For both people and businesses, good cash management is a key part of staying financially stable and growing. Our Cash Budget Example is a carefully created Excel tool that can help you carefully plan and control your cash flow.

This template is important for small business owners, financial managers, and people who want to keep a tight grip on their cash coming in and going out.

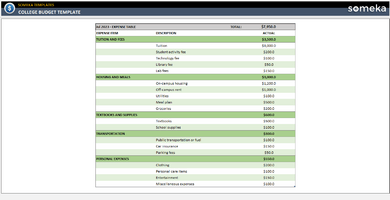

The Cash Budget Template gives you a detailed and useful way to handle your cash. It helps predict how much cash will be needed, make sure there is enough cash for daily activities, and plan for future cash needs. This form is a good way to get organized and plan ahead with your money because it focuses on being precise and flexible.

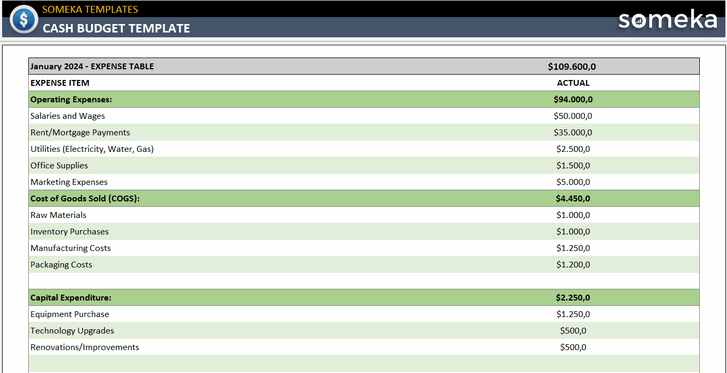

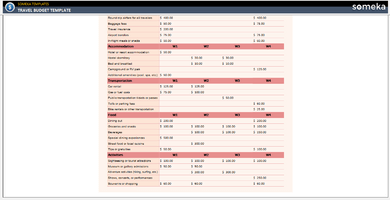

Expense Categories in a Cash Budget

You can use different expense catogories in your cash budget example:

- Operating Expenses: Salaries, office rent, utilities

- Cost of Goods Sold (COGS)

- Capital Expenditure: Equipment purchase, technology innovation, renovations

- Debt Servicing: Loans, interest payments

- Other Expenses: Miscellaneous costs like legal fees, insurance, travel expenses

What’s important in a Cash Budget Template?

Here are some important points for a cash budget:

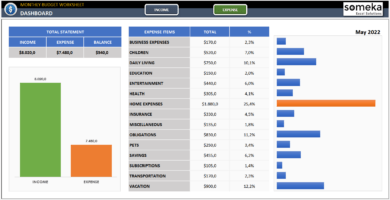

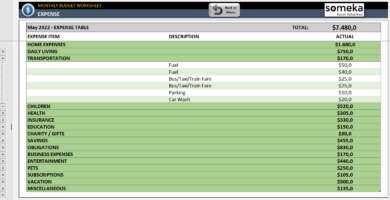

Detailed Tracking of Income and Expenses

Make sure you accurately record and sort all cash coming in and going out, such as purchases, sales, payments, and debts.

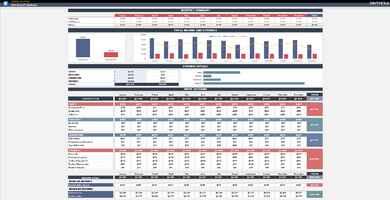

Monthly and Quarterly Projections

Plan and make predictions about your cash budget every month and every three months. This will help you see what cash you will need in the future.

Cash Flow Analysis

Find out how much cash you have at the end of each period. This will help you figure out if you have any gaps or surpluses.

Budget Variance Analysis

Look for differences between expected and actual cash flows to find out what went wrong and change your budgeting approach to fix it.

Planning for an emergency fund

Set aside money for unplanned costs, so you’ll be ready for accidents and keep your finances stable.

Key Features of Cash Budget Example:

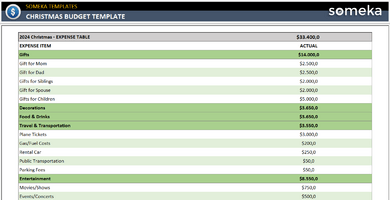

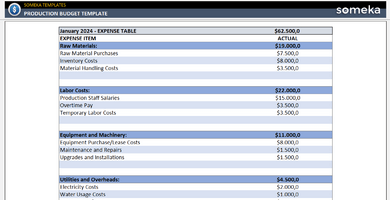

- Customizable Categories: You can change the categories for income and expenses to fit the needs of your business or personal funds.

- Debt Management: Keep track of all of your loans and bills, including when they are due to be paid back and how much interest you are paying.

- User-Friendly and Collaborative: It was made to be easy to use and work together, so many people can add to the budget and see it.

- Printable: It’s a print-ready template.

The Cash Budget Template is an important tool for managing cash that can be used for both personal and business purposes. It supports a disciplined approach to planning your finances, making sure that your cash resources are used in the best way possible and in line with your financial goals.