10+ Budget Templates to Manage Your Money: Free and Editable Spreadsheets

Budgets are financial plannings of expected revenue and expenses. And, when it comes to financial management, budget templates are an indispensable resource. We have gathered a collection of top budget templates for you.

Table Of Content

WHAT IS A BUDGET?

BUDGET TEMPLATES

1. Monthly Budget

2. Weekly Budget

3. Bi-Weekly Budget

4. Event Budget

5. 50/30/20 Budget

6. Household Budget

7. Other Budgets

CONCLUSION

What’s a Budget?

A budget is a financial plan that outlines expected income and expenses over a specific period. Basically, it’s a tool for managing money, helping to balance earnings against expenditures.

Individuals or organizations can monitor their financial resources and make sure they have enough money for goals and necessary expenses by creating a budget. Budgets are essential for preventing overspending, setting money aside for emergencies, and preserving general financial stability. They are especially helpful when deciding how much money to save and spend.

Budget Templates

Budgeting templates offer an organized approach to tracking and managing earnings and outlays, which simplifies the process of comprehending one’s financial well-being. These templates help in the creation of an understandable financial plan, whether it is for personal or professional use.

Budgeting spreadsheets also support financial discipline, goal-setting, and the identification of spending patterns. This article examines several budgeting template kinds, each intended to meet distinct financial requirements and timelines. Budget templates are essential for stress-free and well-organized financial planning, from tracking everyday spending to organizing major events.

Finally, these templates are provided in Microsoft Excel and Google Sheets formats, as the most common spreadsheet software of the business world.

