Excel Amortization Schedule Template

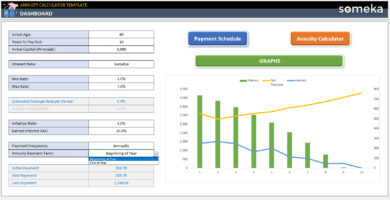

Loan amortization calculator in Excel. Define your credit payments and create printable amortization table in one click. With flexible term options.

TEMPLATE DESCRIPTION

If you need an Excel Amortization Schedule Template, this product will provide you with a one-sheet solution. This simple amortization calculator Excel tool will help you to create your repayment schedule plan for the money you borrow for a mortgage, student loan, farm loan or any other credit type.

What is the amortization schedule?

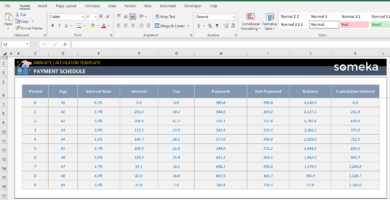

An amortization schedule is a table that shows how much each payment on an amortizing loan will be over time. The schedule breaks down each payment into how much goes toward interest and how much goes toward paying down the principal.

The amount paid toward interest goes down over time, while the amount paid toward the principal goes up. This schedule shows borrowers how they will pay back their loan over time.

How to use Amortization Schedule Template?

