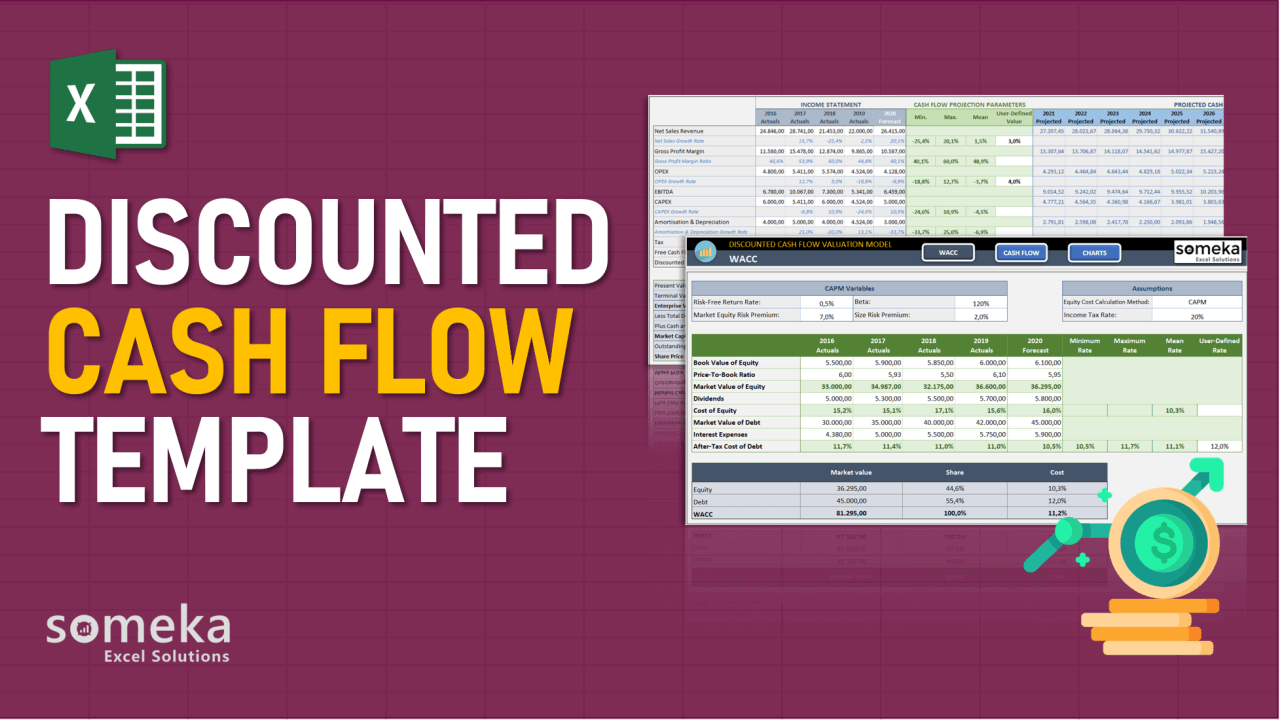

Discounted Cash Flow Excel Template

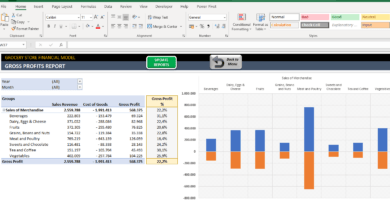

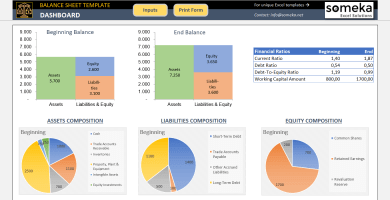

DCF valuation spreadsheet in Excel. Estimate value of future cash flows. CAPM and Actual Dividend methods. Printable dashboard with charts.

TEMPLATE DESCRIPTION

The Discounted Cash Flow (DCF) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Our Discounted Cash Flow template in Excel will help you to determine the value of the investment and calculate how much it will be in the future.

In brief, the time value of money concept assumes that one dollar in the future is worth less than today’s dollar. Because the reason you should invest today’s dollar is to bring in more value.

In fact, you can use the same concept to value equity investments or a company as a whole. It applies to assess both financial investments (purchasing equity or debt securities) and business investments.

