Excel Company Cash Flow Planner Template

Expense and income tracker to project your future cash flows. Suitable for both recurring and one-time payments. Company Cash Flow Planner in Excel.

TEMPLATE DESCRIPTION

Download our Excel Company Cash Flow Planner Template to track and manage your incoming and outgoing cashes and analyze closing cash balances.

What is unique for this tool? It supports both one-time and recurring cash flows. Just plan your expected in and out flows, and let the template analyze it for you.

This is and ultimate tool for managing and projecting your company’s finances with precision. All available in Excel.

How to use Excel Company Cash Flow Planner Template?

Basically, the template consists of an intuitive input section plus three comprehensive output sections, in addition to the Menu part:

- Menu

- Income and Expenses Input

- Dashboard

- Monthly Table

- Transaction Log

Let’s see the entire structure in details.

So, we’ll start with the menu part and then explain other input and output sections.

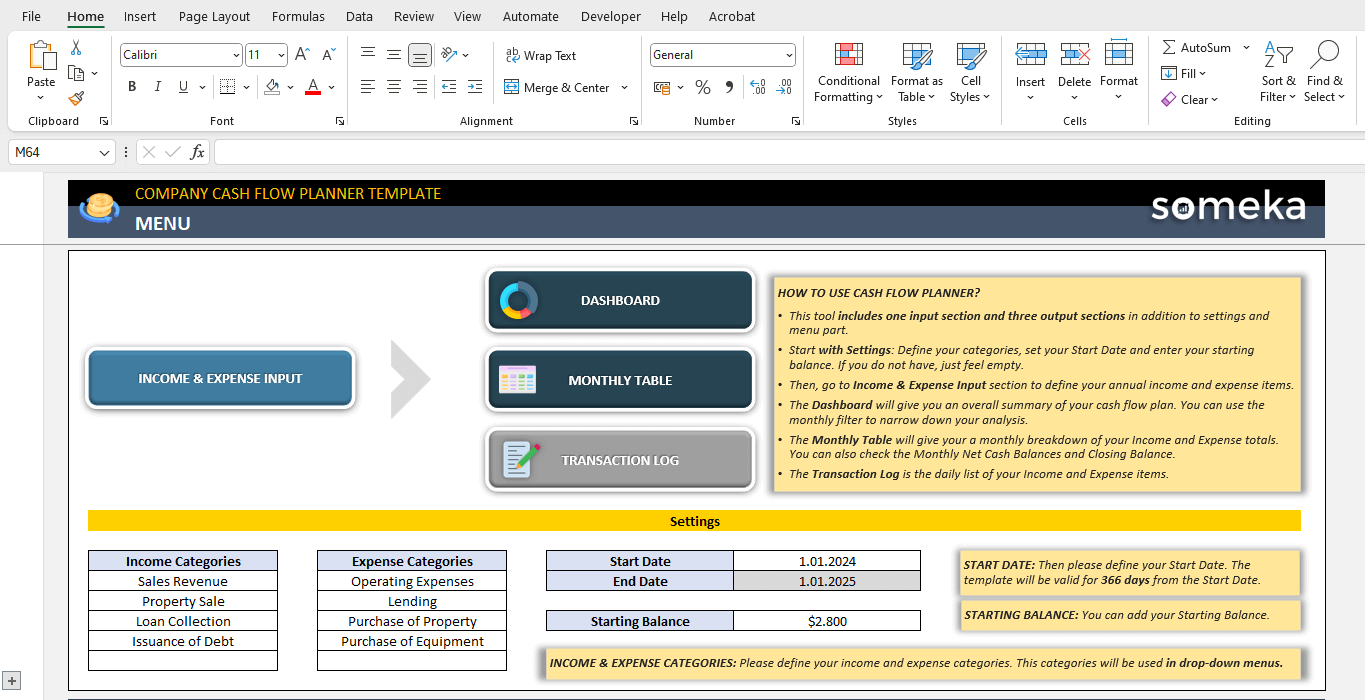

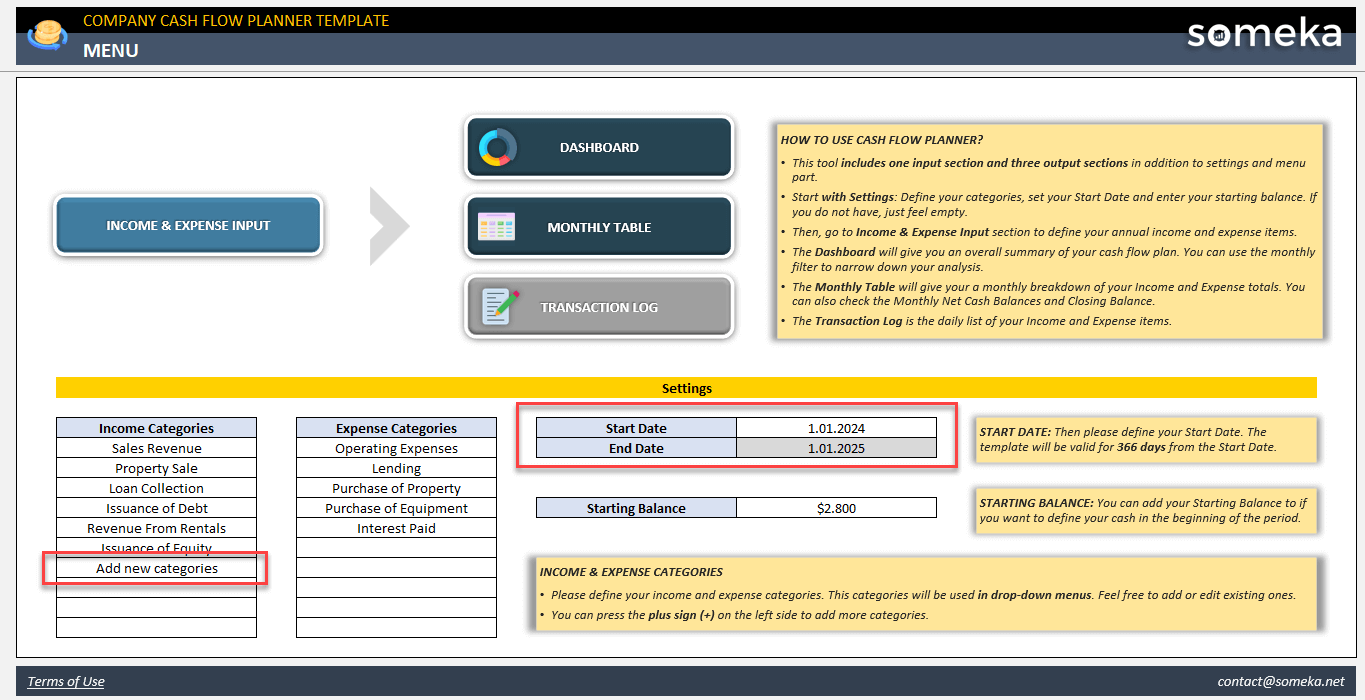

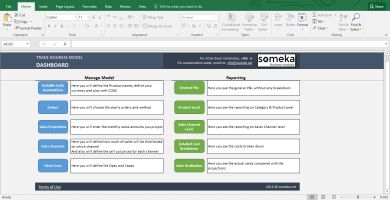

1. Menu

Firstly, the template will open with a menu section, which includes:

- Settings

- Navigation Menus

Firstly, on the settings section:

- Define your income and expense categories: Those will create your drop-down menus and calculate your top expense and income categories. Also, you can use the plus (+) signs to add more categories. Finally, the template supports up to 30 different income and 30 different expense categories.

- Set your starting data: Note that the template will work for the following 366 days from the Starting date.

- Define your opening balance: If you have a negative or positive cash flow in hand on the starting date, then add this amount here. Thus, this will also populate on your final calculations.

Lastly, the buttons on the Menu will help you to understand the general structure and easily navigate through the template.

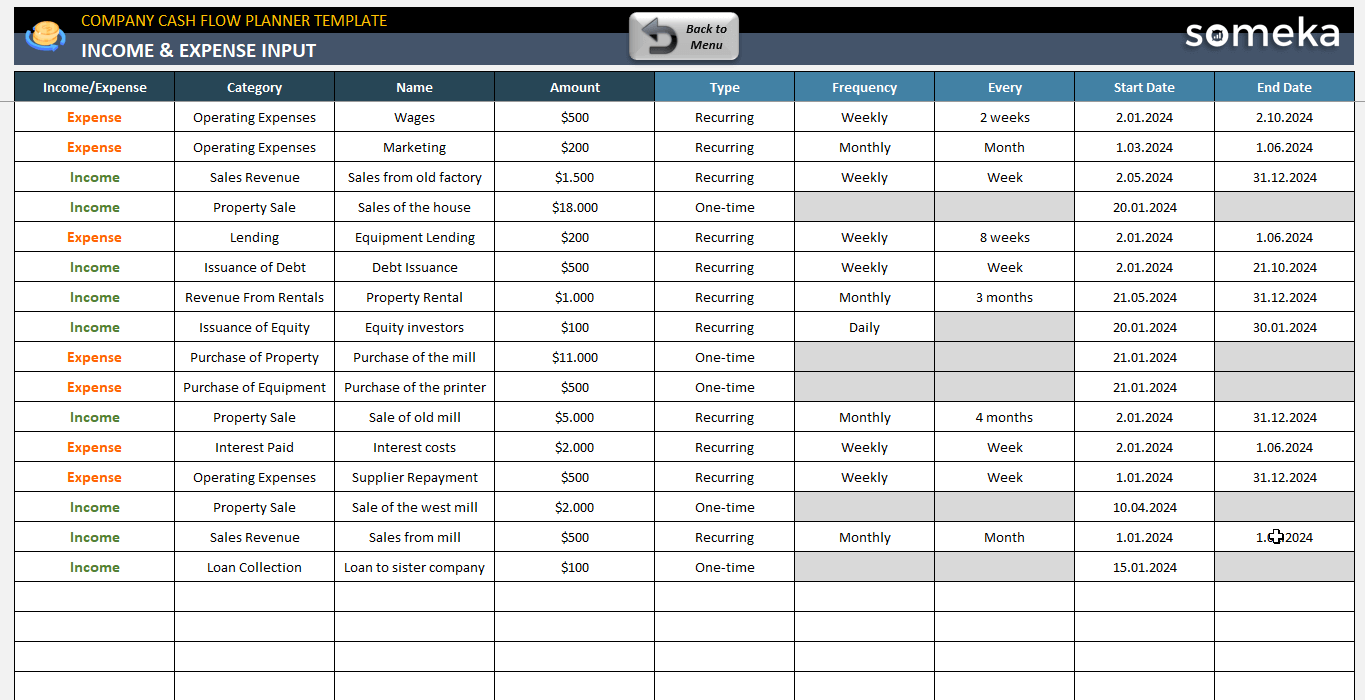

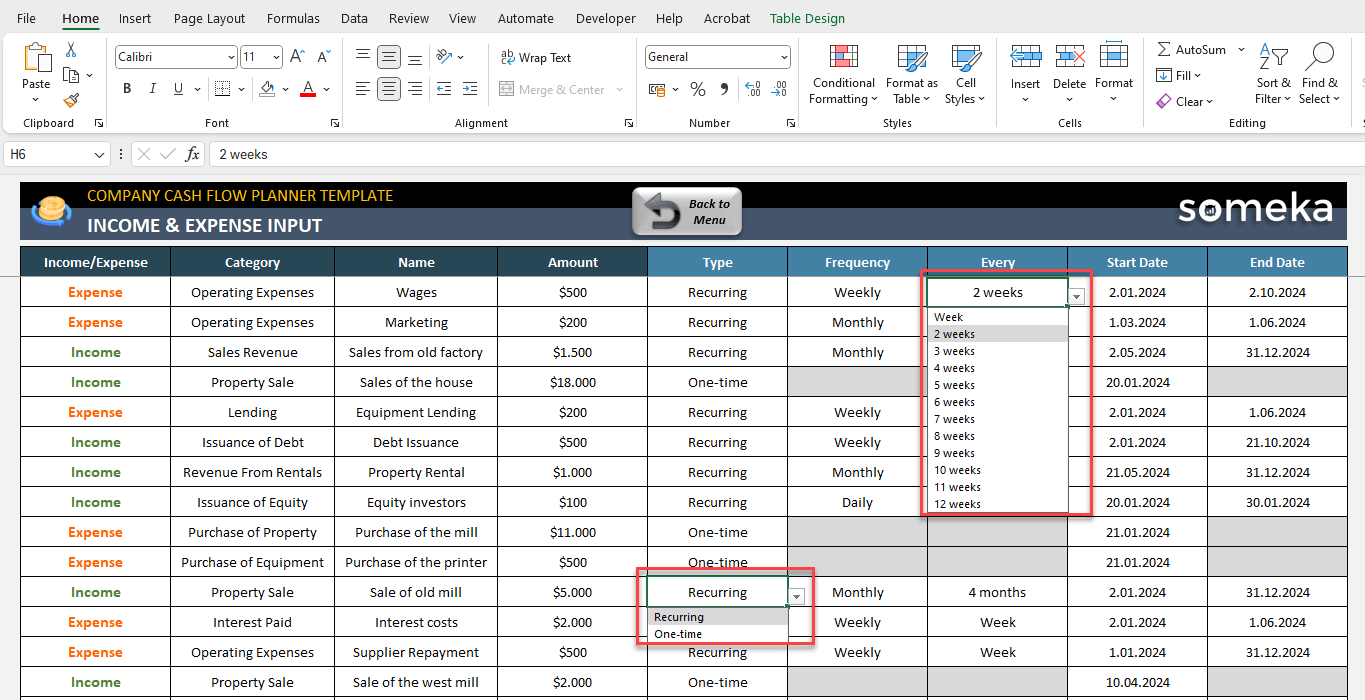

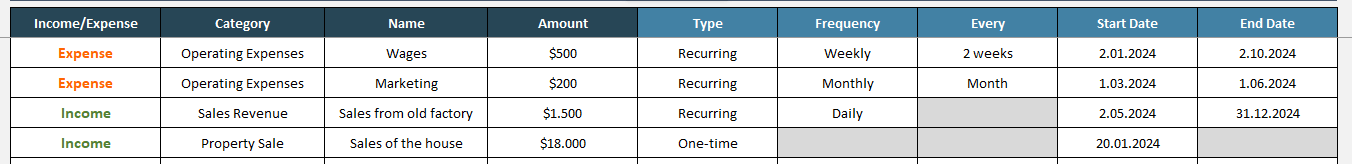

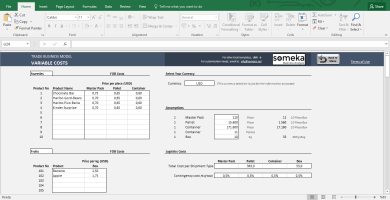

2. Income and Expenses

Firstly, this is the main and only input area of your cash flow planner template. So, you’ll add all your income and expense items in this list.

Additionally, this is list is designed as super helpful for you to support both recurring and one-time purchases.

You do not have to add your recurring income or expense items each day, week or month anymore!

Because, this template automates it for you.

- So firstly, select the type of your item: Expense or Income

- Secondly, define the category, name and amount of that item.

- Thirdly decide if this is an one-time or recurring income or expense.

- Then, if it’s a one-time, you’ll only write the expected date of that income or expense. You can use the Start Date column for this.

- However, if it’s a recurring one, then you’ll choose the Frequency as Daily, Weekly and Monthly. Afterwards, you will define in which frequencies the income or expense will repeat: such as in two weeks, in three weeks or in three months, every month, etc.

- Lastly, you can also define the end date of your expected cash flow.

Please note that the input section will help you with dynamic dropdowns and formattings to ease your data input process. For example, when you select the one-time as the type, you’ll only see the Start Date column open. Likewise, if you select the Expense, you’ll only see the Expense categories on your dropdowns.

Lastly, this list will support up to 500 different one-time or recurring income or expense input.