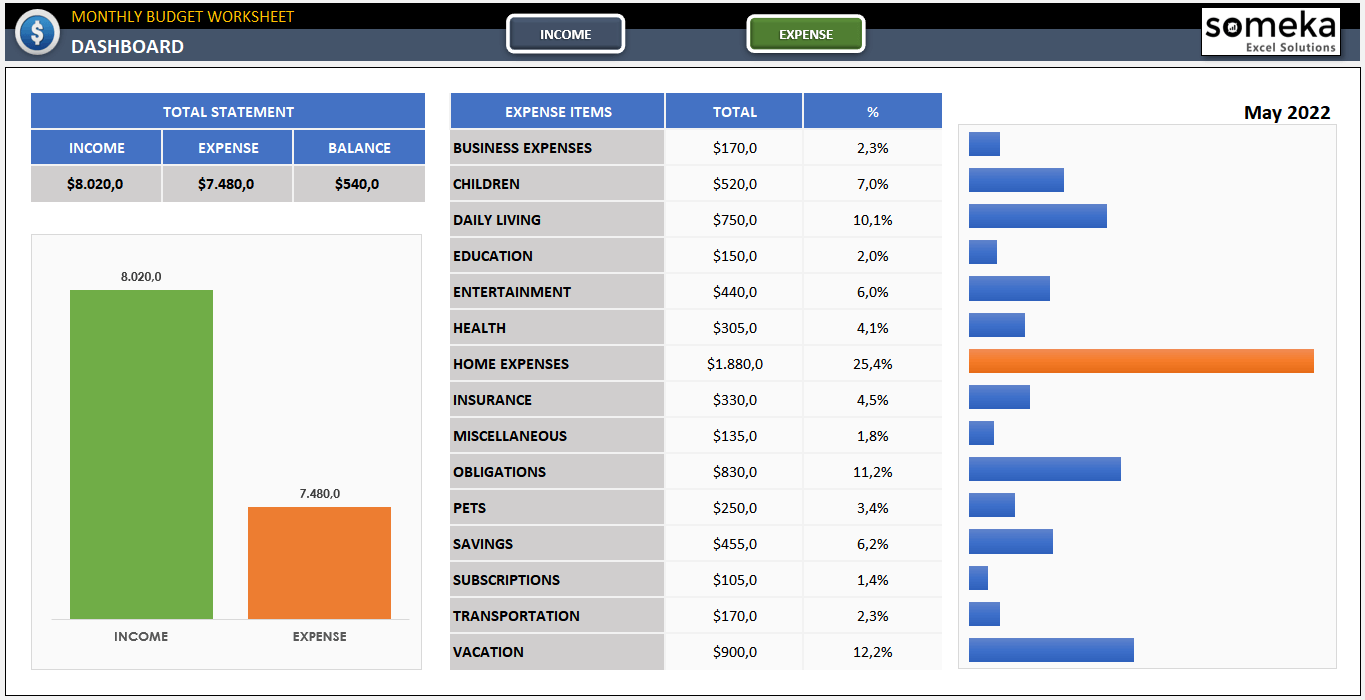

1. Monthly Budget Template

A monthly budget will give you a calendar-wise financial overview. Therefore, monthly budgets assist users in setting aside money for various costs. For monthly income and expenses that are consistent, this kind of template is perfect.

The main idea of monthly budget sheets is to make a detailed analysis of expense and income items in a given month. Additionally, you’ll find charts and bar graphs in this template to visualize your monthly balance.

You can download this file in Excel or Google Sheets.

>> Download Monthly Budget Template

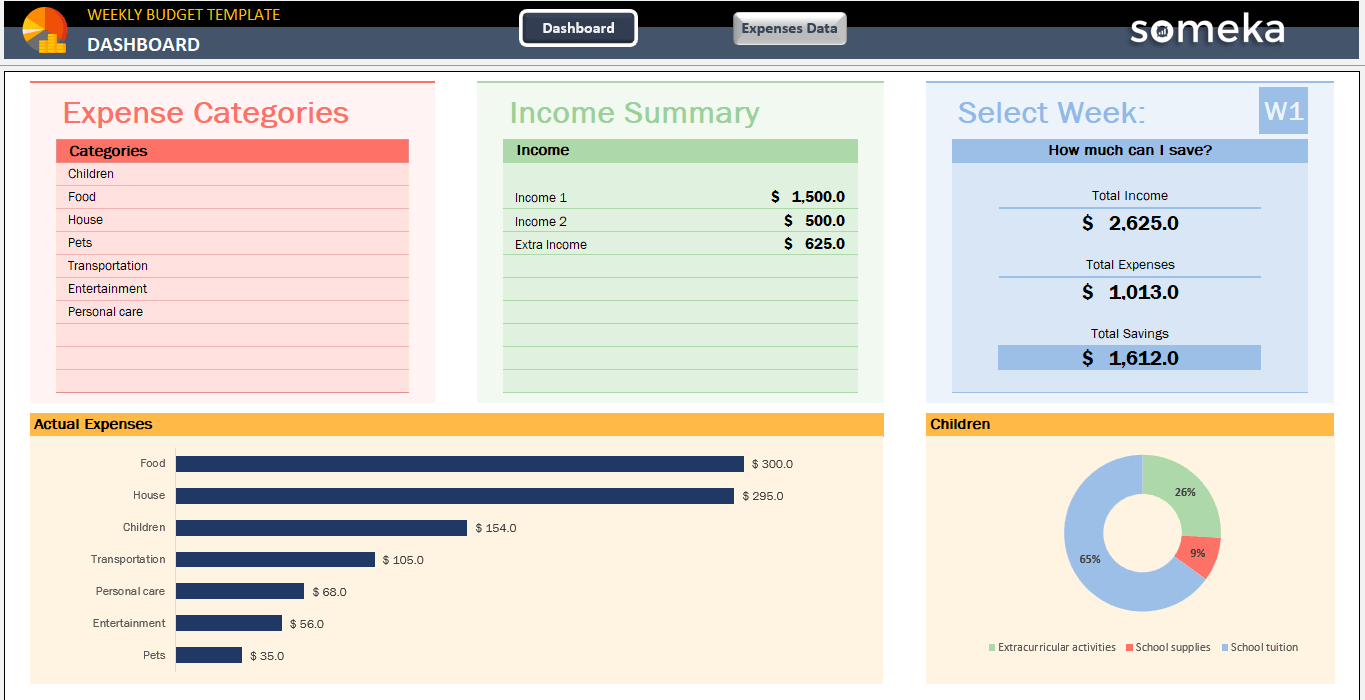

2. Weekly Budget Template

Weekly budgets emphasize financial planning for the near future. So, they are ideal for handling regular spending. This template works well for people whose weekly expenses or income fluctuate.