What is Discounted Cash Flow Valuation?

Before our Discounted Cash Flow Excel Template, let’s look at the DCF model.

Discounted cash flow valuation involves two steps:

- Making projections of how much money a company will generate in the future

- Discounting projected future cash flows

If the present value of the investment is less than the cost paid, or to be paid by the investor, the investor is better off. It is because he or she obtains an opportunity to make more money than spends. Of course, the usefulness of this assessment depends heavily on how accurate its outcome is.

Here we face two problems:

- How to accurately predict future cash flows

- What interest rate should we use to discount projected cash flows

Discounted Cash Flow Template Features:

Discounting rate must reflect the opportunity cost for an investor, in other words, should he or she decide to put his or her money elsewhere. However, the problem is that there exists a wide range of investment opportunities, with dramatically different return rates.

Assume that the relevant return rate must reflect the risk level associated with an investment. The more risk an investment involves, the higher the interest rate it has to provide.

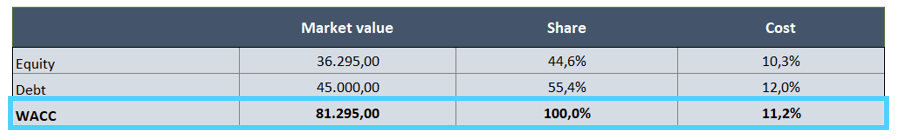

The weighted average cost is generally used in place of the discount rate when a company evaluates its value. A commonly accepted convention is that the company’s weighted cost of capital (WACC) already takes into account the risk level associated with the company’s business.