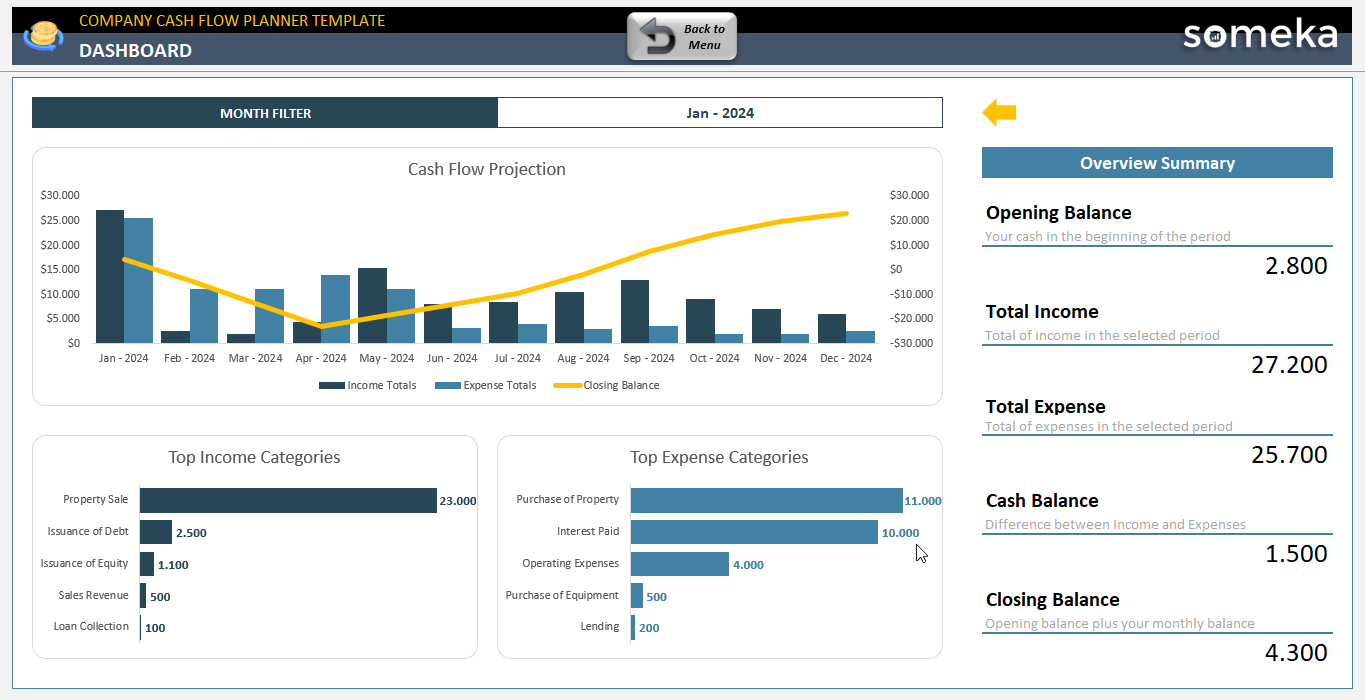

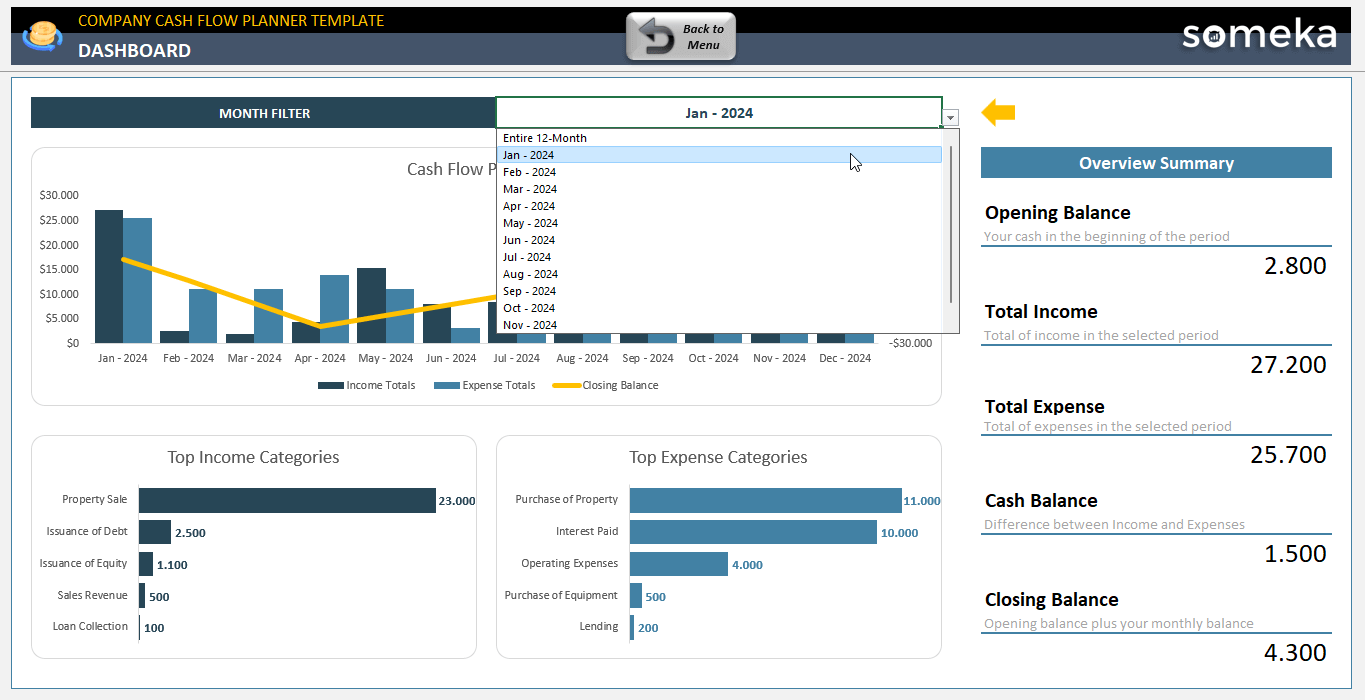

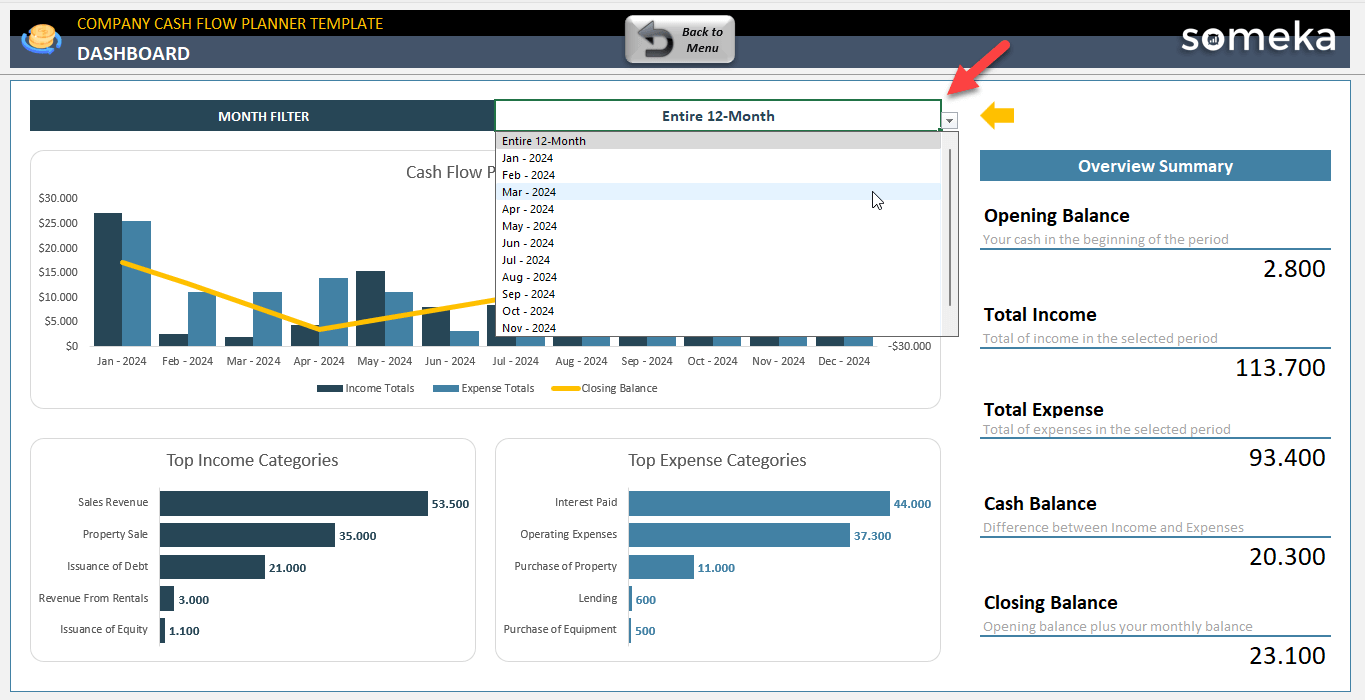

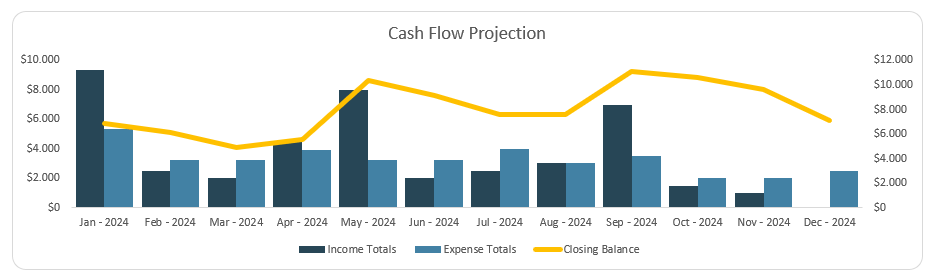

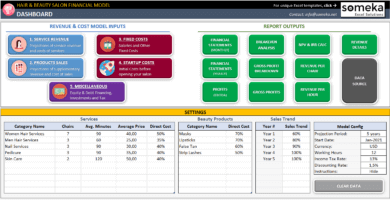

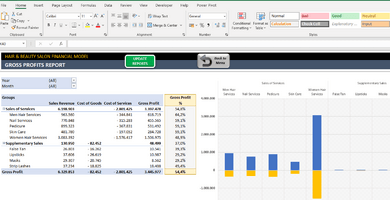

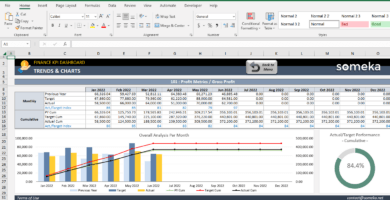

3. Company Cash Flow Planner Dashboard

So, this section is one of the main three outputs of this template. Thus, you’ll see a visualization of your expected cash flows here.

Firstly, you’ll find a filter on the top to narrow down your analysis. You can either select the entire 12 months or just narrow it according to a particular month.