As this is a fully customizable file, you can edit the boxes to form your own budget spreadsheet.

>> Download Weekly Budget Template

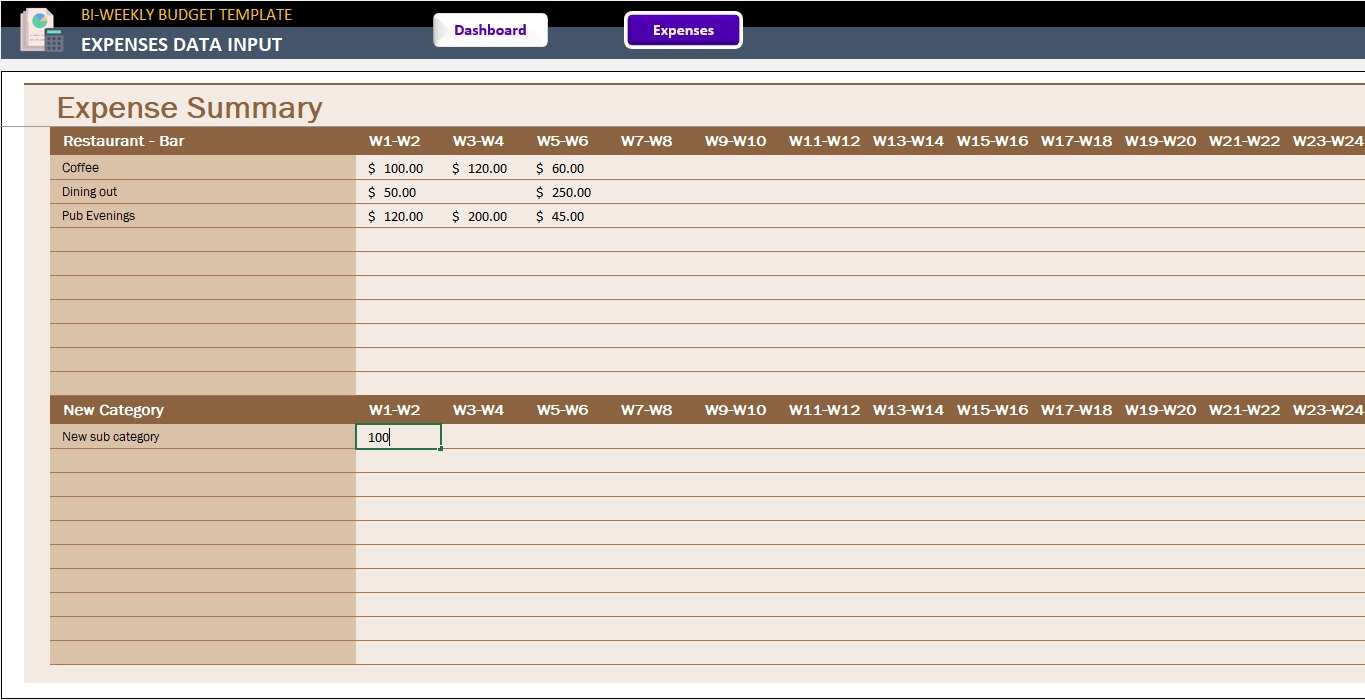

3. Bi-Weekly Budget Template

For people who get paid every two weeks, there is a bi-weekly budgets. It connects the weekly and monthly budgeting methods. Thus, using this template makes it easier to match spending to biweekly pay cycles.

Additionally, you can also analyze your expense distribution with a sleek-design dashboard in this template, provided in Excel and Google Sheets.