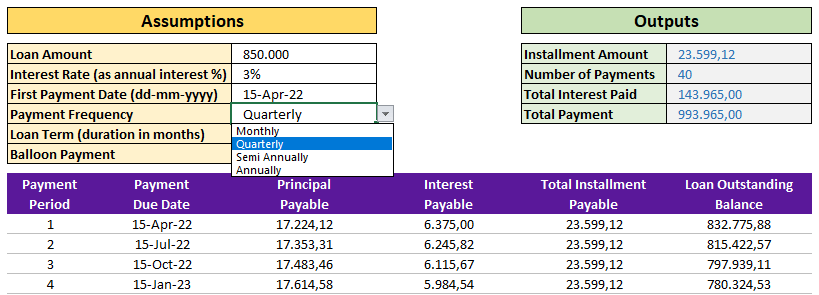

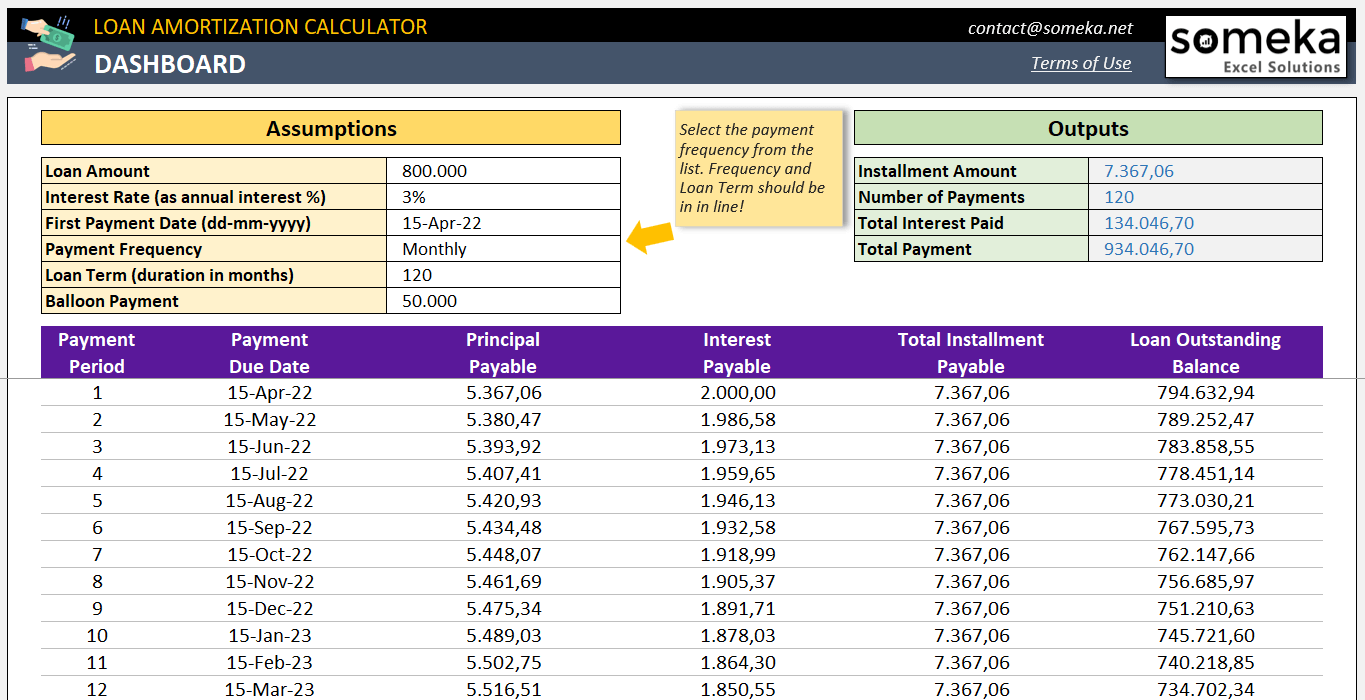

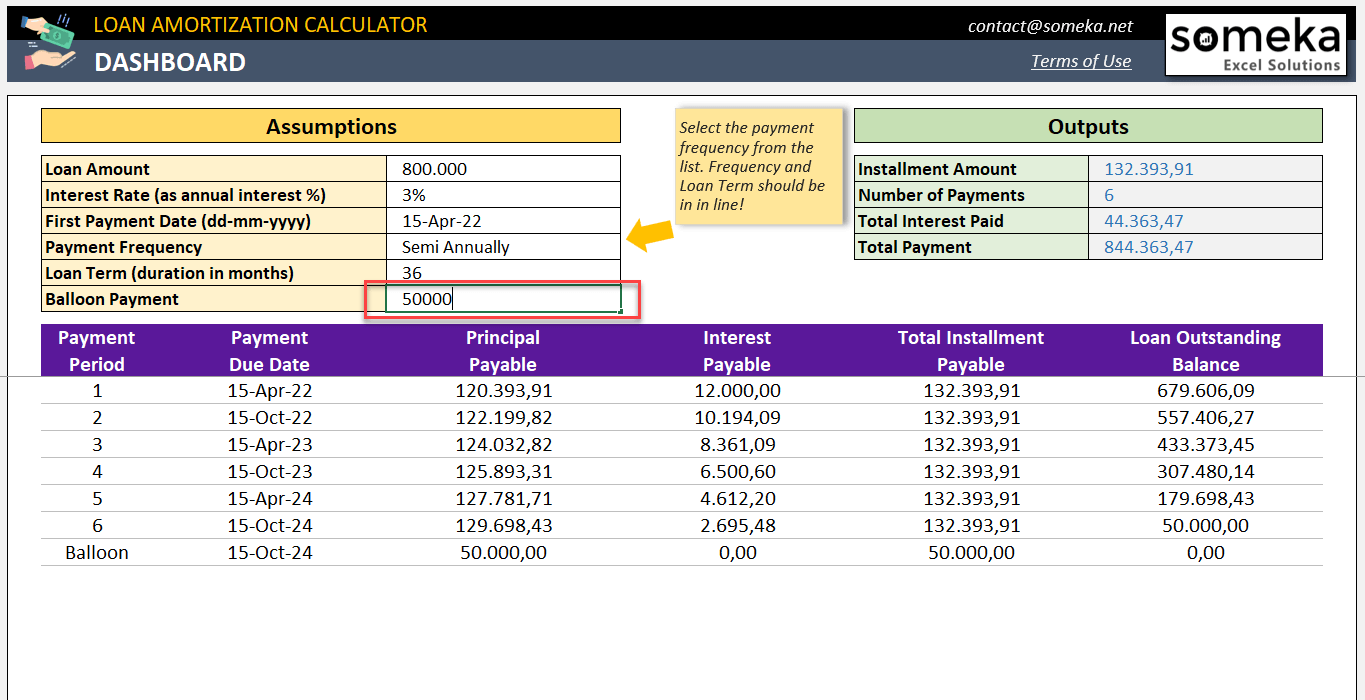

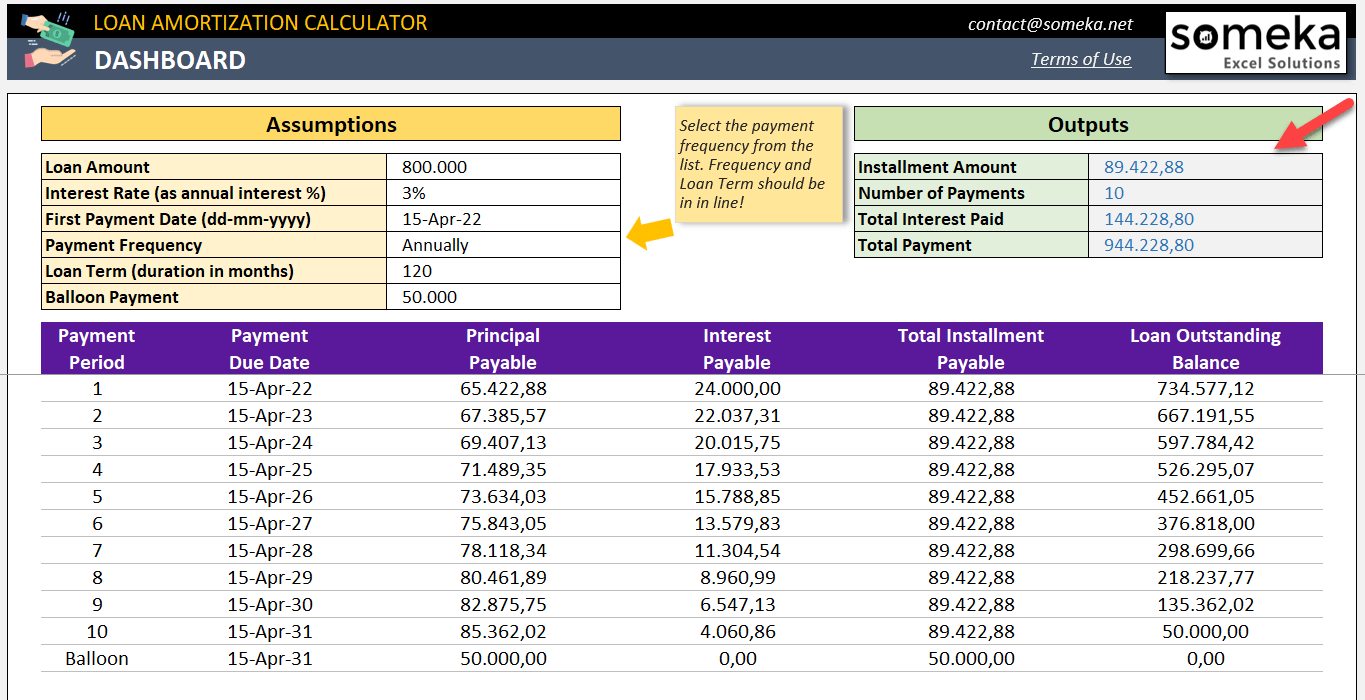

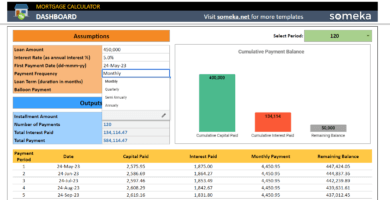

Basically, this Excel amortization schedule template is a tool where you can input the amount of money, interest rate, payment frequency, balloon payment, and loan term according to your situation. After you type in the inputs, you may create an amortization schedule with fixed monthly payment and balloon in Excel.