WACC – Weighted Average Cost of Capital

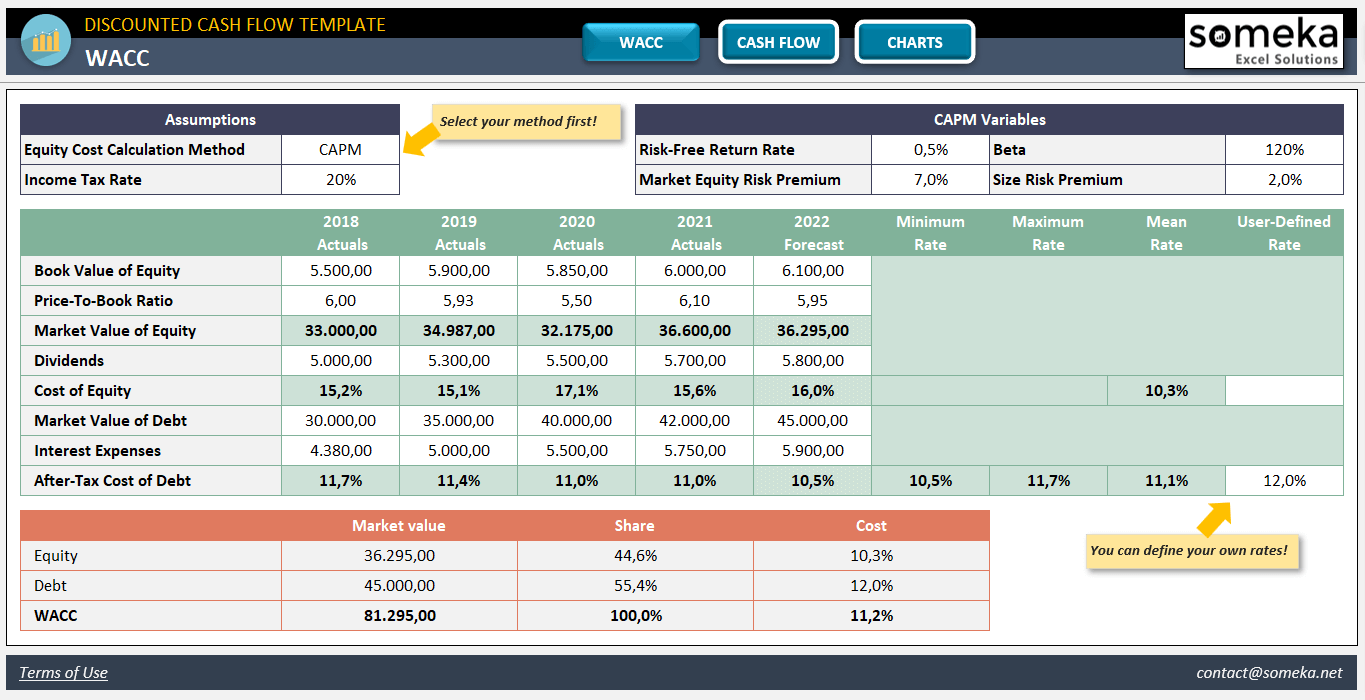

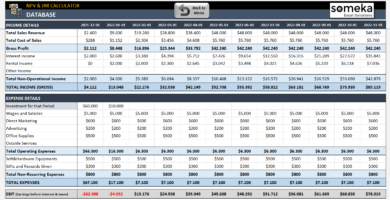

The Discounted Cash Flow Excel template calculates WACC using the historical financial data, as well as Capital Asset Pricing Model.

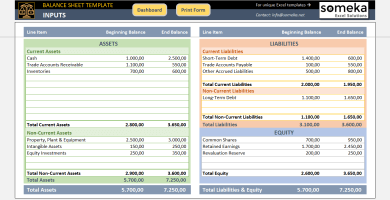

Most companies finance their operations using various mixes of equity and debt. While it is quite straightforward to calculate the cost of debt, it is not so for the equity part, because, unlike debt, equity does not have an explicitly associated cost.

If a company pays its shareholders dividends on a regular basis, you can calculate the cost of equity by dividing dividends by the equity value. However, dividend policies are not consistent across companies, and some companies do not pay dividends at all. In such cases, the only available option for estimating the cost of equity is using the Capital Asset Pricing Model (CAPM).