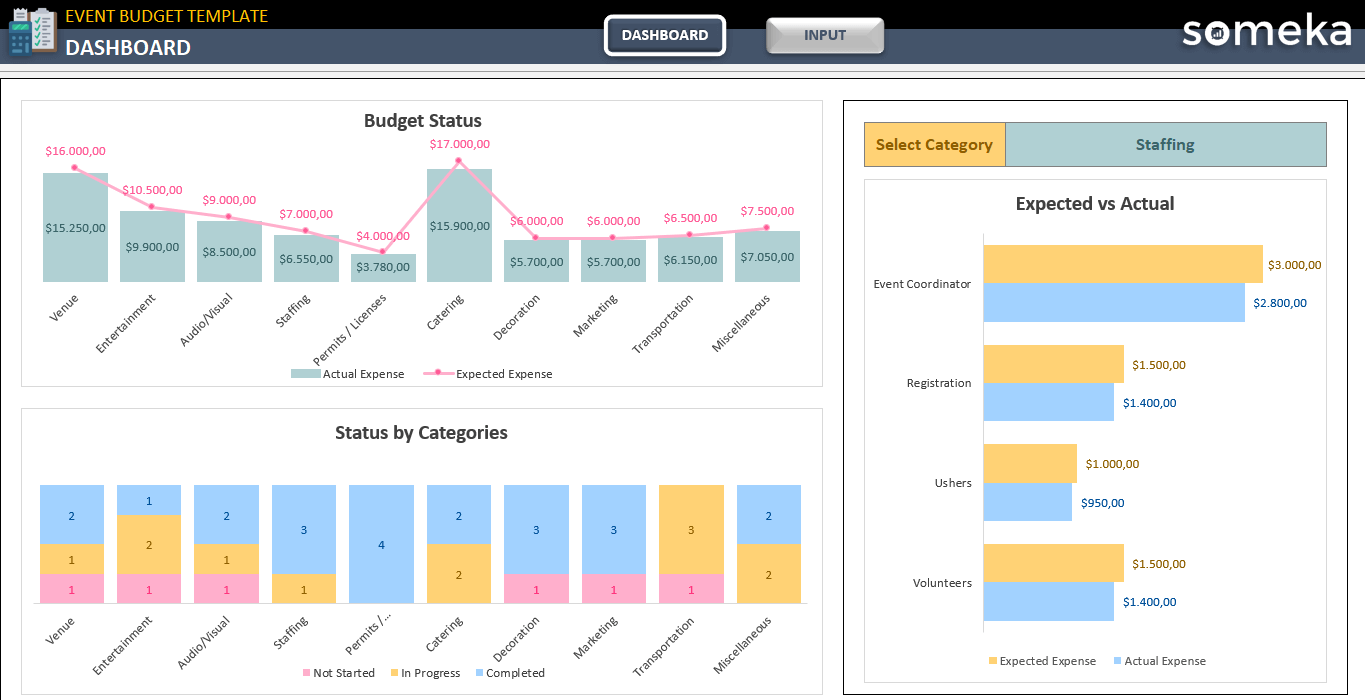

4. Event Budget Template

Templates for event budgets are made for particular organizations, for smaller events, conferences, concerts, and so on. Event budgets support the organizing and monitoring of costs for parties and weddings.

These templates guarantee that events don’t go over budget.

>> Download Event Budget Template

5. 50/30/20 Budget Template

50-30-20 Budgets are used to group your budgeting items into three categories. As a popular personal finance tool, this method is ideal for efficient money management.

What is the 50 20 30 budget rule?

The 50/30/20 budget rule is a simple guideline for managing personal finances. It suggests dividing your after-tax income into three categories:

- 50% for Needs: This portion is allocated for essential expenses, such as rent or mortgage, utilities, groceries, and transportation. These are the expenditures necessary for basic living.

- 30% for Wants: This part covers non-essential expenses, like dining out, entertainment, shopping for non-necessities, and other leisure activities. These are expenses that you could live without but enhance your lifestyle.

- 20% for Savings: The remaining 20% is designated for savings, investments, emergency funds, or paying off debts, such as credit card balances or student loans.

Is 50 30 20 effective?