Now, with a cash flow projection graph, you can analyze the monthly trends of your expenses, income and also the closing cash flow balances:

Also, you’ll find Top five income and expense categories for the selected period. So, these charts will help you understand where is your cash flow mostly coming, and where it is going.

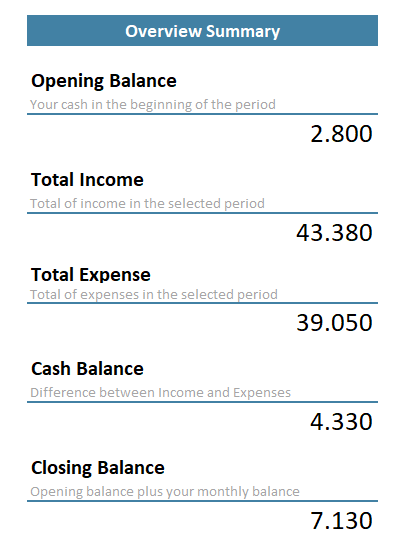

Lastly, with an overview card on the right side of your Dashboard, you can easily analyze the cash flow plan for the term that you’ve selected on the top:

So, this vertical card will show the sequences of your cash flows:

- Opening Balance

- Total Income

- Total Expense

- Cash Balance

- Closing Balance

Remember that this card is also sensitive to the monthly filter above.