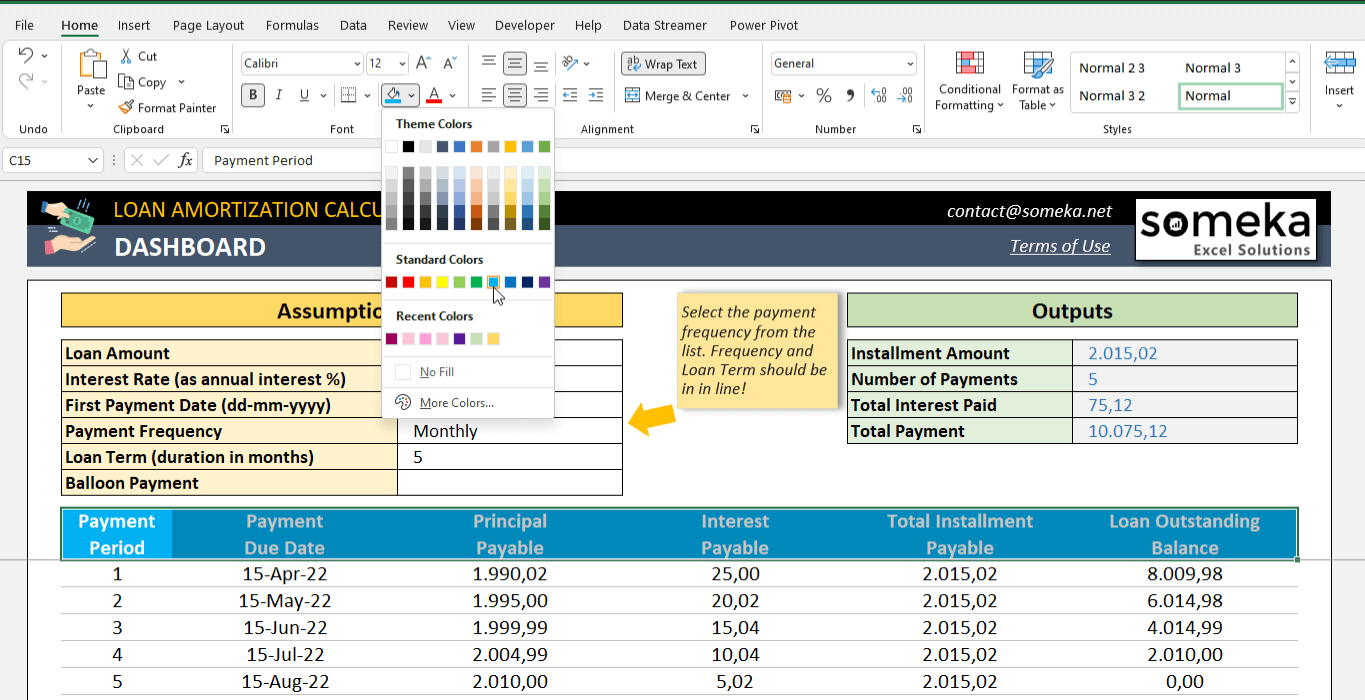

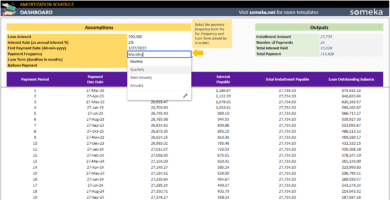

Furthermore, you can select your payment frequency from the drop-down, which contains Monthly, Quarterly, Semi-Annually, Annually installment options in this excel loan amortization table.

To emphasize, the input parts have been clarified with white cells. So the gray areas show the results. Thus, just put your financial data in and let the loan amortization calculator template help you to find the best option for you.

Once the schedule is created it is easy to observe your payments (principal and interest) and your Outstanding Loan Balance. Besides that, if the loan amortization schedule does not match your needs you may check other scenarios. In that way, you will be able to see if they are attractive or not. That’s how our loan amortization calculator in excel works.

What is an example of amortization?

In amortization, a loan is broken up into a series of fixed payments that are made over time. Take the case of a $200,000 mortgage loan with a 4% interest rate that lasts for 30 years. The amount of interest and principal that is paid each month will change, but the monthly payment will always be the same amount.

At first, more of the payment goes toward interest. As time goes on, more of the payment goes toward the principal.

Excel Amortization Schedule Template Features Summary:

- Monthly, Quarterly, Semi-Annually, Annually payment options

- Loan Amortization Schedule with a balloon payment

- Easy to fill

- Also full print ready

- Informational notes included

- No installation needed, ready-to-use

- Works both on Mac and Windows

- Compatible with Excel 2010 and later versions

- Does not include any VBA code or macros

USER REVIEWS & COMMENTS

13 reviews for Excel Amortization Schedule Template

You must be logged in to post a review.

Liz YO –

I want to have a visualize summary like a graph of my template, how is that possible?

Someka –

Greetings! To acquire this new sheet, please make a request for our customizable service. If you have any inquiries regarding this, kindly reach out to contact@someka.net.

Olivia Kalberg –

SO simple, just add your input and some easy numbers and the template will do all the work for you. Well done.

Tamara Clifford –

I couldnt undrestand the idea of ballon payment, can you explain more about it?

Someka –

Sure, with a mortgage containing a balloon payment, the amount due at the conclusion of the loan term may be significantly larger than usual. Prior to that point, payments may be comparatively low, however the amount owed at the end is substantial.

Alex Sid –

If you have a hard time keeping track of your loans and debts and never know when it’s time to make payments, then this template is perfect for you. It showed me exactly how bad I was managing my loans and now I’m in much better shape because of it.

Vahid Imani –

I want to pay my loan each 3 month. how should I add it in this template, so I know did I paid it or not.

Someka –

Greetings, thank you for reaching out to us.

If you would like to adjust the frequency of your payments, simply navigate to the Assumption section on the Dashboard page and select your desired option from the dropdown menu.

We are here to help with any other inquiries you may have – simply email contact@someka.net and we will get back to you.

Rebbeca Porter –

What should I add in the assumption of this template?

Someka –

Greetings! In the assumption section, kindly enter the details regarding the loan you have obtained.

Murali –

The template has useful functions and it helped me with my finances. Recommendable

Ginette –

great amortization calculator i used it several times and it worked awesome at work

Nicole –

nice and useful app team thx. Please remove your logo and add ours.

Someka –

Hello Nicole,

You can remove the logo or replace it with your own logo for each sheet. For Free Versions, you are not allowed to remove the logo or alter any copyrighted material in the template.

You can do it in the full version. Please check how to do that in this link.

Hope this helps!

Jeana R –

thank you great product. but tiny question how can I change payment frequency. I want to see annually.

Someka –

Hello Jeana,

You can select the payment frequency from the dropdown list.

Please see the image below.

Dory –

really useful!!

U Tin Tun Win –

I had see you are great Someka.net.

Thank you so much

MANUEL GONZALEZ –

MUY BUENA PLANTILLA