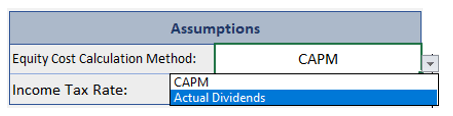

Our Discounted Cash Flow Model tool in Excel allows you to select two different methods.

In the WACC section, select Equity Cost Calculation Method in the Assumptions sub-section, as provided above. Please enter the applicable income tax rate. It will have an effect on both WACC and free cash flow calculations, thus on enterprise value.

What are the CAPM Variables?

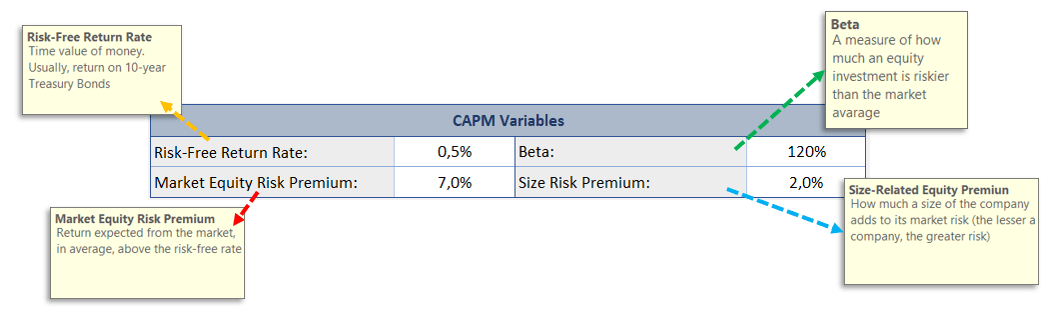

If you chose using CAPM in this discounted cash flow template, you need to enter the parameters of the model:

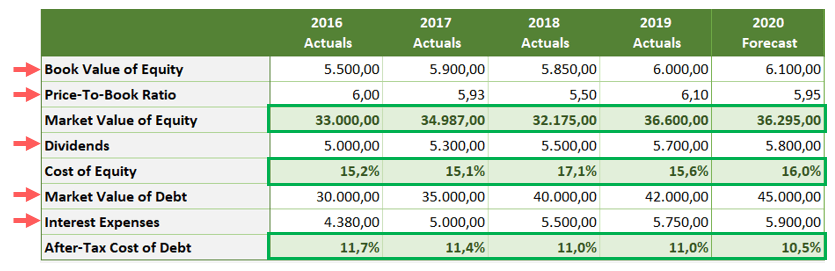

Fill in historical data for Equity Value, Dividends, Market Value of Debt, and Interest Expenses. This DCF Template will calculate the After-Tax Cost of Debt by dividing Interest Expenses by the Market Value of Debt, less the tax effect of the cost of debt.