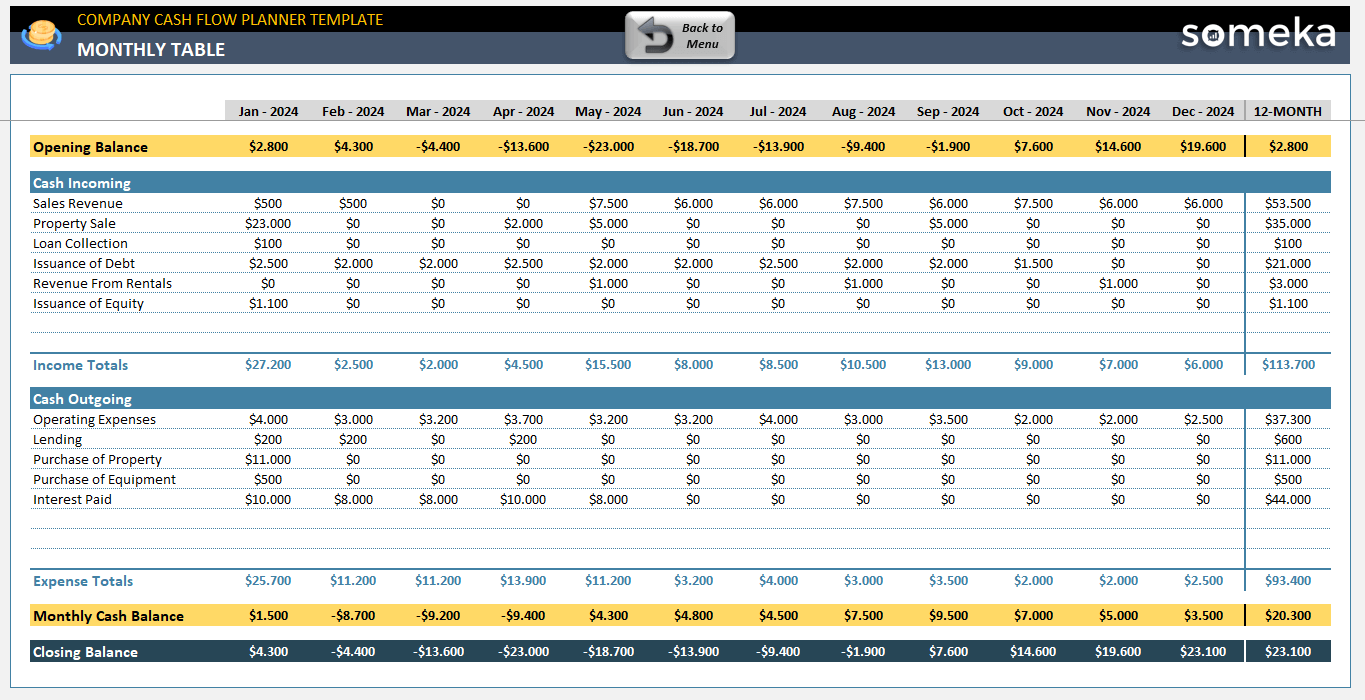

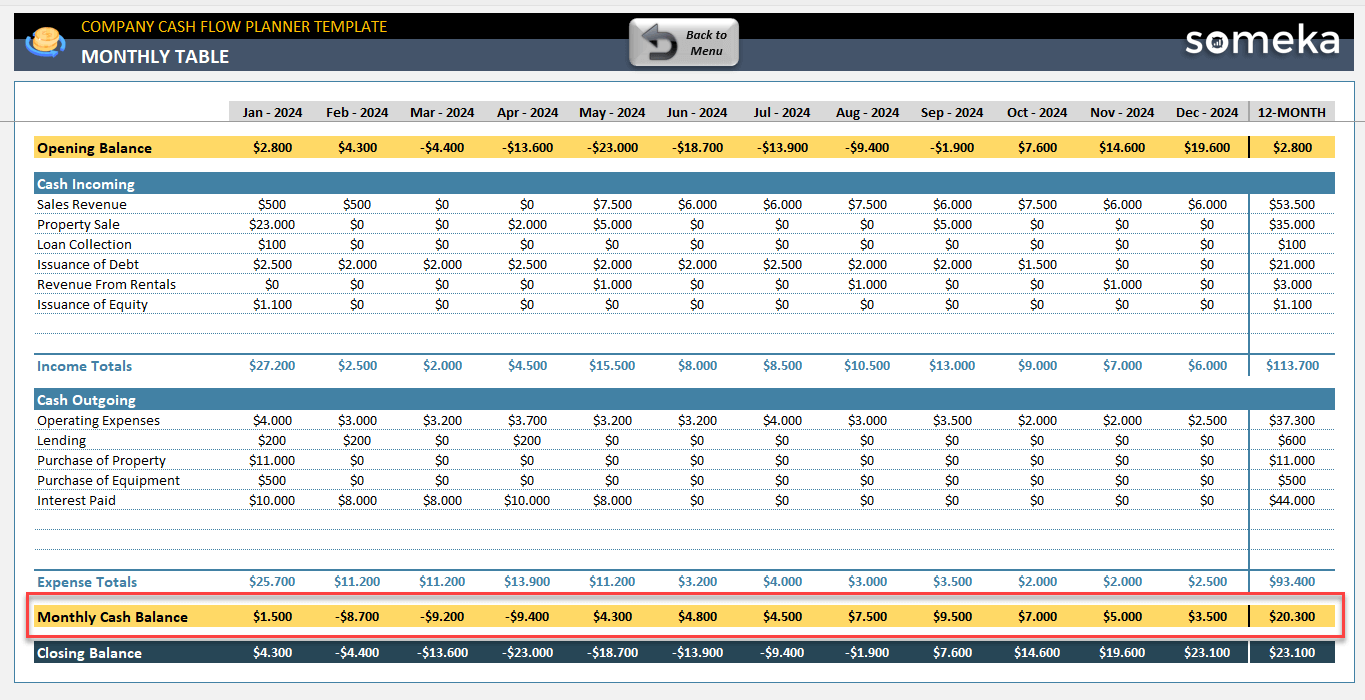

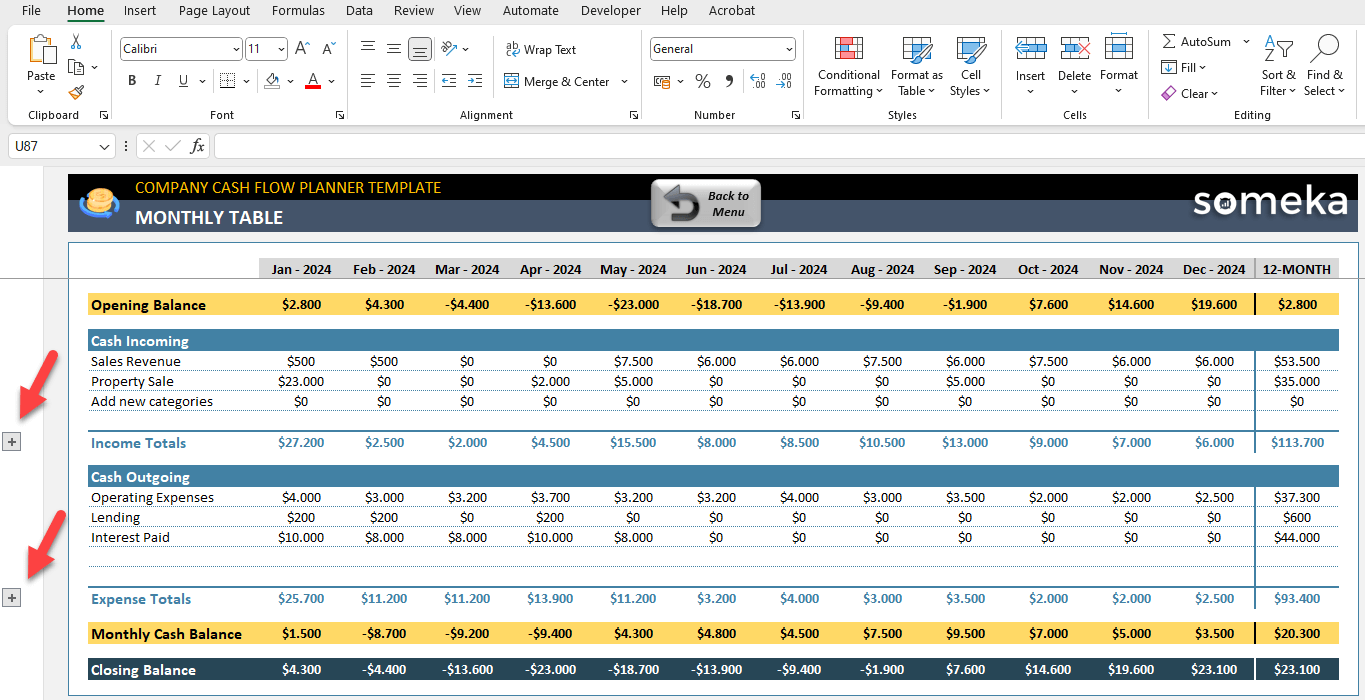

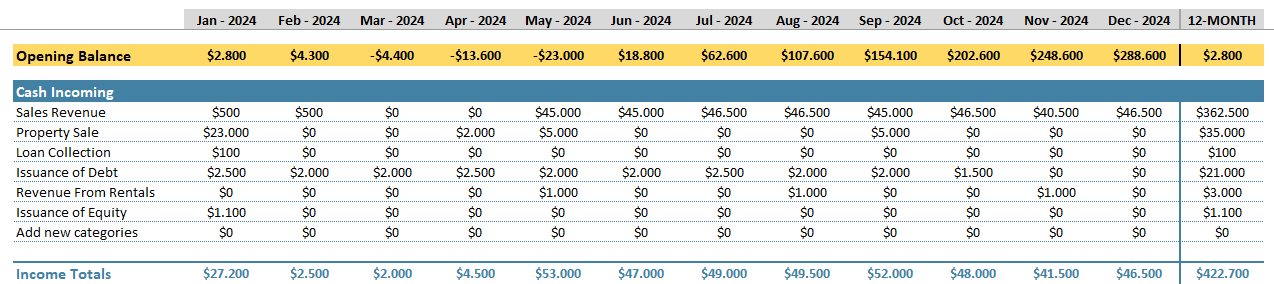

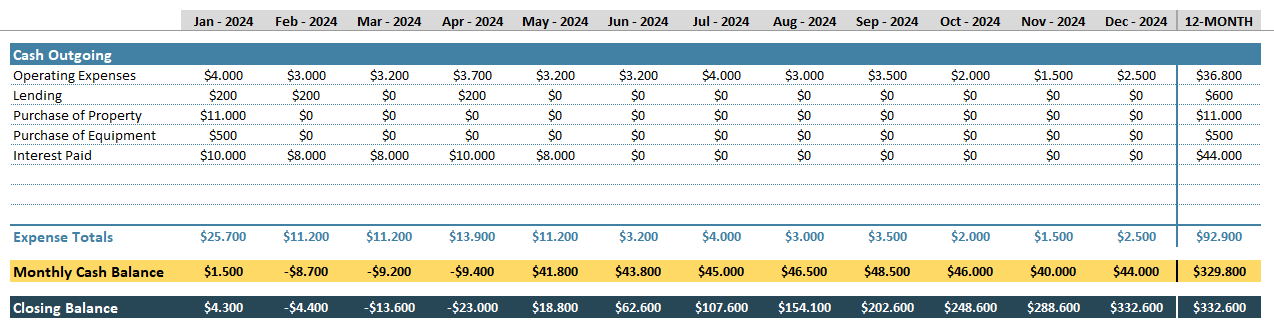

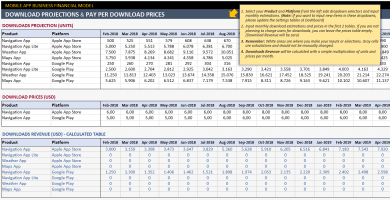

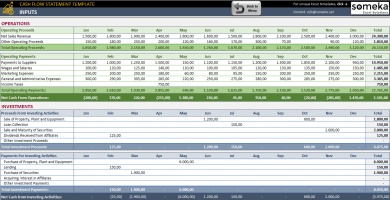

4. Monthly Table

Basically, this Monthly Table will give you the monthly and annual breakdown of your cash flows. Similar to a basic cash flow statement, this table also includes an area for incoming cash, and another for outgoing cash.

Please remember that this is an output section. So you do not have to input anything manually here. All the calculations are coming from your Income and Expense input section.

Firstly, you’ll see the monthly breakdown of your incoming cash with opening balances:

And secondly, you’ll see the outgoing cash with net cash flows and closing balances:

Again, if you need more rows for different categories here, feel free to use plus (+) signs on the left side of your table.