This rule is popular because of its simplicity and flexibility, making it easy for people to adapt to their own financial situations and goals. As the main idea is categorizing your expenses here, there are also other methods like 70-20-10 Budget Rule or 80-10-10 Budget Rule. This depends on the personal needs, preferences as well as the economical conjuncture.

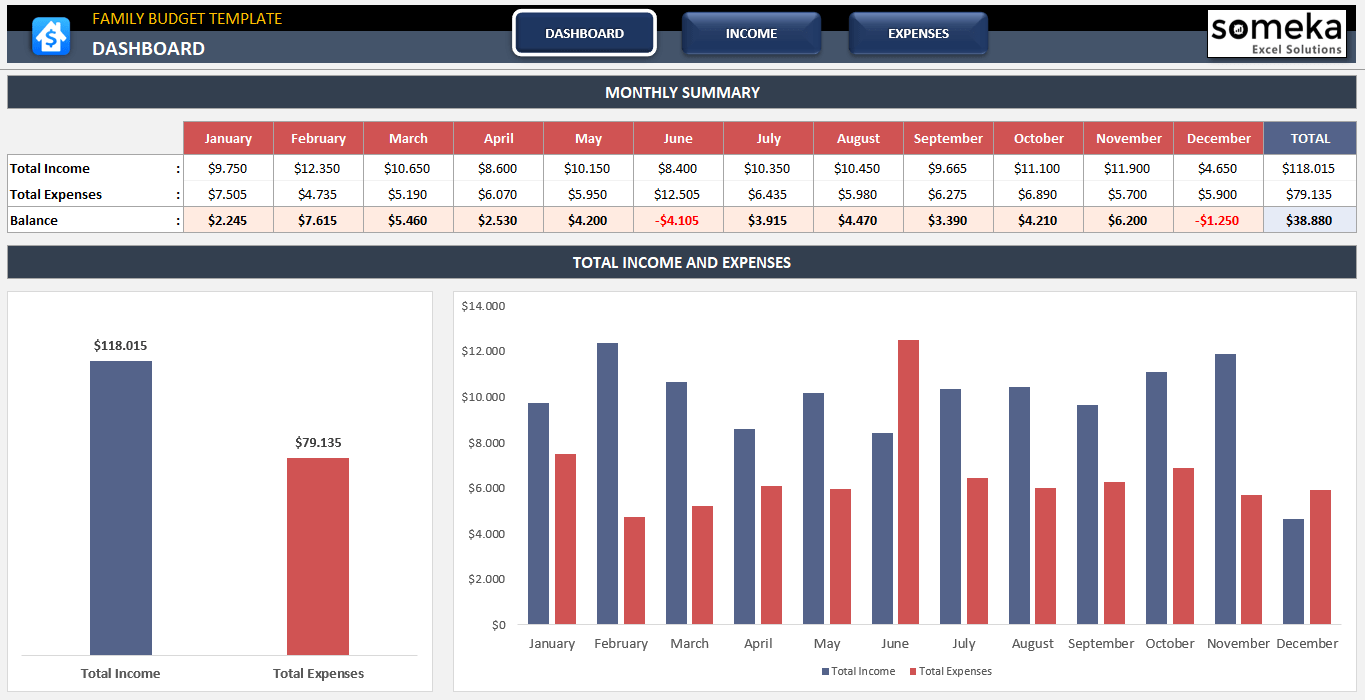

6. Household Budget Template

If you are looking for a family budget, then you can download household budgets. This tool is provided as monthly-basis, so you can make monthly comparisons and analyze your total income and expense trend through the year.

Additionally, this template is provided in Google Sheets and Excel formats.

>> Download Monthly Household Budget

7. Other Budget Templates

We have listed the main budget sheets from Someka portfolio above. In addition to these budgeting tools, we have also created many examples with those templates.