According to your method, this Discounted Cash Flow Excel tool can calculate the Cost of Equity by dividing Dividends by the Market Value of Equity or using CAPM. WACC is equal to the average cost of equity and debt, weighted on equity and debt market values respectively.

You can override calculated interest rates with manually entered User-Defined Rates. Then you can go to the Cash Flow section.

Cash Flow

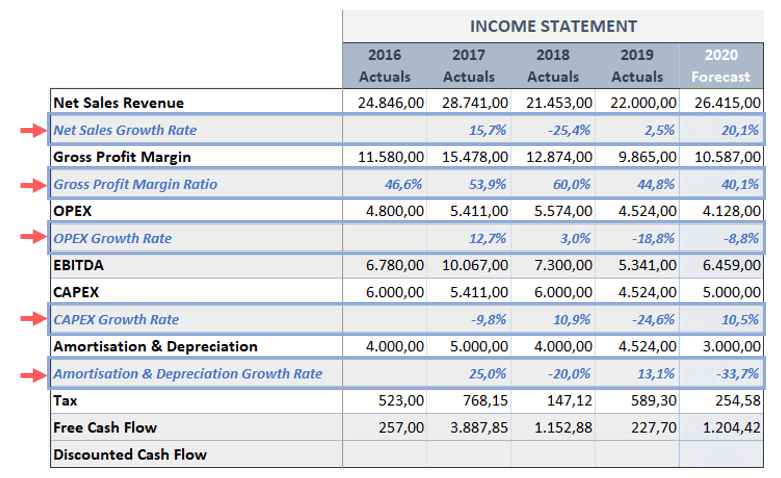

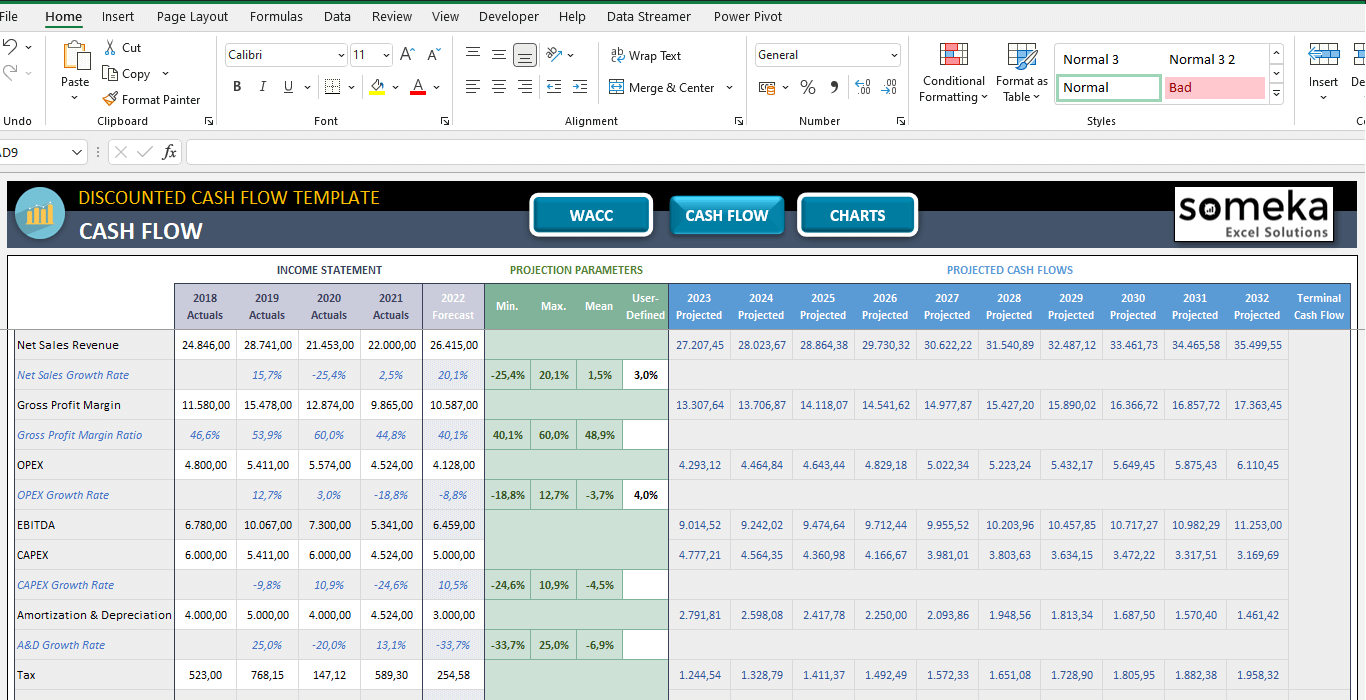

Firstly, input the historical financials (from the income statement) along with forecasted figures for the current year. You must enter at least three sequential years of data, including the most recent forecast. You can use the blue written parameters to predict future cash flows.

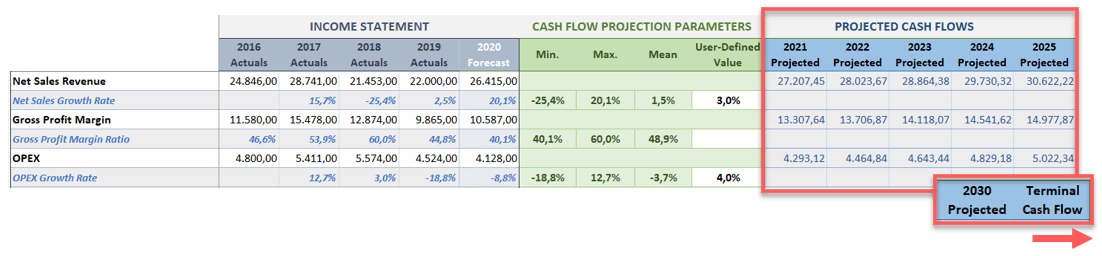

In this Excel tool, the Cash Flow Projection parameters calculate automatically, but you can enter any parameter value manually. Unless you enter User-Defined Value, the mean value will be used in the projected future cash flows.