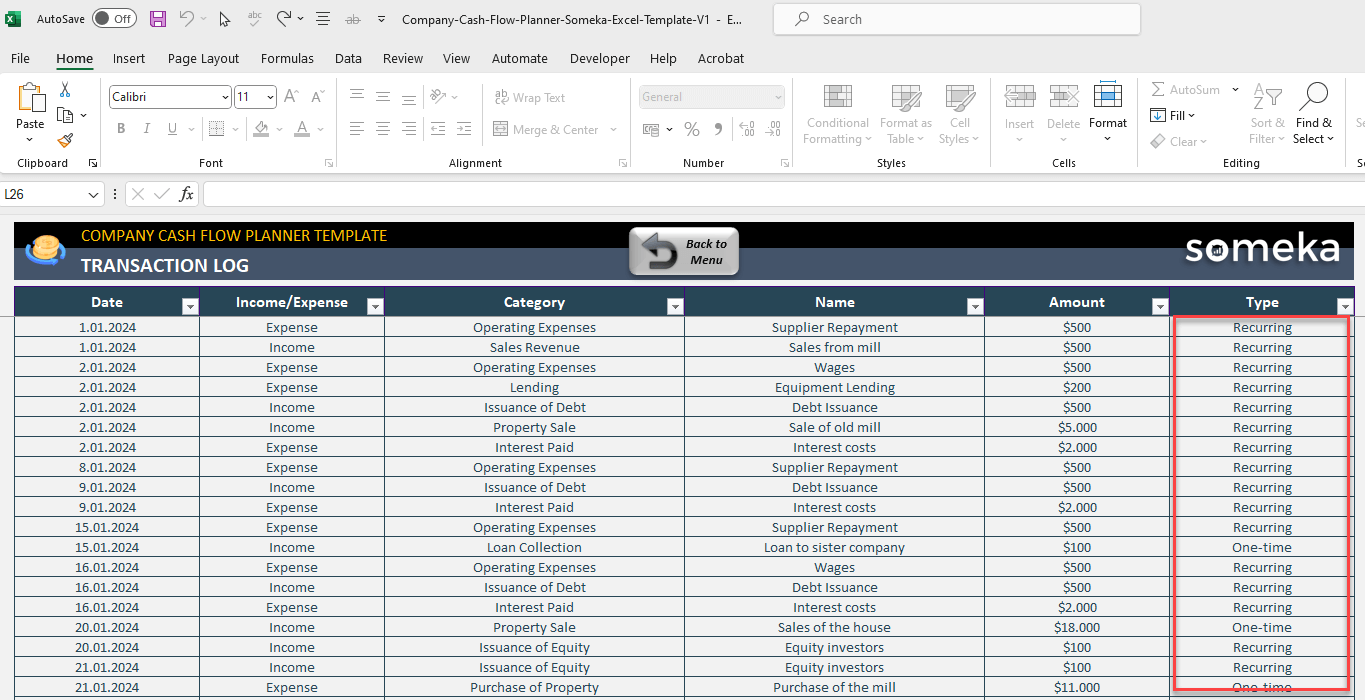

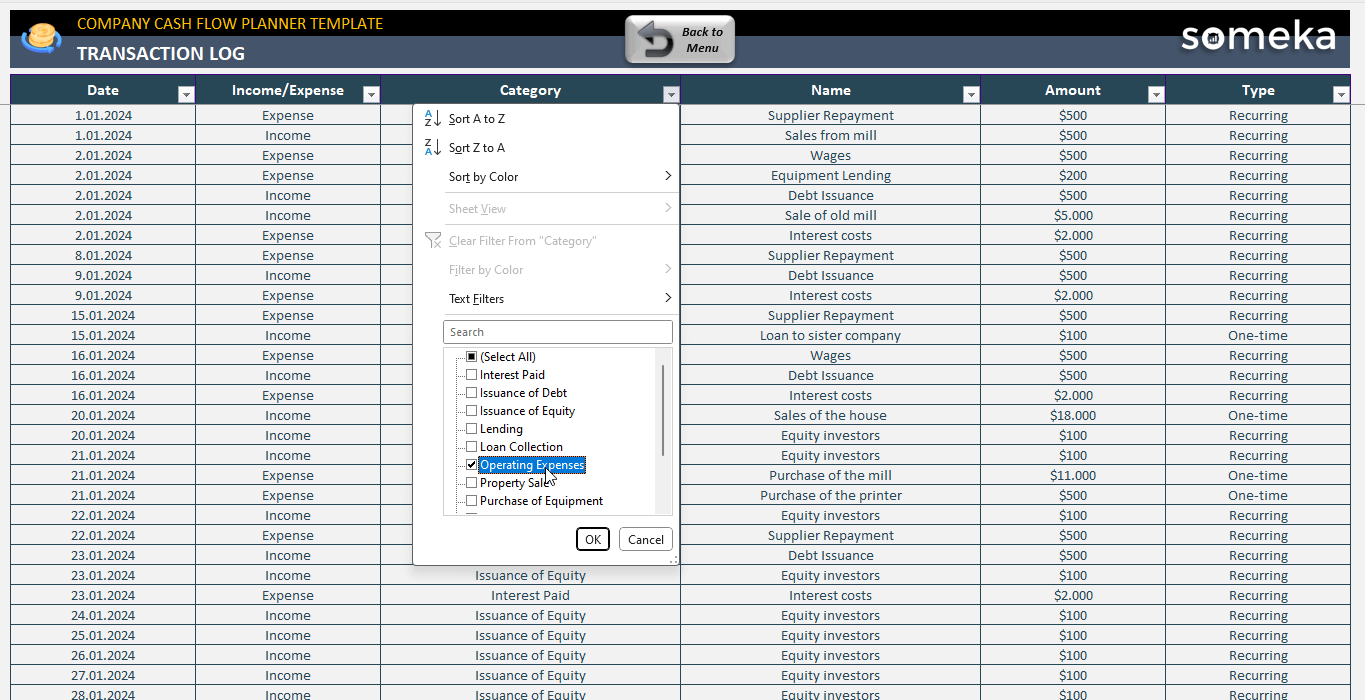

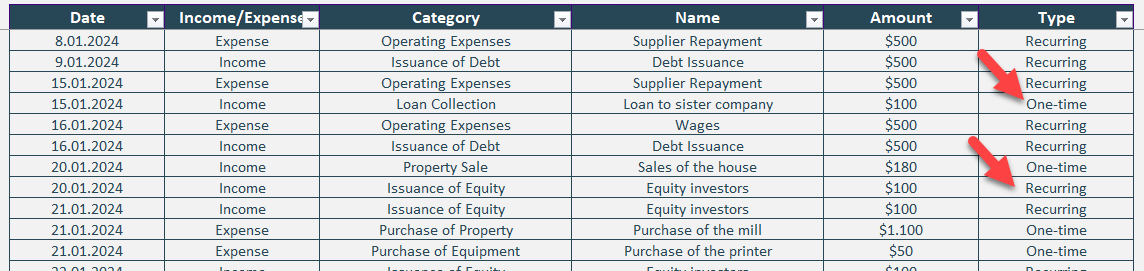

5. Transaction Log

Lastly, you’ll find a transaction log for your excel company cash flow planner template. In addition to general one-time payments or revenues, this log basically returns all your recurring items into an individual income or expense items for the relevant date.

For example, if you have a recurring expense which you pay at the 1st of each month, then on this log you’ll see the entire monthly payments.

Also, with the auto-filters on your headers, you can easily narrow down your list and see the particular expenses or incomes, or see a particular month’s cash flows.

Lastly, this log will keep up to 3,000 individual expense or income items for your cash flow forecasts.

That’s all for the template.

Company Cash Flow Planner Template Features Summary:

- Cash flow projector in Excel

- Suitable for both recurring and one-time payments and revenues

- Dashboard and monthly table included

- Expense and Income tracker

- Printable and editable cash planner

- Informational notes included

- No installation, no setup

- Works both on Mac and Windows

- Compatible with Excel 2013 and later versions

- Does not include any VBA macros

FREQUENTLY ASKED QUESTIONS

Company Cash Flow Planner Excel Template Product FAQ

To plan a company’s cash flow, you should keep tabs on all of the money coming in and going out, use this information to make predictions about the future, and make sure there are enough funds in the bank to cover all of the bills.

Templates and cash flow planners are useful tools that can automate and streamline this process.

A company cash flow planner template is a structured spreadsheet that allows businesses to input their income and expenses and generates projections and forecasts for future cash flows.

It helps in visualizing the company’s financial health and making informed decisions.