In this collection you can find department-based budgets such as:

There’re also sectorial templates in this collection:

In addition to these, you can also find many personal organization or daily life budgets in this portfolio:

- Wedding Budget

- Apartment Budget

- Grocery Budget

- Vacation Budget

- And much more…

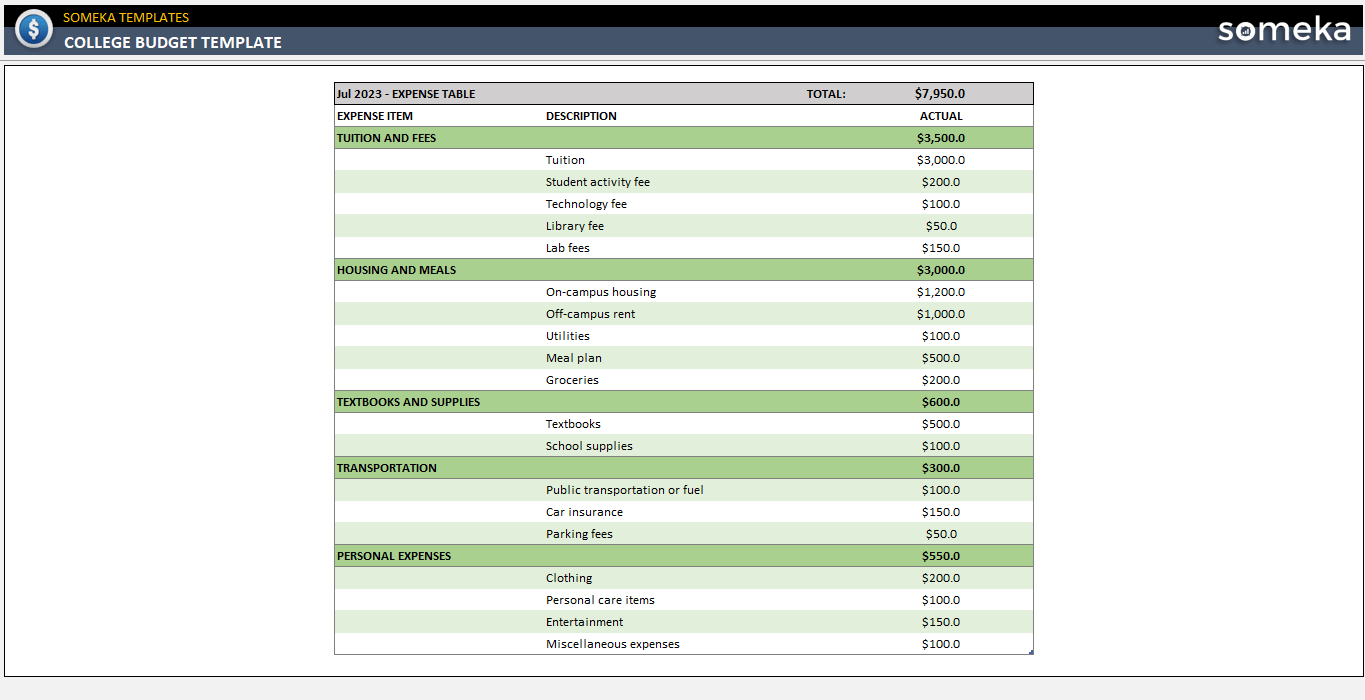

– This is an image from College Budget Example from Someka’s examples portfolio –

So, you can find different budgeting templates are available to suit different requirements. While some are for personal use, others concentrate on business finances. These templates are tailored to particular goals and financial circumstances.

CONCLUSION

Templates for budgets are vital resources for financial planning. As, they meet a variety of needs, including those for special occasions and daily cost, you can ensure more stable and effective money management with these budgets.

All these templates are:

- Printable

- Also customizable

- Ready-to-use

- In Excel and Google Sheets formats

- Instant download

So, you can download Excel Budgets for free and start your money management today. If you prefer online tools, you can check out our Google Sheets Budgets with access from all devices.

Recommended Readings:

How to Make a Budget in Excel? Easy and Quick Instructions

Making a Budget in Google Sheets: A Step-by-Step Guide

How to Calculate Total Revenue in Excel? With Examples and Template