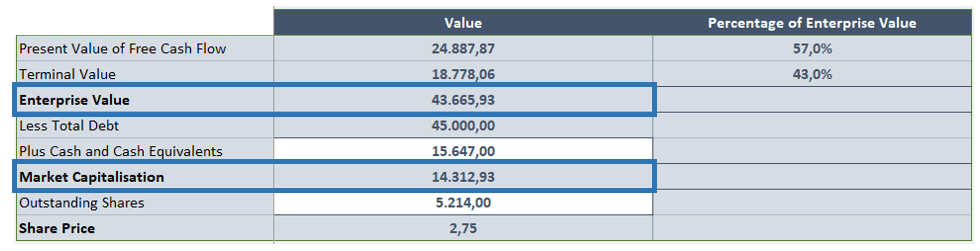

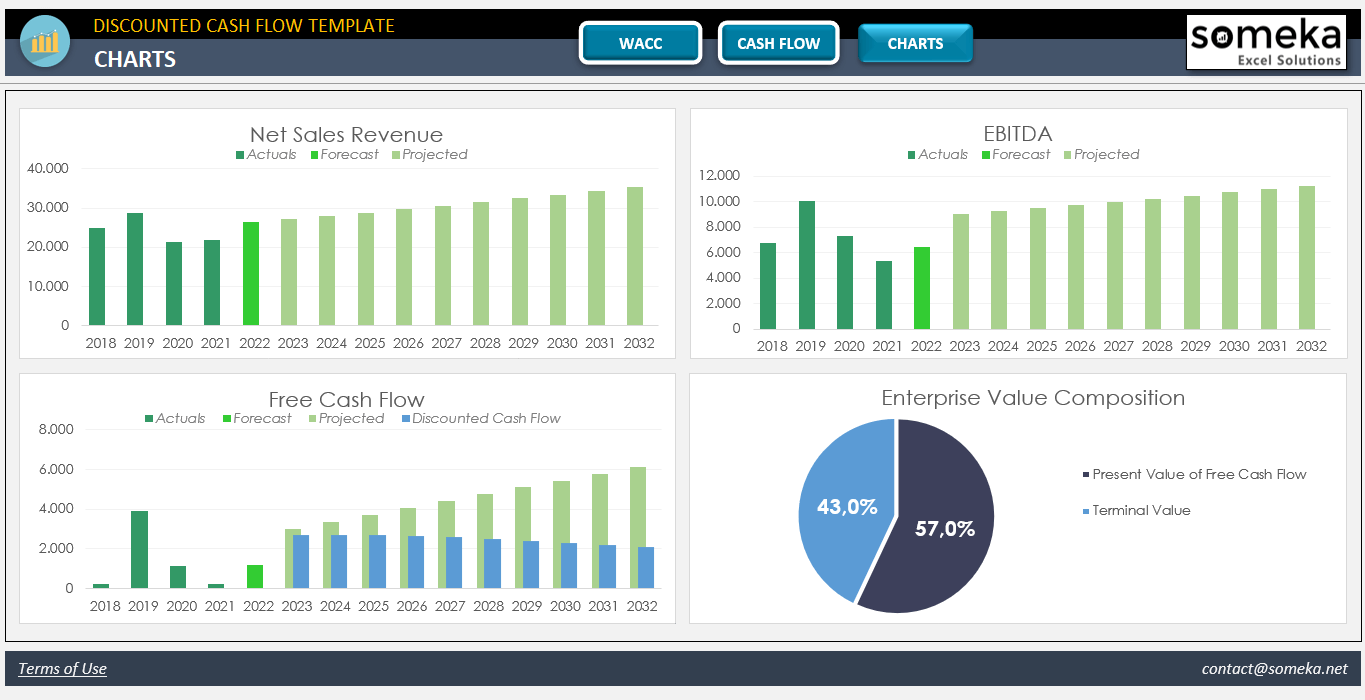

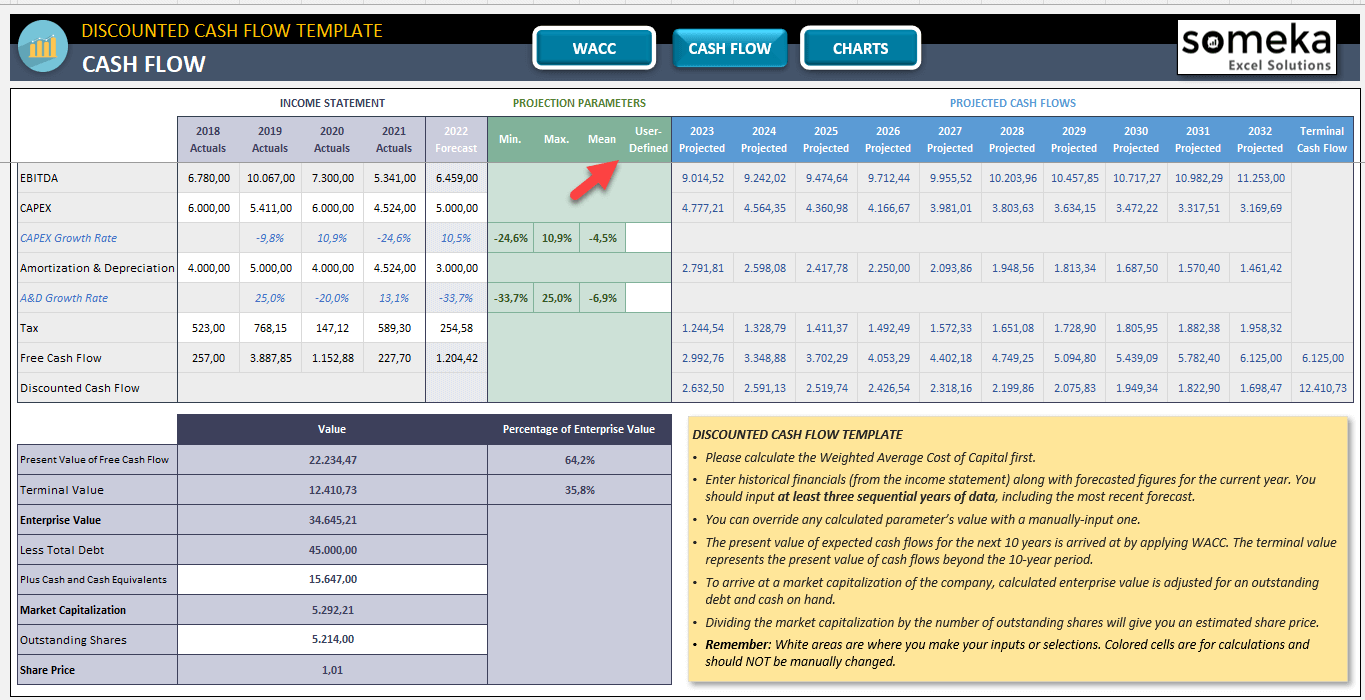

In addition, the present value of expected cash flows for the next 10 years shows up by applying WACC. The terminal value represents the present value of cash flows beyond the 10-year period.

In addition, the present value of expected cash flows for the next 10 years shows up by applying WACC. The terminal value represents the present value of cash flows beyond the 10-year period.

To arrive at a market capitalization of the company, the calculated present value of future cash flows (enterprise value) is adjusted for an outstanding debt and cash on hand (manually entered). Lastly, dividing the market capitalization by the number of outstanding shares will give you an estimated share price.

Discounted Cash Flow Excel Template Features Summary:

- Making a projection for your future value of money

- DCF Template in Excel

- Informational notes

- No installation needed, ready to use

- Works both on Mac and Windows

- Compatible with Excel 2010 and later versions

- Does not include any VBA code or macros

FREQUENTLY ASKED QUESTIONS

Discounted Cash Flow Excel Template FAQ

Our Discounted Cash Flow Excel Template simplifies this process:

- Input historical financial data and forecasts in the Cash Flow section

- Set your WACC (Weighted Average Cost of Capital) in the dedicated section

- The template automatically calculates the present value of future cash flows

- View the results, including enterprise value and estimated share price

This ready-to-use template eliminates complex manual calculations, providing instant, accurate DCF analysis.

Creating a DCF model is straightforward with our template:

- Choose between CAPM and Actual Dividend methods for equity cost calculation

- Enter required parameters (e.g., risk-free rate, market return for CAPM)

- Input historical financials and forecasts

- The template projects future cash flows and calculates their present value

Our template guides you through each step, ensuring a comprehensive and accurate DCF model.

Yes, our template is designed to account for various capital structures.

