement, you must input your financial information into the relevant fields.

PFS formats include Assets, Liabilities, Income and Expense info. You should have the breakdown of the items of each group. Then, input the relevant data for the selected period.

6. Who prepares a personal financial statement?

Basically, anyone can prepare a personal financial statement. But, it’s particularly useful for:

- Individuals for budgeting, saving, and loan applications.

- To evaluate one’s own and one’s company’s financial situation in order to pitch that information to possible backers or investors.

- Financial advisors to educate customers about their current financial status and assist them in creating a plan to improve it.

- People looking for loans or other forms of financial assistance to give potential lenders an accurate view of their financial situation.

7. Conclusion: How to make a personal financial statement?

Finally, you may need personal financial statements to demonstrate your financial situation to a third party or you may just want to track your own financial health. Then, you need to learn how to make a personal financial statement.

So, this guide provides instruction to make a PFS with examples, formula and format tips. Below are the some key takeaways:

KEY TAKEAWAYS:

- First, you should gather your asset, debt, income and expense data.

- Excel is one of the most suitable platforms to create your personal finance statement.

- Also, ou should keep your statement updated.

- Lastly, in order to save time and energy while preparing a professional looking PFS, you can download ready personal financial statement templates.

Last but not least, you should understand the net worth and net profit of your personal wallet in order to keep healthy in the financially hard days.

Hope you find our article useful!

Recommended Readings:

10+ Budget Templates to Manage Your Money: Free and Editable Spreadsheets

How to Create an Expense Report in Excel?

Financial Statement Templates: Free Excel and Google Sheets Formats