This template supports 366 days or 12-months from the Start Date. So you can use this for any 12-month interval depending on the Start Date you choose. However, that’s not the end. For the next year:

- Make another copy your file

- Refresh the Start Date and Opening Balance

- Set your expense and income items

That’s all. You can use this template for the following years.

If you input a Start or End Date out of the template period, you’ll see a small red warning (!) just near your input row. The template will only calculate the recurring and one-time payments inside its time interval.

Yes, sure! All our sheets are print-ready. Just click on CTRL+P to have a good-looking print-out or export to pdf. Also, feel free to use them on your presentations.

If you’re planning your future cash flows, the Company Cash Flow Planner Template will calculate the closing balances of each month for you. So, you’ll be able to see the free cash flows for the following month.

And, if you’re looking to create a statement and see the calculations of the free cash flow equation, then you can also download Someka’s Cash Flow Statement Template.

This metric is essential for understanding how much cash is available after maintaining or expanding the asset base.

USER REVIEWS & COMMENTS

4 reviews for Excel Company Cash Flow Planner Template

You must be logged in to post a review.

Sheldon K. Talarico –

It’s great to see someone creating a tool to track recurring expenses. I haven’t had the chance to use it yet, but it looks promising at first glance!!

Timothy Ogg –

I came across this product and decided to subscribe. Although it looks nice at first glance, I haven’t tried it yet. I will update my review after trying it.

Will Dickson –

I needed a solution like this because my company deals with many recurring payments.

Jade Dunlea –

I got it to help me keep track of my clients’ payments. The support team was incredibly helpful!