It calculates WACC by considering both the cost of equity and debt, providing a more accurate valuation for companies with different financing mixes.

The template incorporates the time value of money concept by discounting future cash flows to their present value. This is done automatically using the calculated WACC, ensuring that the valuation reflects the principle that a dollar today is worth more than a dollar in the future.

Absolutely. While the template provides automatic calculations based on historical data, you can easily override these with your own projections. Simply enter your custom values in the User-Defined Value fields to tailor the model to your specific assumptions and scenarios.

USER REVIEWS & COMMENTS

10 reviews for Discounted Cash Flow Excel Template

You must be logged in to post a review.

Diana F. –

The instructions are bit confusing. It would be helpful more detailed explanation

Najva Ziaee –

What is the difference between WACC and CAPM?

Someka –

Hi! We want to let you know the difference between WACC and CAMP. WACC stands for Weighted Average Cost of Capital. CAMP stands for Capital Asset Pricing Model. Both of these terms might sound tricky, but they’re actually pretty simple to understand!

Rafael M –

Does this template work on Mac with Excel 2011?

Someka –

Hi! This cash flow template is totally compatible with Excel 2010 and any newer versions, plus it runs super well on Mac too!

Ruslan G. –

I had no idea how to use DCF model before using this template. It made my life so much easier. Thank you!

Zeynep Yilmaz –

This template is awesome! It’s simple to use and always gives you an accrate value. I really like it!

Marie –

this is incompatible with mac and i don’t have excel on my computer

Someka –

Hello Marie.

Sorry to hear you can’t use the product.

Our templates have been built specifically for use on Windows. If you have a suitable Excel version, most of our templates are compatible with both Windows and Mac.

In order to make sure that the template is compatible with Mac as well, first, we suggest checking the product description to learn more detailed information about it.

Tae –

like the product it help me a lot easy to use and very complete. thanks

stella moi –

the information was really helpful

ahlat mus –

excellent product

javier –

excellet product